- Bruno Mellado

- Global Head of Payments & Receivables, BNP Paribas

- Carole Djen-Ullmo

- Global Head of Communications and Marketing, BNP Paribas

- Eleanor Hill

- Editorial Consultant, Treasury Management International (TMI)

- Sophie Ryckaert

- Senior Cash Management Advisor, BNP Paribas

BNP Paribas recently hosted an insightful Treasury Lab event next door to the Roland Garros tennis stadium, bringing together around 60 leading industry professionals to discuss emerging trends, challenges, and innovations in treasury management. For those who missed it, or as a refresher for those who became swept up in the ideas, here are the key takeaways from the gathering.

Named after the pioneering French aviator Roland Garros, the famous Parisian tennis stadium opened its doors in 1928 and has since become synonymous with excellence in the sport. The venue’s rich history of innovation and experimentation, such as being one of the first to embrace the modern clay court, perfectly mirrors the spirit of the BNP Paribas European Treasury Lab event.

Just as Roland Garros continuously evolves to meet the demands of modern tennis, the Treasury Lab fosters a collaborative environment where cutting-edge treasury strategies and tools are developed and refined. This year’s edition was no exception. Expertly hosted by Pierre Fersztand, Global Head of Cash Management, Trade Solutions and Factoring, BNP Paribas, the event featured four insightful discussions on the topics of treasury talent, virtual accounts, marketplaces, and AI.

Nurturing future treasury talent

SPEAKERS

Valérie Manière-Rochedy, Director, Group Treasury, Dassault Systèmes

Nicolas Murat, Director, Cash Management & Information Systems, Group Treasury, Carrefour

Brice Zimmermann, Global Head Treasury, Alcon

François Masquelier, CEO, Simply Treasury and Chairman ATEL, EACT

Carole Djen-Ullmo, Global Head of MarCom for Cash Management, Trade Solutions and Factoring, BNP Paribas

The day kicked off in style with a presentation on The Treasury Talent Place initiative, which started at the 2023 edition of the event, when a survey confirmed that securing operational resources for short- to medium-term assignments remains difficult for corporate treasurers. To address this issue, BNP Paribas, in collaboration with the European Association of Corporate Treasurers (EACT) and leading academic partners, developed a unique upskilling programme for master’s degree students. It aims to bridge the skills gap in the treasury profession by offering a bespoke combined bank and corporate training journey for students from finance schools – currently the University Paris-La Sorbonne.

This involves six to 12 months working as a paid intern at BNP Paribas within the Cash Management business, thereby providing students with an in-depth understanding of various aspects of cash management, including liquidity, connectivity, payment systems, and KYC processes. After that, comes six months (or more, as the programme is flexible) working at a corporate that has signed up to the programme, within their treasury function.

As outlined, the programme looks to develop the next generation of treasury professionals by providing them with a 360-degree view on cash management. It also seeks to address two common challenges for treasury teams, namely:

- Corporate treasurers require ready-to-go resources to support ad hoc projects, bolster their teams during critical periods, and assist in implementing transformative initiatives such as M&As

- Onboarding young treasurers poses a particular challenge, as there is a need for resources that can quickly become fully operational

Fersztand highlighted the collaborative nature of the initiative, explaining: “We did not come last year to the Treasury Lab with the idea of working on HR and resources, rather we came to explore technology. Collectively, however, you pointed us towards the human side of the subject, and we have seen how powerful this is. It’s a real co-creation.” This shift from focusing purely on technology to addressing human resources underscores the importance of developing talent to meet the evolving needs of the industry.

Meanwhile, Djen-Ullmo emphasised the broader goals of the programme: “There is a gap between talent perception and reality in the treasury profession. Our main goal is to foster collective actions to address and bridge this gap.” The initiative aims not only to provide technical skills but also to inspire passion and create new vocations in the treasury field.

