After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: April 20, 2010

As the world’s leading provider of business software, SAP delivers products and services that help to accelerate business innovation for customers. Today, customers in more than 120 countries run SAP software – from individual solutions addressing the needs of small businesses and midsize companies to suite offerings for global organisations. SAP currently has sales and development locations in more than 50 countries worldwide and is listed on several exchanges, including the Frankfurt Stock Exchange and NYSE, under the symbol SAP.

As a globally active company, we are subject to risks associated with fluctuations in foreign currency exchange rates in our normal operations. Foreign currency-denominated receivables, payables, debt, and other balance-sheet positions as well as future cash flows resulting from anticipated transactions including intra-group transactions, are all subject to currency risks. We manage our currency risk exposure on a group-wide basis primarily using foreign exchange forward contracts.

Our treasury department is always looking for new ways to add more value to existing processes to stay ahead of the curve, so we decided to implement an electronic trading platform to increase efficiency by saving time in the dealing process and by reducing both the post trade workflow, with straight-through processing (STP), and the number of errors. Regulatory pressure to prove that we have achieved best-price execution was also a driving force behind our interest in e-trading.

In the first place 360T’s multi-bank trading platform TEX® offers the widest variety of tradable asset classes of any multi-bank system. It covers all hedging and investment instrument products (FX forwards, FX swaps, FX options, fixed-term deposits, interest rate swaps, money market funds) in which we could use the platform. This was one of the major reasons why we chose 360T. Furthermore nearly all of our core banks are on the platform: only three are missing. Another advantage of 360T is the lower cost for corporates compared to other trading portals. [[[PAGE]]]

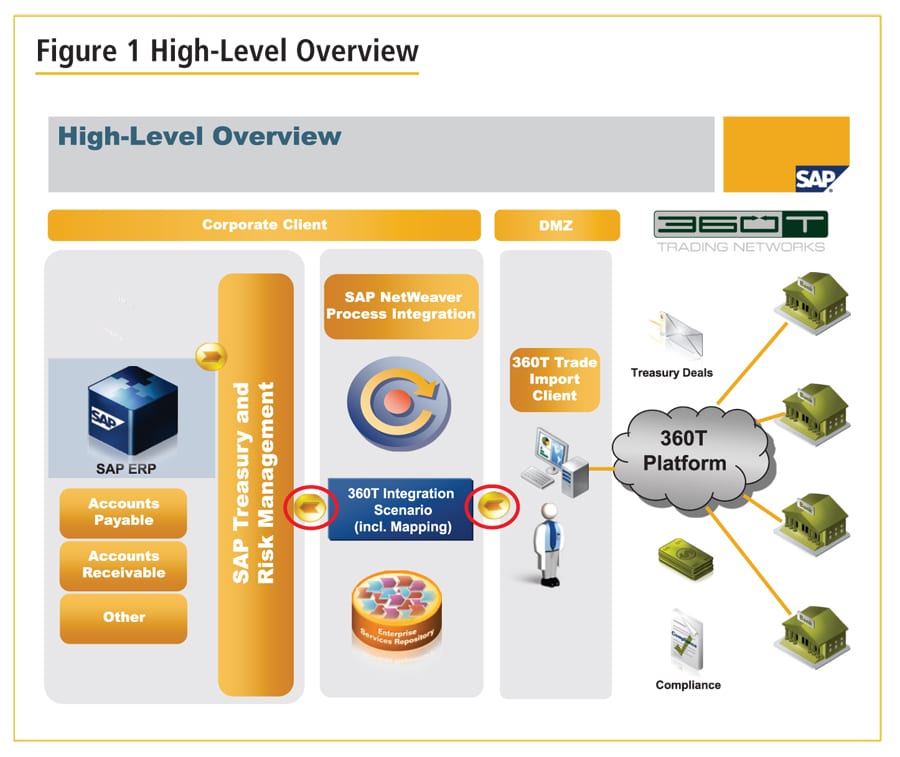

Deals previously executed over the phone are now dealt electronically on 360T’s multi-bank platform. Via our new, fully integrated Trade Import Client, all deals appear online in our SAP Treasury and Risk Management application through mapping on SAP NetWeaver Process Integration technology. This STP solution helps to avoid any data entry errors that might have occurred in the past.

The implementation of TEX® was overall very successful after resolving some issues regarding connectivity (firewall settings, proxies) and the authorisation of the communication user which enters the deal into our system. In addition, a small SAP software customising effort was needed to map external to internal representation. For special additional requirements, such as internal booking, 360T can easily add ‘CustomFields’.

The implementation of both e-trading and STP has certainly brought about remarkable improvements in our entire treasury operation. The most important benefits we identified were:

As a result, e-trading plays a significant role in our treasury department. Our fully automated trading lifecycle would not be possible without it.

At SAP we normally trade FX spots, FX forwards, FX swaps and FX forward swaps.

Currently approximately 95% of our operational business is done via 360T.

[[[PAGE]]]

We are in the process of evaluating whether we will also request fixed-term deposits and IMMFA funds via 360T during the course of the year.

A question troubling us was if and how the usage of a platform would affect the communication and relationships with our core banks. After using the platform for several months we noticed that the contact with some of our banks’ sales people had been reduced; In particular there was much less discussion about particular limit levels, significant currency movements and updates on FX markets in general. Therefore we decided to do most of our standard operational business via e-trading, but to continue to perform non-standard transactions by phone in order to stay in touch with the banks and to keep up the exchange of information..

Considering all the benefits we achieve by using a portal and through STP we can definitely say that our expectations have been met. Obviously in the immediate ‘post-Lehman’ period e-trading showed some weaknesses due to thin liquidity, but after some weeks there was once more some liquidity on the platform every day.

After two years of experience with online trading I can definitely say that e-trading is a ‘must-have’ for treasuries of a certain size. In particular, I would recommend a multi-bank platform, as in this way you can achieve the best depth of the market, the highest level of automation, save costs by using one single applet and manage your counterparty exposure efficiently.

In the long term we certainly want to extend the range of products we trade on the platform, and evaluate the possible adjustment of the interface to support products such as fixed-term deposits.