After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: August 01, 2010

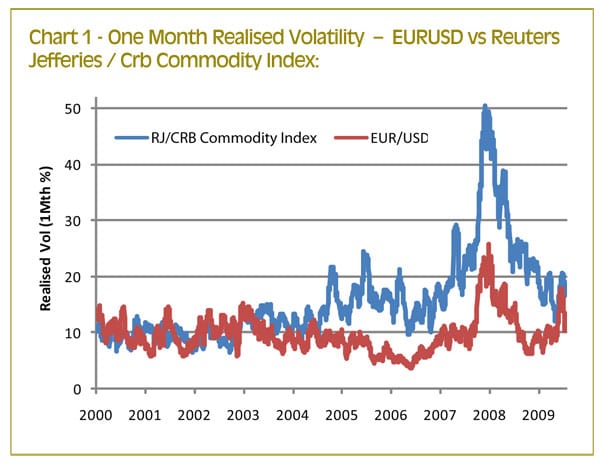

Nothing focuses attention on an organisation’s financial risk management capabilities like a bout of sustained market volatility. When financial markets destabilise, as we saw in 2008 and 2009, risks that may once have been seen as a low priority by many organisations, suddenly become much more visible. Both foreign exchange and commodity prices have witnessed dramatic increases in market volatility since 2007 (see chart 1 below), creating an increased requirement for corporate treasurers to ensure that these risks are being effectively managed.

A recent study by Accenture[1], the international management consulting firm, revealed that 35% of corporate executives surveyed believe that commodity price fluctuations have the potential to cause the greatest increase in risk to their firms (a significantly higher percentage than those who listed other factors such as decreased credit availability and liquidity risk). As a result of this focus, many corporate treasurers have become more concerned with ensuring that firm-wide financial risk is managed efficiently and effectively, incorporating commodity risk management into their current treasury risk management strategy. For those corporate treasurers already used to managing FX and interest rate risk, this has led to a focus on a more integrated financial risk management strategy. This type of strategy considers both the unique characteristics of commodity markets themselves, as well as the complex relationship between FX and commodity price risks that must be considered when implementing a robust hedging strategy.

Traditionally, FX and commodity price risks have been managed independently within many organisations. There are a number of reasons for this segregation, perhaps the most important of which is the fact that responsibility for commodity risk management is often located in a different part of the organisation (e.g., the purchasing department) from FX risk management. Even when corporate treasury is responsible for both FX and commodity price risk management, this does not necessarily lead to an integrated approach that is based upon a holistic view of financial risk. Such an approach should take into account both the direct (causal) and indirect (correlational) relationships present between a company’s commodity and FX exposures.

A direct relationship between FX exposure and commodity price exposure occurs when a commodity price is determined in a currency other than the functional currency of the organisation (clearly, as most commodities are priced in USD, this is a common issue for non-USD functional organisations). In this situation, the commodity price clearly drives the currency exposure, and the size of the notional FX exposure rises and falls as a direct result of commodity price fluctuations. For example, take a Canadian lumber exporter, selling into the US market. If the organisation determines its USD hedging requirement based on expected sales volume only, without hedging the underlying lumber exposure, movements in the spot lumber price could easily cause inefficiency in the FX hedging programme. An integrated approach to risk management, where the currency hedging programme is closely linked to the decision to hedge (or not to hedge) the commodity risk is therefore critical, in order to ensure the organisation does not run into severe over or under-hedging situations. In many organisations, this relationship is ignored (due to a separation of responsibilities) leading to considerable hedging inefficiencies. If hedging the underlying commodity is not possible (due to limited forward market liquidity, for example) or desirable, the currency hedging should reflect this through increased use of optionality or carefully calibrated hedge ratios.[[[PAGE]]]

The indirect relationship between commodity price risk and FX risk, which occurs largely as a result of asset price correlations, is more complex, but is a potentially equally important factor to consider. Depending on the strength of the correlation between an organisation’s FX exposure and its commodity exposure, and the direction (long / short) of these exposures, the diversification benefit to the organisation may be significant. Such benefits are often seen in non-USD functional organisations with large energy requirements. As oil and the USD tend to exhibit a strong negative correlation (see chart 2), the FX exposure and oil price exposure tend to offset each other to a degree. Hedging one of these exposures without the other can actually be counterproductive by impacting / reducing this diversification benefit.

These correlation effects can create a dilemma for corporate treasurers, as whilst it is important to ensure that a corporate hedging programme does not increase overall risk by destroying natural hedging opportunities, such diversification benefits must be used cautiously, as correlations can change in strength, reverse in direction, or break down completely. Incorporating optionality (through the strategic use of plain vanilla options or structured products) into a hedging programme can be a useful method of overcoming this dilemma, by providing downside protection (on commodity risk, FX risk, or both), without reducing the natural diversification benefit that exists. If an organisation’s risk management strategy is not fully integrated, and FX and commodity risks are managed independently, the diversification benefit can be disturbed. In effect, an un-integrated hedging strategy can inadvertently add risk to the organisation. One useful method of ensuring that this dynamic is accounted for is using a quantitative risk measurement methodology, such as Cash Flow at Risk (CFaR), which considers asset correlations, when assessing different hedging strategies. Analysis can be undertaken, whereby potential hedging strategies can be hypothetically tested to determine their probable impact on CFaR, and compared relative to one another.

