- Neil Hutchison

- Lead Portfolio Manager for Managed Reserves, Europe, J.P. Morgan Asset Management

by Neil Hutchison, Executive Director, J.P. Morgan Asset Management

Corporate investors are no strangers to the complex market issues that are encumbering decisions on how to invest surplus cash. Negative interest rates are creating particular challenges, and it becomes difficult to counteract these issues using the most familiar and popular cash investment instruments. Although the past two years have witnessed an increase in M&A activity, corporate cash reserves remain at a record high. At the end of 2013, for example, the top thousand public, non-financial companies were holding $3.53tr. (source: The Cash Paradox, Deloitte LLP) with no considerable change since then. Given the scale of investment challenge experienced by many corporations, treasurers are now starting to look beyond traditional cash investment instruments and find out what choices and opportunities they have to boost returns within a controlled risk framework.

Market constraints on investment

With most corporate treasurers taking a conservative approach to portfolio risk, deposits and short-term liquidity funds such as money market funds (MMFs) remain their most common investment choices. These are straightforward to transact, allowing treasurers to diversify their risk across counterparties (particularly with MMFs) and maximise access to liquidity. Now that the overnight euro market rate has fallen to 20 or 25 basis points (bps) below zero at best, and is likely to fall further, the convenience and familiarity of deposits needs to be weighted against the negative return. Yields on euro denominated MMFs are also now slipping into negative territory as they start to reflect current market conditions.

This creates a new and unprecedented situation for corporations. While the long period of record low interest rates prompted treasurers to start thinking about the cost rather than the return on surplus cash, this is now a reality. Given the level of cash holdings in many corporations, the financial implications can be substantial.

Regulatory pressures

The situation is exacerbated further by the changing regulatory environment. MMFs need to hold more cash and cash-equivalent instruments than they have done in the past, leading to a further depression in yield. Banks, typically the largest allocation in AAA-rated money market funds, are terming out their funding in response to Basel III requirements creating a mismatch between supply and demand.

One of the most commonly highlighted potential regulatory changes in MMFs is the shift towards variable net asset value (VNAV). Many investors are wary of investing in these funds, not least because they are less familiar with variable NAV than constant NAV funds that characterise many short-term MMFs in Europe. They may also need to seek a change from their current investment policy to permit investment in variable NAV funds. It is important to understand the relative risks of variable NAV funds: for example, they have the potential for a lower credit quality than constant NAV funds as well as longer duration, but given the cost of holding cash, it is likely to be worthwhile to understand and explore the opportunities for using variable NAV funds.[[[PAGE]]]

Exploring investment alternatives

While managing risk remains a critical priority for corporate investors, a perspective which we share, risk management issues need to be considered in conjunction with other investment priorities. In the immediate aftermath to the global financial crisis, company boards prioritised risk and liquidity, while yield became largely irrelevant. Negative yields, however, are encouraging boards to review this position, and rethink both their appetite for risk and need for short-term liquidity. This is particularly the case now that many treasury departments have become more adept at forecasting cash flow, and are therefore in a better position to segment their cash between short-term working capital requirements, core cash and strategic cash that is not required to support daily cash flow needs.

