After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: August 01, 2014

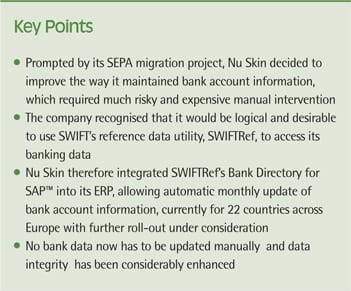

Premium personal care and nutritional supplements corporation Nu Skin was experiencing considerable challenges in maintaining counterparty bank account information in a timely, accurate way, leading to considerable manual intervention, risk and cost. Prompted by its SEPA migration project, Nu Skin has implemented SWIFTRef to automate the maintenance of this data, providing considerable referential integrity and automation.

As a direct selling organisation, most of our revenue is derived from home demonstrations and online sales. Customers therefore use a wide variety of payment methods, including cards, direct debits, cash, cheques (in some markets) and electronic transfers. As all payments are made in advance or on delivery, we avoid the need to manage customer credit. However, a significant issue for a company of our size and geographic reach is the diverse range of payment instruments and cultures that exists across each European market.

Around 80% of our customers in EMEA use card payments. To manage these collections efficiently, we work with Digital River World Payments for secure transaction processing and Barclaycard for merchant account services and customised tools for collections management. We work with European banking partner BNP Paribas for collection via other payment methods and use the bank’s electronic banking Connexis to achieve visibility over our bank accounts across the region. We currently reconcile accounts and post collections to customer accounts manually, but we are working to integrate our account statements into our accounting system in due course to automate these activities.

Although the majority of collections are made using cards at a regional level, this is not the case in all countries. In Austria and Germany, for example, the proportion of SEPA collections is high (42% and 53% respectively) which includes a high concentration of SEPA Direct Debits (SDD). Consequently, it was essential that we converted our systems, formats and processes to accommodate the new SEPA instruments by the end of the mandatory conversion period (1 August 2014). One challenge we had experienced in the past was inconsistency and omission in the way bank account information was kept up-to-date in our systems. This led to a large number of manual entries to keep this information constantly accurate. This process was time-consuming and cumbersome, and led to significant operational risk and cost.[[[PAGE]]]

As part of our SEPA migration, we needed to update our existing bank account information with IBANs (International Bank Account Numbers) and BICs (Bank Identifier Codes), which we were seeking to do in a systematic and automated fashion in order to manage our resources appropriately, reduce operational risk and ensure SEPA compliance before the conversion end date. We recognised that as SWIFT is the primary source of BICs and IBAN formats globally, it would be logical and desirable to use SWIFT’s reference data utility SWIFTRef to access this data.

Consequently, we have now integrated SWIFTRef’s Bank Directory for SAP™ into our ERP (Bank Data for SAP™) which allows us to update our bank account information each month automatically. Currently, we use bank account information for 22 countries across Europe, although we may expand this further in the future. As the SWIFTRef data is accurate and presented in a standard format, we no longer need to update bank account information manually, therefore eliminating manual intervention and reducing operational risk and cost. We have also far greater confidence in the integrity of our bank account data, which will enable us to build more automated processes for payments and collections in the future.

Despite not using SWIFT for bank connectivity, the ability to implement and integrate the SWIFTRef directory into our ERP offers enormous advantage for companies like us. In particular, it enables us to gain up-to-date access to the acknowledged data authority on bank account information in an automated and straightforward way without impacting on our technology infrastructure. The implementation effort is minimal, whilst enabling us to eliminate manual updates and therefore reduce scope for error, omission or fraud.

For more information, visit www.swift.com/SWIFTRef