After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: September 01, 2012

AstraZeneca has a centralised approach to treasury management, with a team of 12 based in London. As the company has grown through merger and acquisition, treasury has had to be highly efficient and agile in order to manage additional volumes and risks. In addition to responsibility for cash, liquidity and market risk management, we also provide invoice factoring, including credit terms of up to 12 months, which adds further to the complexity of our treasury activities.

A key objective in our treasury department is to focus our expertise on activities that provide direct value to AstraZeneca. For example, we have outsourced our treasury back office to Bank of America Merrill Lynch in Dublin and the management / monitoring of critical interfaces to SunGard so that we could reduce the amount of resource that was dedicated to routine tasks. We were also looking to automate treasury processes to improve our efficiency, and enhance our reporting to facilitate better decision-making.

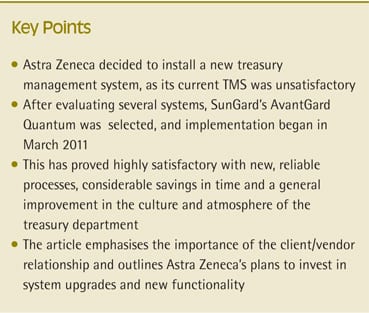

We had acquired a treasury management system (TMS) a few years ago, but the choice of solution, and implementation process had been less successful than we had envisaged. There had been insufficient investment in ongoing maintenance of the solution, both by the vendor and AstraZeneca, there was a lack of knowledge of the system within the business, and there was no engagement with the vendor, resulting in a solution that had effectively become obsolete in our treasury. Consequently, a number of treasury activities and processes were being performed manually and there was a lack of ‘operational trust’ in the TMS.

To address this, we engaged an experienced treasury technology manager. Initially, the plan was to re-engage with the vendor, place the relationship back on a positive footing, and re-implement the TMS. However, having approached the vendor, we quickly realised that this approach was unlikely to be successful, prompting us to review alternative solutions.

Based on the experiences we had had with our TMS and the vendor, we were very clear about our selection criteria. While it was very important that the solution was integrated, user-friendly and provided a high level of functionality, the long-term credibility of the vendor was a key priority. In particular, the vendor needed to have the financial capability, expertise and commitment to develop the system on an ongoing basis, with a strong organisation to avoid over-reliance on key individuals. We were also seeking a hosted solution to ensure that the ongoing management of the system was conducted on a professional and cohesive basis.[[[PAGE]]]

We went through a detailed evaluation and scoring process, based on a list of detailed functional deliverables, including the degree of automation and integration, to ensure that we would be able to transfer all of our core and ancillary processes onto the system, many of which were being undertaken on spreadsheets. We also used the opportunity to evaluate our processes and identify scope for improvement. This was a three-month project, but we recognised that implementing a new system alone would not deliver the efficiency, control and decision-making advantages that we were seeking; we also needed to optimise our processes.

Having analysed a variety of solutions, we made the decision to implement SunGard’s AvantGard Quantum. The system met our functional, automation and integration requirements and was easy to use. SunGard was financially stable, could demonstrate a track record of investment, and had the depth of organisation that we were seeking. Furthermore, the company provided dedicated, robust hosting services that would enable us to outsource the hardware and systems management. A number of the team already had experience of the system and were therefore enthusiastic about the project.

We started the implementation of AvantGard Quantum in 2010 and completed it in March 2011, which was a major achievement for a small team. Unlike some projects which adopt a phased approach to implementation, we implemented all of our key deliverables within the initial project timescale. As we had benchmarked our processes before implementing the system, we were better able to quantify the benefits than many treasuries are able to do. In reality, our objective had not been to save costs or reduce headcount, but to de-risk our treasury operations and decision-making. Not only were we successful in achieving this, but we also calculated initial savings of more than 300 days per year through more efficient daily and monthly processes by removing manual processes and reducing complexity. This has allowed us to reallocate our treasury professionals to tasks that deliver greater value to the organisation.

Outsourcing the infrastructure has removed the need for our internal IT team to manage the system. As SunGard has specific expertise in hosting the application and maintaining the relevant infrastructure, with service level agreements and robust backup and disaster recovery plans, we now have the confidence that our treasury infrastructure is being maintained according to industry best practice. In addition to hosting the application, we have also contracted with the vendor to manage the interfaces between AvantGard Quantum and our internal and external systems, which again removes the need to maintain specialist resources internally.

What has been particularly noticeable in implementing a new TMS is that the entire atmosphere and culture of our treasury department has changed. The manual time- consuming processes that were so prone to error are now replaced with a set of clearly defined, accurate and reliable processes. We now produce our month-end submission a full 25% earlier, and people are again able to trust the information that the system produces.

Based on our experiences, in addition to the normal project disciplines of project management and issue tracking that are essential to every large, complex project, we would emphasise the importance of the vendor relationship. It is important to maintain an active dialogue between client and vendor not only during the implementation but on an ongoing basis. This investment is valuable for both parties. The company can remain up to date with new developments and opportunities, and seek support for business change. The vendor can ensure that the client is using the system in the best way possible, resolve queries or concerns before they become major causes of dissatisfaction, and ensure that the client has the right support available to manage business change. Another issue for companies implementing a TMS to consider is that in most cases, they are licensing an off-the-shelf system. So, while there may be significant opportunity to configure the system, it may not be possible to replicate every single process that is currently performed. It is therefore better to be flexible about how some processes and activities are implemented to maximise the potential for automation and integration.[[[PAGE]]]

Looking forward, we recognise that we need to continue investing in our TMS on an ongoing basis. We now have a rolling five-year TMS Roadmap, and therefore, we are now proactive in planning for upgrades and implementing new functionality. This will in turn enable us to gain further advantage to using the new TMS, and manage change effectively as our treasury organisation evolves in the future.