After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: October 06, 2014

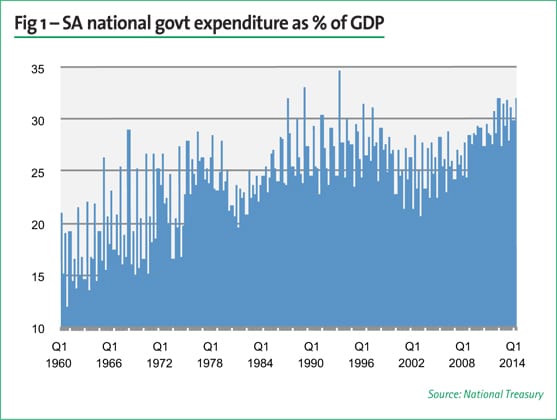

SA has been heading down a road of unsustainable government expenditure for several years now, in the hope that the illusive growth the government is searching for will materialise to boost government tax revenues and rebalance SA’s fiscal position. This has not materialised. Instead we are now dealing with an environment where government expenditure has gradually increased relative to GDP and where the budget deficit has not been reduced over the past five years. It is a dangerous situation resulting in credit ratings downgrades. Unless there is a significant reduction in government profligacy and greater respect shown for SA’s stretched tax base, SA may be forced to consider a series of unpleasant austerity measures of its own. All avoidable.

It is a rhetorical question of course. No-one wants or needs to live through a fiscal crisis. It is massively destructive to say the least and would precipitate considerable reforms which would initially be very destabilising from both a financial and a socio-economic perspective.

Why the question then? To raise awareness of the lack of progress in addressing SA’s fiscal decline and to highlight how the only event that might prompt a full-scale reassessment of the fiscal status quo might be a crisis that jolts SA authorities into taking stock.[[[PAGE]]]

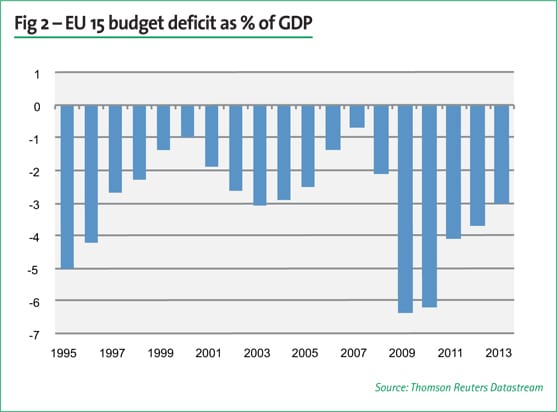

Dating back to 2009, when most governments around the world were faced with a massive recession and dearth in tax collections, the fear was that the fiscal authorities would struggle to recover their fiscal balance easily. What was not envisaged was that SA would struggle as much as it has. In the past five years, whilst countries across the globe have gradually reduced their budget deficits relative to GDP, even within very trying economic environments such as the Eurozone, SA has achieved very little.

At first, the high deficit was couched as a counter-cyclical fiscal policy that was described as prudent and responsible, but slowly that explanation is losing currency as SA lags in its efforts to do what it has been telling investors it would do, namely reduce its budget deficit to more sustainable levels.

In the eyes of the authorities, SA has been producing sub-trend growth and that has been the fault of the international environment and yet, here we are in 2014 when the US, the UK and arguably even China are posting stronger economic expansion and SA continues to produce a budget deficit that remains above 5% of GDP. Blaming the international environment also only stretches so far when one notes the progress made by the Eurozone in balancing their fiscal books and reducing their aggregate budget deficit to less than 3% of GDP in a non-existent growth climate.

Steadily, SA’s credit ratings have been eroded and despite warnings that the government should adopt a more conservative approach to its budgeting process and work around the premise that tax collections and GDP growth would be weak, it has persisted in structuring its budget under far more optimistic and seemingly unrealistic expectations. Now the amount of fiscal room left to work with has evaporated and SA will be producing one of its weakest growth performances in years. No amount of berating the credit ratings agencies will help either. They have a job to do and that job is to highlight to a global community when a country’s ability to repay its creditors is being eroded.[[[PAGE]]]

Instead, there are some glaringly obvious trends that government should identify and reverse, starting with the tendency of government to prop up the employment numbers by swelling the public sector employment ranks as opposed to enabling the private sector to do so itself. Not only has government been swelling its ranks, but the increase in the wage bill has in many instances in the past ten years been more than twice the inflation rate. Readers can appreciate how when a tax base is not rising anywhere near as quickly, this implies that funds have been diverted away from arguably more productive deployment to pay for growing ranks of civil servants with the objective of service delivery top of mind. Except that service delivery has barely improved.

Simply removing the additions to the civil service and entrusting the private sector with doing more would have accounted for some 2% of GDP which on its own would have accounted for a budget deficit to GDP ratio shrinking towards the more palatable 3.0% of GDP and would have reduced the total debt as a percentage of GDP by as much as 8% over the past five years. One doubts whether the credit ratings agencies would have downgraded SA had the budget deficit been significantly smaller and SA’s overall debt pile under 40% of GDP. Had they done so, it would have only been by one notch, not more.

The SA government may have one last opportunity to head down the righteous path where trimming the right kind of government expenditure is still an option. Currently, the US and the UK are both experiencing cyclical upswings and the ECB is under pressure to conduct QE type policies to reflate the Eurozone economy. Japan is throwing the monetary kitchen sink at their economy whilst the Chinese are becoming increasingly accommodative once more. An opportunity where international growth will still be reasonable and which the SA economy can leverage if given the chance still exists to conduct SA’s version of fiscal reforms without impacting too severely on growth. It is a growth environment that will allow the fiscal authorities a little flexibility to rebalance the fiscal ship without any of the hard choices that some countries in the Eurozone have had to face where growth was non-existent and still they were forced to trim government expenditure.[[[PAGE]]]

Finance Minister Nhlanhla Nene was quoted as saying that the government had no plans to curtail spending and that “cost pressures would simply be absorbed through reprioritisation”. It is not clear exactly what this entails but it is unlikely to be enough given the magnitude of the budget deficit that needs to be reined in. Anything short of a dramatic reversal of fiscal strategy by the Department of Finance, not getting the basics right and not rebuilding SA’s fiscal buffers is bound to lead SA into troubled waters where the fiscal profligacy of the past five years comes back to haunt the country in the form of further credit ratings downgrades and significant financial market volatility.