For many corporate treasurers, implementing an integrated risk management strategy may involve dealing with commodity exposures, with which they have limited experience. Whilst commodity risk management and FX risk management share many common features, there are some important differences to consider, such as:

1. Increased levels of volatility with many commodities; and

2. Limited liquidity in certain commodity markets and instruments; and

3. The potentially significant impact of the forward curve in commodity markets.

These factors can often make the action of hedging of commodity price risk more challenging than hedging FX risk, due to higher hedging costs, lower availability of hedging instruments, and increased basis risk (see below), which can reduce hedging effectiveness.[[[PAGE]]]

Commodities are consistently more volatile than other asset classes traditionally managed by corporate treasuries, such as FX and interest rates. There are a number of reasons why commodity price volatility is normally higher than FX volatility, including:

Ease and cost of storage: Unlike FX, where storage is a non-factor, the ease and cost of storage plays a major role in commodity pricing, and is one of the largest factors contributing to the relative volatility of commodity prices when compared to foreign exchange. In commodity markets, production and storage constraints limit the ability of the market to rapidly adjust to supply and / or demand shocks, leading to substantial price gyrations, especially in the short term, in order to keep supply and demand in balance. As shown in chart 3, there is a negative relationship between the volatility of a commodity and the ease with which each can be stored. Commodities that cannot be stored (e.g. power), or where there are substantial costs involved in storage (e.g., oil, natural gas), tend to exhibit more price volatility than commodities where storage infrastructure requirements are relatively low, such as aluminium or copper, which can simply be stored in a warehouse or even a car park.

Concentration of supply: Another way in which commodity markets differ from the FX market is that most commodities are traded on markets in which the relative concentration of supply is greater, which can act to magnify price volatility. A good example is cocoa, which hit the headlines recently, with prices surging to a 33-year high, primarily due to a disappointing crop in the Ivory Coast. As the West African nation accounts for almost 40% of global cocoa supply, lower Ivorian production will have a huge impact on global prices, creating excessive price volatility.

Lower market liquidity: Limited market liquidity can often lead to price volatility, as a lack of market depth necessitates larger price movements to create equilibrium between buyers and sellers. While the FX market is the largest and most liquid financial market in the world, many commodity markets (especially commodity futures and options markets) face much more limited liquidity. As a result of these factors, commodity prices generally have higher volatilities and larger price discontinuities (i.e., moments when prices leap from one level to another).

In addition to contributing to higher commodity price volatility, the limited liquidity of certain commodity hedging products can also constrain an organisation’s hedging options. For example, the cash price for many energy products is often determined by specific geographic or grade-related parameters, for which there may not be a liquid forward market. As such, proxy hedges may be required using a product where a liquid forward market exists (either in a different derivation of the same commodity, or sometimes in a completely different commodity altogether). Airlines, for example will often hedge jet fuel exposure using either crude or heating oil contracts, as they are exchange-traded.

To illustrate this point, consider a business that purchases natural gas based on a Chicago hub spot price. As forward market liquidity is limited for this benchmark, the company may prefer to hedge this risk using a NYMEX futures contract based on the Henry Hub price in Louisiana. The difference in price between the underlying contract and the hedging contract, known as the location differential, can lead to basis risk, defined as the possibility of loss from imperfectly matched risk offsetting positions in two related but not identical markets. A variety of basis contracts (e.g. basis swap) are available in the OTC markets to hedge locational, product and temporal differences between exchange traded contracts and specific underlying exposures. However, this basis risk can make the process of hedging commodity price risk more complex than hedging FX risk, where there is rarely a need to use proxy hedges (except in the case of controlled currencies). While a million Btu of natural gas in Chicago is not the same as a million Btu in Louisiana, a million USD is always a million USD. This basis risk is demonstrated in Chart 4, which shows the difference in price between Henry Hub 3 month futures and Chicago Hub natural gas spot prices over time.[[[PAGE]]]

When looking to hedge commodity price risk, one crucial factor that can affect hedging behaviour is the shape of the forward curve. You would expect the forward curve to twist for both commodities and FX over time, however, in relation to the FX curve, which is derived from interest rate expectations, the relative movements tend to be far less erratic than those seen in the commodities market. This is especially relevant at the present time as global interest rates have tumbled to record lows, thus muting the impact of interest rate differentials between currencies.

In contrast, the commodity forward curve is primarily determined by demand and supply factors concerning the spot price relative to the price for future delivery, of which inventory levels play a major role. In general, high inventory levels (which usually stem from waning demand) tend to lead to a discount in the spot price relative to the price for future delivery, effectively establishing an upward sloping forward curve, or a contango. Backwardation occurs when the price of the commodity for future delivery is lower compared with the spot price (often as a result of low inventories). Seasonal swings in supply and demand can also ensure regular phases of contango and backwardation in some commodity markets such as natural gas, where the forward market spends most of its time in contango in the spring and autumn, as the market anticipates seasonal demand in the summer and winter (due to heating / air conditioning requirements). The impact of the commodity forward curve can clearly be significant when it comes to implementing a forward hedging strategy as the cost of hedging commodity inputs into a backwardated market (or commodity outputs into a contango market) can make hedging prohibitively expensive. Shifts in the forward curve must also be closely monitored; the infamous Metallgesellschaft hedging disaster resulted from the use of a hedging strategy designed to perform in a backwardated market, which was unable to cope with a shift to a contango market.

For many corporate treasurers, commodity risk management represents an opportunity to apply their financial risk management expertise to a new class of risk, while simultaneously gaining exposure to other areas of their organisation. Commodity risk management implementation generally requires a close working relationship with purchasing, sales and / or operations functions, and offers a chance to gain an in-depth understanding of some of the key drivers of an organisation’s profitability. The treasury professional’s familiarity with risk measurement tools, risk management strategy development, and hedging execution, will allow them to make valuable contributions to management of their organisation’s commodity price risk, while simultaneously ensuring that financial risk is viewed on a holistic basis. Whilst the many idiosyncrasies of the commodity markets can make commodity risk management a complex and challenging field, implementing an integrated approach to firm-wide risk monitoring and management will ensure that the organisation’s financial risks are transparent and effectively managed.