Supporting this initiative, Masquelier from the EACT said: “Discussing with our members across Europe, talent recruitment is a significant issue. We should work together to make the job more attractive and recruit the required new skills.” His comments highlight the widespread recognition of the need for proficient and versatile professionals in treasury and the collective effort required to attract and develop new talent.

Several corporates also lent their support to the discussion. Manière-Rochedy noted that: “Participating in this initiative was a natural choice for Dassault Systèmes because we share a common vision and a sense of duty to foster passion and curiosity in our field. And our future depends on the talented individuals we attract today.”

She then went on to explain the work she has carried out to raise awareness of the treasury profession, giving presentations to younger generations – highlighting that treasury is not just a single job or position but encompasses various roles and missions.

Murat, meanwhile, spoke about the win-win of The Treasury Talent Place. “While we have previously welcomed students into the Carrefour treasury team, normally they have come from financial controlling and know next to nothing about treasury. With this programme, the student comes with a great understanding of all the basic concepts, and also some valuable insights and perspectives from the bank side. It’s beneficial for everyone.”

This view was shared by Zimmermann, who praised the fact that students understood about ongoing projects between the bank and the company, and came equipped with experience from working with other BNP Paribas clients too. “For example, we want to implement APIs very soon with the bank. And if there is a possibility for a student to discover what an API is as part of the programme, and then come on our side to implement it, that would be incredibly powerful. I’m really excited to see where this initiative heads next.”

To register your interest in being a corporate participant in The Treasury Talent Place, get in touch: [email protected] or [email protected]

Getting real about virtual accounts

SPEAKERS

Sabrina Jérôme, Global Head of Cash Management, L’Oréal

Bruno Mellado, Global Head of Payments & Receivables, BNP Paribas

While innovation was a central theme at the Treasury Lab, with a focus on the integration of new technologies and methodologies to enhance efficiency and effectiveness, the audience were reminded that some existing solutions are still under-used and under-appreciated. One such solution is virtual accounts – unique IBAN identifiers that help ensure proper allocation of flows.

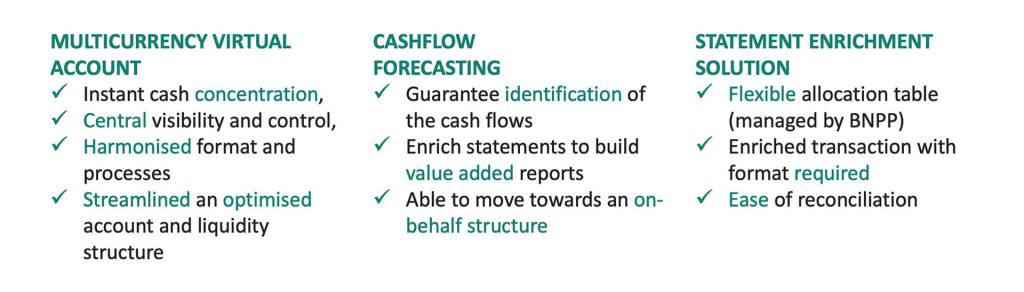

As aliases of a physical account, they are highly efficient for uniquely identifying affiliates or counterparties, enhancing reconciliation and cash allocation processes, and setting up on behalf-of structures, such as collections. However, implementing this solution can be challenging, even for companies with advanced IT resources. BNP Paribas offers a highly specialised implementation method for virtual accounts, enabling companies to delegate the mapping process to the bank. The bank then enriches invoices with virtual account information and provides the relevant reconciliation data.

Mellado elaborated on the practical applications of virtual accounts: “Virtual accounts help in centralising and simplifying cash management processes, providing better visibility and control.” He explained how virtual accounts can streamline operations and improve the accuracy of cash flow forecasting by assigning unique identifiers to different types of transactions.

The benefits of virtual accounts were further detailed, emphasising their role in improving cash concentration, enhancing visibility, and reducing implicit FX risks through a multicurrency set-up. This system allows for instant cash concentration and provides enriched reporting that matches specific treasury needs.

