After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: January 01, 2000

In today’s market environment, it is essential for companies to be open to transforming their current operations to enable new and sustainable growth. As many leading United States (US) corporates have discovered, it is no longer possible to rely on organic growth alone to deliver the financial performance needed to satisfy investors and analysts. A critical factor in the success of any transformation effort is the integration of treasury into corporate strategy. Today’s corporate treasurers have a vital role to play when it comes to strategy, and their input and a critical seat at the table can help ensure an optimal result. Their advice on matters such as transaction structures, funding sources and capital allocation can fundamentally affect the success of expansion programmes. Treasury is also well positioned to help the company grow financial returns and increase efficiency by providing guidance on topics such as centralisation, risk, financial control, regulation, currency controls, plus cash and liquidity management.

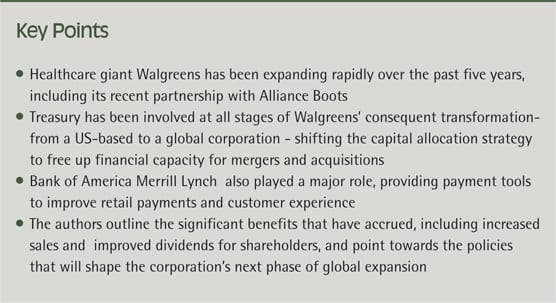

Walgreen Co. is an illustration of how involving treasury in this way can deliver a great result. Already the largest pharmacy retailer in the US, Walgreens undertook a transformation effort in 2008 to position itself as America’s first choice for health and daily living needs. The firm today serves more than 40 million customers a week in more than 8,000 stores across the US and Puerto Rico. Nearly two-thirds of Americans live within three miles of a Walgreens store.

For the past five years, the company has continued to expand and transform its business model to meet domestic healthcare challenges in the aftermath of the global financial crisis. At the same time, this has led to a repositioning of its capital structure. The culmination of transformation is the company’s strategic partnership with Alliance Boots. In June 2012, Walgreens acquired 45% equity ownership in Alliance Boots. It recently announced that it has exercised its option to complete the second step of the transaction.

Walgreens’ treasury has played a central role, enabling transformation through financial innovation and partnerships — not only with other company departments, but also with vendors, banks and other financial services providers. All are playing key roles as the company continues its transformation into a global leader in pharmacy-led health and well-being services with more than 11,000 stores in 10 countries upon close of the Alliance Boots transaction. This created an unparalleled portfolio of retail and business brands, as well as increasingly global health and beauty product brands. The full combination also will establish the worlds’ largest pharmaceutical wholesale and distribution network.[[[PAGE]]]

Treasury at Walgreens is more than just a support organisation. It’s a strategic participant within the company that helps enable corporate strategy. Through its early transformation efforts, the company viewed transformation not as a one-time effort but a continuous process of corporate and operational change.

Transformation on any scale, and particularly with Walgreens, has required a cultural shift impacting all parts of the organisation. For Walgreens’ treasury, this shift has been accompanied by a new approach to teamwork and leadership, and an enterprise perspective, as the company moves from a US-only base to global operations. Treasury has been integrated into corporate strategy to help drive change, allocate capital, grow the business and make sure shareholders are rewarded appropriately.

The global transformation effort began more than five years ago at a time of major economic turmoil. The company was growing rapidly at its peak, opening a new US store roughly every 16 hours. It had been an incredibly successful strategy for growth. However, by the beginning of the financial crisis in 2008, the organic growth that had driven the company for so long began to slow.

At that time, Walgreens reassessed its organic growth strategy. Its new strategy of expansion through mergers, acquisitions and alliances represented a major change for a company that had traditionally grown by internally generated expansion into new retail markets. With a greater voice in corporate strategy, treasury has served as a strategic enabler by providing liquidity, capital allocation and structure, dividend policy and share repurchase, real estate and debt financing, and risk management.

