A Call to Order

Aliaxis transformed LatAm treasury in 15 months, winning TMI’s 2025 LATAM Best in Class award.

Published: May 21, 2021

With risk, cost and process inefficiencies multiplied by complexity, spreadsheet-based currency management has surely had its day. But what added value does currency management automation software bring to the table? In this roundtable discussion, three industry experts explore the opportunities.

TR: The first thing that comes to mind is the operational risk. Excel often has a life of its own. Spreadsheets tend to pass through many different hands, becoming more complex, often to a point where nobody dares touch the formulae, even when they need to be updated because the underlying business has changed. Companies can find they’ve built their own ‘black boxes’ that no one fully understands.

Using Excel can also increase the risk of making mistakes and of not understanding or even being able to find or correct those mistakes. But it goes far beyond operational risk. With large values, currency volatility can create a huge impact on corporate accounts. A company may implement a robust foreign exchange [FX] policy, but through the inherent risks of using Excel, if those processes are not being followed in real time, FX risk can increase. Also, the labour-intensity of spreadsheets detracts from time spent on other activities, so it’s worth asking if this model is imposing limitations.

Moderator: Eleanor Hill, Editor, TMI (EH)

JL: Managing execution risk is absolutely critical. Moreover, when a software, like Excel, is used for a purpose for which it was not necessarily designed – we call it shadow IT – there’s always a time lag between when the FX risk is created and when the exposure is actually managed. With Excel, there’s indeed no live monitoring, and in today’s volatile markets, that’s a risk in itself.

FM: I think there’s an overuse of Excel for FX management, and it stubbornly remains a manual process among corporate treasury in Europe. The rise of home working (or remote working) during the pandemic has increased risks too. Using Excel gives people a very individual tool; it’s too easy to duplicate operations or fail to hedge because you assumed someone else was doing it. Excel demands perfect co-ordination – which rarely happens in reality! A more robust, automated approach makes it easier to track activities, enabling better execution and adherence to procedures and policies.

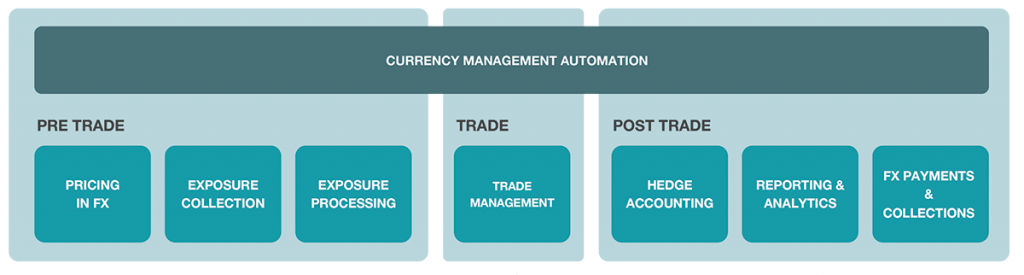

TR: The aim is to create an end-to-end FX workflow [see Figure 1]. Depending on the business need, there may be multiple pre-trade, trade, and post-trade tasks, with a number of subtasks, all of which might occur daily, monthly or yearly. Each exposure must be understood and processed according to what’s required. And, typically, there will be several functions fighting their own corner, somehow trying to communicate their own needs using their own spreadsheets, reporting their own exposures and budgets via email, for another department to run calculations, and another to trade.

Even with an ERP [enterprise resource planning] system or TMS [treasury management system] and a multi-dealer platform [MDP], the communication process can become fragmented and error-prone – and this is replicated for every single trade, with some companies making hundreds of trades per month. Currency management automation is about breaking down silos and then ‘gluing’ them all back together using a common platform. Importantly, it is not about creating another autonomous function but a single connected flow across the piece.

FM: I absolutely agree with Toni on this. When you see the FX process broken down, you understand just how complex it is – and how much automation could assist. ERP software typically fails for this kind of task, and even the best-of-breed TMS cannot give treasurers all the functionality they need. Something additional is required to create a more complete picture.