L’Oréal’s Jérôme then shared her experience with virtual accounts: “As a global business, centralisation and concentration of cash management are key. Virtual accounts help us maintain real-time visibility and simplify our banking structure.” She explained how L’Oréal uses virtual accounts to manage multicurrency transactions and improve liquidity management, reducing the complexity of maintaining multiple bank accounts.

These solutions can also be used to track specific data, such as which hair colour products are popular in which countries, or even salons. Helping the company with stock management as well as solving cash and liquidity challenges.

Tapping marketplace momentum

SPEAKERS

Guillaume Massis, CEO, 1POINT6

Camille Constensoux, Axepta In-Store and Marketplace Manager, BNP Paribas

In the day and age of e-commerce, digital marketplaces are becoming the go-to business model. Constensoux noted that there is huge focus in this area and that US B2B marketplaces are doubling in annual sales volume, reaching $224bn.

According to Massis, “B2B buyers now expect the same client experience as B2C buyers, prompting corporates to adapt their strategies accordingly”. Specifically, leading corporates are:

- Expanding their range of products and services, offering a larger catalogue to position themselves as a one-stop shop in their sector

- Providing their affiliates with a ready-to-use platform to sell products online

- Enhancing cross-selling opportunities and increasing the presence of their products through direct counterparties

- Embedding finance offerings in the marketplace

- Delivering a digital, 24/7 customer experience

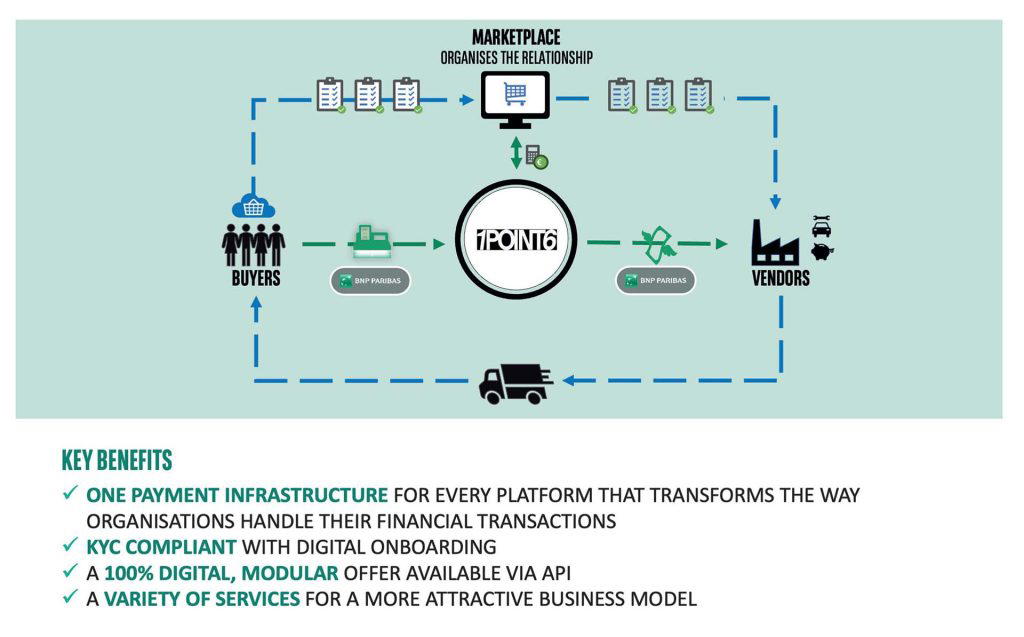

This is why BNP Paribas has supported and funded the 1POINT6 project. In a nutshell, the fintech provides a comprehensive payment solution tailored for various platforms, particularly marketplaces. 1POINT6 aims to enhance compliance, fraud prevention, and operational performance, while enabling platforms to increase their revenue.

As Constensoux noted: “The 1POINT6 project is the result of combining the agility and innovation of entrepreneurs with BNP Paribas’ expertise in cash management and marketplaces.” Moreover, the modular design of 1POINT6 means that it can be adapted to various marketplace models, enhancing efficiency and customer satisfaction.

