After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: January 01, 2000

Corning Incorporated is the world leader in speciality glass and ceramics. Established in 1851, and headquartered in Corning, New York, Corning employs around 24,000 individuals worldwide. The company creates and makes keystone components that enable high-technology systems for consumer electronics, mobile emissions control, telecommunications and life sciences. 2007 revenues exceeded $5.8bn with net income of $2.15bn

In late 2005 we embarked on a project to centralise our banking in Asia and EMEA through a regional banking structure...

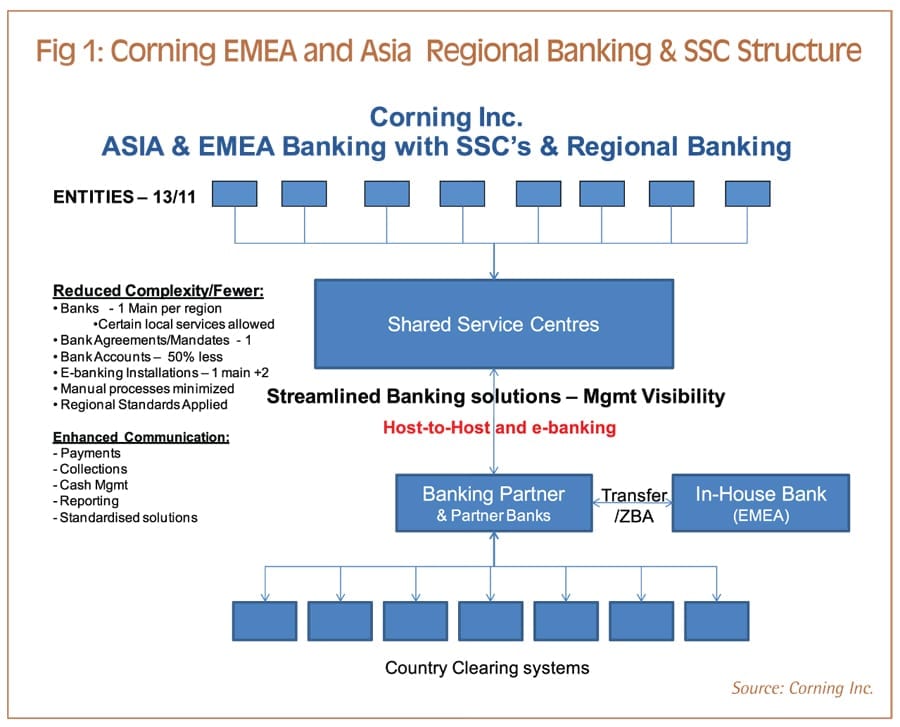

In late 2005, we embarked on a project to centralise our banking in Asia and EMEA through a regional banking structure, a project which took place alongside the implementation of shared service centres (SSCs) in Shanghai for Asia and Budapest for EMEA. The Shanghai SSC initially covers China, Hong Kong, Japan, Taiwan, Korea, Philippines and Singapore and will potentially support operations in India, Thailand and Australia in the future. In Europe, the SSC in Budapest caters for business needs in UK, Netherlands, Germany, France, Spain, Italy, Turkey, Poland, Ireland and Hungary and its scope could potentially extend to Denmark, South Africa, Russia and Luxembourg in the future. While material internal efficiencies were achieved through the creation of the SSCs, many of the potential transaction processing efficiencies were being hampered through the lack of a cohesive approach to banking in these regions. We had approximately 36 banking relationships in place with various mandates and close to 160 bank accounts. The diverse banking group also meant that a multitude of banking systems were used to communicate with our different banks for payments, collections, cash management and reporting etc. - not only were technical solutions and processes unique to each bank, but it also required more varied skill sets, per bank across the region, to correctly apply local standards and regulatory/clearing requirements. In addition, the lack of cash management cohesion meant that it was difficult to gain timely and accurate visibility over the company’s cash position, hampering our ability to manage cash related activities efficiently both locally and globally.

It took some effort internally to prioritize the move to a regional banking structure. In particular, we needed to convince senior management that there would be sufficient upfront value in rationalising our banking relationships and connectivity bearing in mind we were already dedicating resources to the implementation of the regional SSCs and other key standardisation projects. Eventually, after having identified clear project objectives and both absolute and potential beneficial outcomes, the decision was made to progress the selection of preferred partner banks for EMEA and Asia to match the scope of the regional SSCs.