As part of the transformation effort, the company is redesigning its store network while reinventing its customer experience. For instance, Walgreens has improved and differentiated its store layouts, with a brighter retail atmosphere in areas like cosmetics and an emphasis on healthy eating and living.

The company gained media attention and customer traffic as a result of the grand opening of a new flagship store. Located in the company’s hometown of Chicago, in the thriving Loop business and government district, the new up-market store features organic foods and snacks, sushi, frozen yogurt, a better selection of wines and longer Healthcare Clinic hours.

While continuing to build new stores domestically, Walgreens also sought merger and acquisition opportunities. Treasury shifted its risk management and capital allocation strategies: with slowing capital expenditures, Walgreens freed up financial capacity for acquisitions and more shareholder-friendly activity, including increased dividend payments.

The transformation efforts are visible. Since the process began, the company has increased annual net sales to $72 bn from $53 bn and store locations to 8,116 from 6,443 (based on figures from fiscal year-end 2013). Cash returned to shareholders has increased, even in the face of expansion expenses.

Over the last five years, the company has generated almost $20 bn in operating cash flow and $13 bn in free cash flow. It has deployed more than $7 bn in capital expenses to once again support organic growth, as well as technology investment, including a new point-of-sale (POS) network. More than $10 bn in cash and stock has been deployed in mergers and acquisitions and strategic partnerships. As part of this overall strategic shift in reallocating capital and rewarding shareholders, the company has returned to shareholders more than $8 bn in dividends and share repurchases.

In addition to securing access to capital through its banks, Walgreens recognised that Bank of America Merrill Lynch could provide payment tools to help retail customers make payments in ways that are most convenient, and vendors get paid within terms that support their businesses. Retail payments are evolving in an exciting way, and treasury plays an important role in deciding what will improve a customer’s experience at checkout. The treasury team was at the centre of Walgreens’ launch of its Balance Financial prepaid debit card earlier this year as part of a suite of financial service offerings.

Convenience is important to retail customers, in terms of both store location and the checkout experience. Walgreens views the POS as a customer interface. Whether a payment at the POS involves cash, a swipe, a tap or the scanning of a phone, it’s a treasury transaction on behalf of a Walgreens customer. The customer’s experience is wrapped around that transaction, and treasury is at the centre of making it a positive one. This is also an area where the right bank provider can add considerable value, as it will be able to provide guidance on new payment types and how best to deploy them.

For example, treasury is a critical component of working capital management for the company, which includes inventory, receivables and payables. Supplier relationships touch treasury in association with procurement, and treasury has been working to find ways to support its suppliers, many of which are much smaller businesses.

Payment terms and vehicles for payment are absolutely critical to suppliers, especially the smaller businesses. The company offers a range of ways for suppliers to accept its payments, whether through purchasing cards or other electronic means.[[[PAGE]]]

Treasury’s strategic collaboration and leadership within Walgreens, and relationship with banks, will only continue in importance as the company expands internationally, most recently by merging with Alliance Boots. Walgreens’ treasury is focused on its future capital structure and capital allocation policy to meet the challenges of the company’s next phase of global transformation. Treasury is helping Walgreens meet the changing financial needs of a retailer, healthcare provider and global enterprise public company.

A combined Walgreens and Alliance Boots will have a network of more than 370 distribution centres, delivering to more than 180,000 pharmacies, doctors, health centres and hospitals in more than 20 countries. Outside the US, capital planning, cash management and other treasury operations require a very different set of skills and activities, and the company is collaboratively planning for these activities.

It takes a top-flight team of treasury professionals who can broaden their skills and think about the entire expanding enterprise by looking beyond the traditional treasury boundaries. This team includes personnel from both corporate treasury and their bank transaction service teams. Bank teams that evolve in this way can add appreciable value by supporting clients such as Walgreens (and the future Walgreens Boots Alliance, Inc.) as they grow internationally. Walgreens has been able to rely on a team of treasury professionals through the initial phases of its change initiative, and will continue to transform its operations to keep pace with the company’s global expansion plans.