Nevertheless, technology alone is not the answer to marketplace success. Constensoux stressed the importance of involving treasury teams early in the project, as they act as a bridge between different departments. Acknowledging the evolving regulatory landscape, she also highlighted the need for treasury’s proactive involvement in marketplace development to navigate challenges effectively and create comprehensive and compliant marketplace solutions.

Exploring AI in treasury

SPEAKERS

Emmanuel Baviere, Financial Services Industry Advisor, Microsoft France

Jörg Bermüller, Vice President Head of Cash Management and Risk, Group Treasury, Merck

Hasan Kuas, Treasurer, Vienna Group Treasury, Mondi Group

Nicolas Trimbour, Head of Fraud Prevention and Chief Data Officer, BNP Paribas

Su Yang, Head of AI Transaction Banking, BNP Paribas

The final session of the day focused on an essential part of any current innovation discussion – AI – with in-depth exploration of its potential to transform treasury management.

BNP Paribas’ Yang provided an overview of AI’s potential: “AI has reached a stage where it can significantly enhance our operations. From fraud detection to cash forecasting, the applications are vast.” He also explained the basics of AI, how machines learn, and the importance of data quality in ensuring accurate outcomes.

Meanwhile, Trimbour highlighted specific use cases within BNP Paribas. “In trade finance, we use graph theory for anti-money laundering activities. For cash management, ML helps in detecting outlier transactions, preventing potential frauds.” These examples demonstrated how AI is already being applied to enhance security and operational efficiency by banks, on behalf of cash management clients.

Several corporates also documented their own experiences – and some cases, experiments – with AI. Mondi’s Kuas outlined the journey of implementing AI in treasury, starting with APIs and RPAs 10 years ago, then progressing to ML. In the past five years, the company has formed a Digital Excellence team focusing on AI solutions using large language models, implementing more than 50 tools for Mondi group.

He also piqued the interest of the audience by highlighting four current projects:

- Dynamic intraday limit allocations for payments, using AI to manage liquidity and security

- Anomaly detection to identify potential fraud and human errors

- AI-driven FX management to improve accuracy

- Utilising GPT technology for document review and comparison, enhancing efficiency and consistency in document management.

Next, Bermüller shared insights on integrating AI into Merck’s treasury processes, while emphasising the importance of solid, straight-through processes and robust IT systems for global operations. He described treasury’s journey starting with RPA for account statement verification, eventually evolving to AI solutions. Speaking about a real turning point for the use of AI, he said: “There was a $10m mis-conversion, which highlighted the need for automated exchange rate verification, leading to the implementation of a system that teaches machines to recognise and correct such errors.”

Bermüller also touched on Merck’s exploration of valuable information within account statements, anticipating further AI use cases in cash and liquidity management. All in all, his comments underscored the practical benefits of AI in automating routine tasks and enhancing decision-making processes.

The role of AI in improving operational gains, such as automatic data extraction and fraud detection, was also a key focus for Baviere. Sharing his own experiences with the audience, he discussed the company’s strategic partnership with OpenAI, accelerate AI breakthroughs to ensure these benefits are broadly shared with the world. He also stressed the need to take a “human first, AI second” approach, using AI to enhance employee productivity and customer interactions. Key implementations at Microsoft include Microsoft Copilot for Finance, which integrates generative AI with systems such as SAP to automate processes and save time.

Finally, Trimbour noted that while rigour is absolutely necessary in any AI project, “A ‘try and dare’ corporate culture, focused on innovation, and expert resources on data and AI are also crucial for success.”

Driving the future forward

In conclusion, the BNP Paribas European Treasury Lab event showcased a blend of innovative strategies, practical applications, and collaborative efforts, highlighting the dynamic future of treasury management. By deploying new technologies, in combination with human expertise, while fostering talent, and working together towards the greater good, the industry can address current challenges and seize new opportunities for growth and efficiency.