Our research shows that ten operating practices are tied to higher service levels and lower inventory costs.

by Raoul Dubeauclard, Kerstin Kubik, and Venu Nagali, McKinsey

What would it take for manufacturing businesses to operate like the best online retailers? How can such companies turn orders around in a day, deliver them with greater customization, and replenish stocks seamlessly? These aren’t idle questions for the top teams of manufacturers, because customers, across both B2C and B2B markets, are more fickle now; service demands are steadily notching upward; and economic volatility shows no sign of abating. Supply operations often struggle to keep pace, as many aren’t sufficiently agile to capture fleeting upside opportunities or to mitigate fast-moving risks.

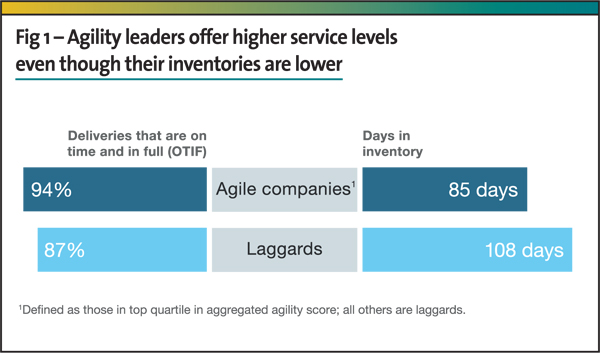

To shed light on the enablers and enemies of agility, we examined the supply-chain performance of companies in five industries, as well as a range of practices that influence it. We analyzed proprietary data from interviews with operations executives at more than 250 global companies. The interviews assessed ten supply-chain capabilities, including portfolio and complexity, order and demand, forecasting, and risk.[1] Responses were plotted on a scale of one to five and the overall agility scores organized into quartiles. We then compared those scores with two widely employed measures of supply-chain performance: service levels, as measured by the proportion of orders delivered on time and as promised,[2] and days of inventory held.[3] Companies with more agile supply-chain practices (as described by executive-survey respondents) had service levels that were seven percentage points higher and inventory levels that were 23 days lower than their less agile peers did (Figure 1).[4]

We also looked at specific agile practices and how consistently top-quartile companies adopted them (Exhibit 2). Most, we found, do well in areas such as demand forecasting, labor flexibility, and the optimal placement of inventory across distribution networks. Fewer had mastered capabilities such as modularization and postponement, which require standardized manufacturing and process inputs so that companies can respond more fluidly to fluctuations in demand and to lower stock levels. Most struggled to shape demand, a practice that relies on variable pricing—increasingly grounded in advanced analytics—to regulate the flow of products through supply networks and to optimize margins. One example of a company that uses these techniques is Amazon, which adjusts prices and inventory levels in real time in response to competitors’ moves, among other things.

Notes

[1] The survey solicited self-reported answers to more than 60 questions on the following topics: forecasting, the ability to shape demand, risk management, modularization and postponement, integrated planning, labor and asset flexibility, network agility, lean fulfillment, inventory placement, and disruption-response planning.

[2] Operations executives use the term “on time and in full,” or OTIF.

[3] Inventory days average raw materials, work in progress, and finished goods across the supply chain. For this analysis, we examined more than 70 companies distributed across five industry groups. Industries such as chemicals and pharmaceuticals had higher average inventory levels than consumer products and automotive did.

[4] We found statistically significant correlations between reported OTIF service levels and agility scores across quartiles. Regression analysis also revealed a statistically significant relationship between reported inventory days and agility quartiles.

[[[PAGE]]]

Experience in two industries demonstrates how supply-chain agility accounts for divergent levels of performance among companies.

Chemicals. One top-quartile company is an industry leader producing a full range of chemicals used in agriculture and food processing. After regularly missing shipments as a result of raw-material shortages, executives shook up their operations and now tightly integrate planning efforts with those of suppliers: the company shares data on forward orders with them and solicits their insights into the availability of materials and capacity constraints.

The company has also invested in redesigning processes (the modularization and postponement mentioned above) so that end products can be made more efficiently and quickly from standard inputs that are always in the production stream. Thus, when demand increases for an individual product, a plant manager can access the modular base and rapidly create the final formulation with only a few more steps than would be necessary with nonstandard inputs. That capability has not only sharply reduced the number of end products the company needs to stock but simplified SKU management as well. This company has also negotiated greater labor flexibility across its plant network, easing contractual constraints on hours worked. In addition, it has trained employees in multiple areas of process knowledge, so teams can quickly shift from one site to another to meet demand peaks. Factories now run at nearly full capacity, with lower logistics costs and far fewer expensive express shipments.

An industrial-chemical company with a broad product portfolio ranks two quartiles lower. Its service levels have slipped, because chronic shortages of materials, resulting from inconsistent coordination with suppliers, often delay shipments. Meanwhile, the company carries high levels of inventory because of its difficulties adjusting work schedules when demand increases.

Consumer products. A large consumer-goods company had trouble meeting demand for its fast-moving food and beverage categories. On closer inspection, it found that a lack of transparency across its supply chain was the culprit. To remedy the problem, the company charged a senior supply-chain executive with managing sales and operations planning end to end—something consumer-products companies often strive to do but rarely get right. After a successful pilot, the company extended the program to most of its suppliers, retail stores, and distributors. Inventory data became more reliable, collaboration improved, and on-time order fulfillment rose significantly.

Operations executives also sought ways to lower the risks when gyrating geographic and seasonal demand patterns put pressure on the supply chain. After a review of the company’s distribution network, these executives found they could mitigate customer stockouts by outsourcing a significant portion of their warehouse operations. When regional demand for a line of new products surged, the business could easily add low-cost warehouse capacity.

By contrast, service and inventory performance were less strong at one home-products manufacturer, which like the consumer-products company above boasted a diverse product line but had lower agility scores for operations planning and risk management. Its logistics costs are 25 percent higher than those of the consumer company, and it has been hit by persistent transport problems that require it to carry twice as much inventory.

Agile practices can help companies navigate an increasingly volatile and unforgiving global economic environment. Only a few companies, however, are adopting these approaches broadly enough to improve their supply-chain performance significantly.

This article was first published in McKinsey Quarterly, April 2015. Reprinted with permission.