We decided to appoint one preferred bank in each region for all material operational banking services in order to reduce complexity and costs. Some of our specific objectives included:

Initially, we excluded entities which were not part of the SSCs from the project scope, together with trade finance, intercompany netting and joint ventures. Payroll disbursements was also initially excluded but this has since been implemented in a number of the countries with more to come. [[[PAGE]]]

We launched our Request for Proposal (RFP) in 2005 and followed a detailed analysis process. We invited banks with known regional banking capabilities which already provided credit to us to tender; however, we also wanted to make sure that our assumptions about the capabilities of the other banks in our credit facility were valid so they were approached to ensure that we correctly understood their service capabilities in this area. We evaluated RFP responses based on a range of factors including:

While bank fees were also important, cost was not the primary factor in our decision. Once we had come to our conclusions, we informed each of the banks and gave them a high level summary of their scoring. We appointed Standard Chartered for Asia late 2005 and Bank of America for EMEA in ealy 2006 as our regional banks.

A regional banking rollout perhaps always takes longer than anticipated, but it has been worth the effort and the results have been significant.

Following the initial appointment, the elapsed time for the project was longer than would otherwise have been necessary as we did not want to disrupt the progress of the SSC project. In Asia, for example, we negotiated the documentation in early 2006 but did not start rolling out the regional banking relationship until the middle of the same year. Overall, the project took a year, including all of the countries in the SSC scope. Japan was the most difficult country to implement, as a partner bank was involved so it took longer to arrange the necessary documentation etc.

A regional banking rollout perhaps always takes longer than anticipated, but it has been worth the effort and the results have been significant. In Asia, individual country requirements are more specific than in other parts of the world, but even in Japan where we had had the most challenges, we achieved our objectives. In Europe, the project also took a year, although there are fewer country specificities than in Asia. We mainly resourced the project internally, so finding enough resource at the right times in the project was often an issue. Ideally, under different circumstances, we may have avoided embarking on the project at the same time as the SSC rollout but it was crucial for us to rationalise our banking relationships.

When we first appointed our regional banks, SWIFTNet for Corporates was not on our radar as there were few corporates which had implemented it, and few banks were promoting SWIFTNet as actively as they are today. Consequently, we planned the connectivity segment of the project using proprietary technology rather than SWIFTNet, and although the opportunities that SWIFTNet provided became more apparent over the course of the project, we decided not to change tack mid-project. In fact, the solution we have delivers similar benefits to SWIFT. We channel our payments through our ERP systems, SAP and Peoplesoft, through middleware layer Microsoft BizTalk to our banks via their host-to-host solutions. Using the middleware layer means that we do not need to make changes to our originating systems to deliver files in a particular format, which gives us significant bank independence should our banking requirements change in the future. Next year, as we look at our North American regional banking, we may consider SWIFTNet, otherwise we will plug the new bank into our existing infrastructure. [[[PAGE]]]

We still maintain the e-banking platforms for emergency or ad hoc payments but we use these as little as possible. Where these are essential, payments are approved locally and then executed centrally. Some local bank accounts still exist, but these are being gradually phased out except when necessary for occasional local banking services.

The benefits we have obtained by rationalising our banking relationships in Asia and EMEA have been significant. Having a centralised disbursements and receivables model allows us far greater control both operationally and in the way that we manage our working capital. Working with two partner banks simplifies our structures considerably, reduces our costs and means that fees are more transparent. We also have far greater visibility over our cash position and we are able to manage our cash on a regional basis more effectively, for example:

[[[PAGE]]]

There are inevitably a range of factors which contribute to the success of a complex, geographically and culturally diverse project of this nature and some things which one would have done differently with hindsight. For example, it always takes longer to negotiate legal documentation than planned. Housekeeping is also important to achieve the greatest automation in processes, such as maintaining vendor master file data. Clearing systems are different in each country, particularly in Asia, and therefore it is important to understand the requirements in each location. Connectivity with the banks needs to be mapped out clearly at the start.

Project discipline, such as a formal change management procedure is essential, to which there needs to be buy-in from all stakeholders. Resourcing needs to be allocated by aligning individuals with specific project tasks at the appropriate stage in the project. This is also important bearing in mind that competing priorities can otherwise threaten to derail a long-term project of this nature. The project benefits need to be defined clearly and commonly understood, which include both tangible and “soft” benefits which may be equally important to the business. One of the challenges we have experienced is to differentiate clearly between advantages that have been created through the general SSC rollout and which are the result of the regional banking project.

We have a few outstanding points still to finalise on the regional banking project, one of which is to close some legacy accounts and do some fine-tuning. We want to enhance our cash and investment management in Asia as well as our global reporting and bank data analysis. We will review the potential for implementing SWIFT solutions and also define a rollout plan for SEPA. Furthermore, as our needs continue to evolve, and we continue to seek improvements in the way that we operate, we will monitor performance through SLAs and metrics.