JL:

Without wanting to make this discussion commercial, the partnership between Kantox and BNP Paribas is a good demonstration of this additional layer. Kantox brings the technology, which delivers the streamlined and automated capabilities that Toni spoke about. Meanwhile, BNP Paribas brings the ability to price and provide liquidity, even in troubled markets like we experienced last year.

Importantly, though, we strive not to disturb a client’s existing processes when we present them with such innovative solutions as Kantox. A successful implementation of any innovative solutions indeed depends on its ability to integrate within our clients’ existing ecosystem, with minimal disruption.

TR: While people sometimes think that by introducing automation they will lose control, the reality is that automation allows more control. That is the big difference between manual and automation: intervention at the right time.

Arguments that an automation project cannot be justified because there isn’t enough budget, or that there is resistance to change are just excuses, in my view. The risks and limitations a company runs by employing manual processes can very easily be put into numbers. And management needs reminding that treasurers are not there to process repetitive tasks; they can make a difference as more strategic players if they define treasury policy from the point of view of the whole company and not just what can or can’t be done in Excel.

JL: In a study that we jointly carried out with the BCG a few years back, we distinguished the ‘morning treasurer’, whose focus is to make sure that all operations are squared, and everything is being executed properly, from the ‘afternoon treasurer’, who can then think strategically about longer-term projects, striving to optimise treasury operations. This means that we need to do everything we can to speed up and secure the less-value-added ‘morning’ tasks through automation, in order to free up time for the treasury team to have a greater ‘afternoon’ impact on the wider company.

FM: Resistance to change is common. It’s a troubling time right now, and one of the issues could be budget. But there are two other obstacles. CFOs know the FX risk, but for them, currency management automation is still a black box. We need to explain to them why it’s important and how value can be generated, for example, by opening new markets when invoicing or being invoiced in the local currency.

The second obstacle is the CIO. They often try to maintain system orthodoxy. They mistakenly believe a TMS can do everything. A treasurer proposing a solution like Kantox may be quizzed as to why they want to add an extra layer of IT. CFOs and CIOs need to be convinced before the company can move forward with automation.

TR: I think the reach of current systems is very well determined. TMSs have a very strong focus on cash management. ERPs are very focused on business operations. Specialisation is really important, so when a MDP is deployed, few argue that the ERP or TMS could fulfil that task. They could, but MDPs have become the best at what they do.

In my view software that automates currency management deserves recognition. There are many companies providing ‘FX solutions’. But this term is so broad, it can really mean anything to do with FX. You have brokers and FX consultants who offer FX related services and solutions, and FX trading platforms. That's why it is necessary to understand that currency management automation has a different type of value proposition.

JL: We all have lots of apps on our phones, each doing just one thing – can you imagine having them all combined in one? It just doesn’t work. In the same way, banks and corporates will see more and more specialised software, doing only one thing but doing it really well. The challenge then is to ensure that all those apps are properly integrated, i.e. they can talk to one another automatically, through APIs [application programming interfaces]. As banks, our role is to identify and source the best apps to address our clients’ specific needs, and bundle them into something both meaningful and user-friendly.

FM: We need to educate corporate treasurers because I’m not sure that all are convinced they could go further in the automation of FX processes. We need to show that the TMS is too generic; it’s missing tools to identify and report risk in real time, so treasury can match its exposures to financial instruments, avoiding a lot of volatility on their underlying portfolio.

Some companies have a monolithic risk strategy, even though they have different divisions and businesses with different FX models and needs. Trying to define a single approach means focusing only on mitigating the main risks. That can be problematic. We need to show that automation helps in the application of a more targeted risk programme.

TR: Look at your business, think what would be the best for you, then look for the solution to enable this. Do not do this the other way around!

FM: I urge treasurers to look upon the crisis as an opportunity to revisit and potentially revamp their FX management. EACT membership surveys repeatedly show FX risk as a major concern. It’s time to do something about it. Start by explaining and selling the revamp idea to the business. Then revisit and document your processes before looking for ways to deliver a proactive approach to FX management.

JL: Automation projects around FX risk management may seem daunting at first but are in reality a true opportunity to not only better manage those risks, but also free up scarce and valuable time for treasury to become more strategic, delivering greater value to the whole company.

For more information please visit the Kantox homepage at: https://www.kantox.com/en/