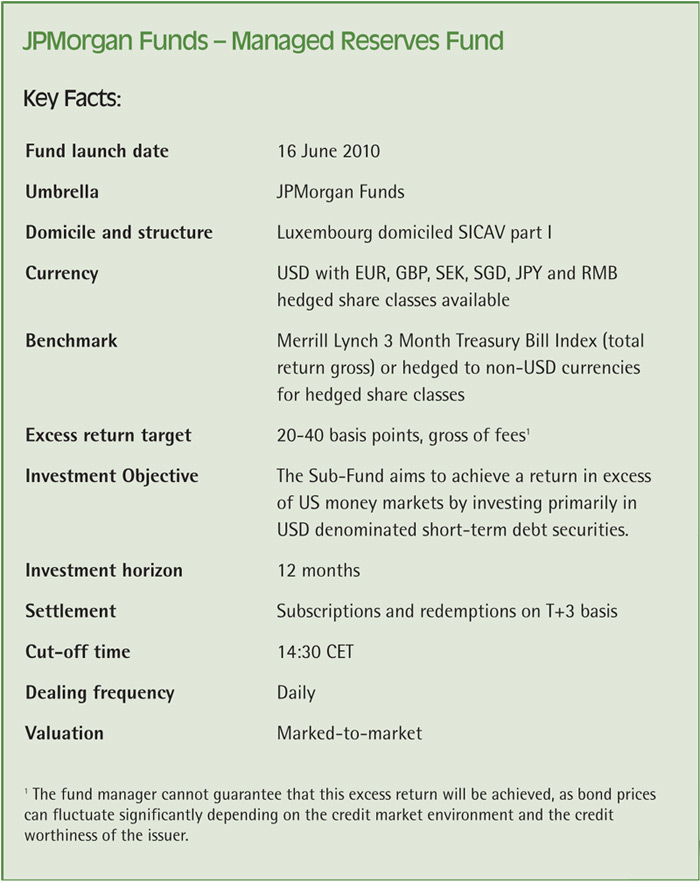

Stepping out from conventional AAA-rated MMFs and deposits into what we call our Managed Reserves (MR) strategy at J.P. Morgan can be a valuable means of overcoming some of the challenges that are currently facing euro denominated MMFs. For example, as traditional AAA-rated funds are obliged to invest in assets with the highest short-term rating, they are often prevented from investing in many non-financial corporations, even though the credit fundamentals of these companies may be strong. A separately managed account or fund following the MR strategy will typically accept more interest rate and credit risk than AAA-rated MMFs, but within set limits.

The MR strategy is a key part of J.P. Morgan Asset Management’s business. Around 30% of the $1.7tr. of our total assets under management are managed by our Global Liquidity business, of which $43bn* are now invested in portfolios following the MR strategy. The majority of this is currently held on behalf of US investors, but we are now seeing greater interest and adoption amongst European investors, representing around 10 per cent of total MR assets. These portfolios build on our global liquidity framework, leveraging the strength of J.P. Morgan Asset Management’s credit approach which has been developed and refined over the past 40 years. This ensures a conservative and consistent approach to managing risk, with an investment approach that is specifically geared to the needs of clients who do not need same day liquidity. Taking into consideration our credit and risk framework we aim to deliver an excess return of around 20 to 40bps over MMFs gross of fees over a business cycle.**

Leveraging the advantage

Our MR fund offering is currently denominated in USD with EUR hedged share classes but we also offer fully customised separately managed accounts for balances of EUR100m or more.

As with other types of term investments, portfolios managed to this strategy are best suited to strategic cash, i.e., cash for which same-day access to liquidity is not required, rather than cash required for working capital purposes. By sacrificing some liquidity (although these funds are by no means illiquid) investors are less exposed to the most negatively yielding part of the euro money market curve, which is up to three months in maturity. The value proposition for the MR strategy is further enhanced given the European Central Bank’s (ECB) policy on quantitative easing which is likely to continue for at least another twelve months.

Creating choices

The growth of variable NAV funds in the market can appear daunting without proper explanation and exploration, but the use of variable NAV funds should not necessarily be considered a shift into high risk active asset management.

In this environment, investors need choice and flexibility in the investment possibilities that are open to them. The Managed Reserves strategy provides access to a low volatility solution with the opportunity to move from a net negative to a net positive return – an extremely valuable addition to any corporate investor’s range of options.

* Source: J.P. Morgan Asset Management as at 30 June 2015

** The fund manager seeks to achieve the stated targets/objectives but cannot guarantee that this excess return will be achieved, as bond prices can fluctuate significantly depending on the credit market environment and the credit worthiness of the issuer.