- Eleanor Hill

- Editorial Consultant, Treasury Management International (TMI)

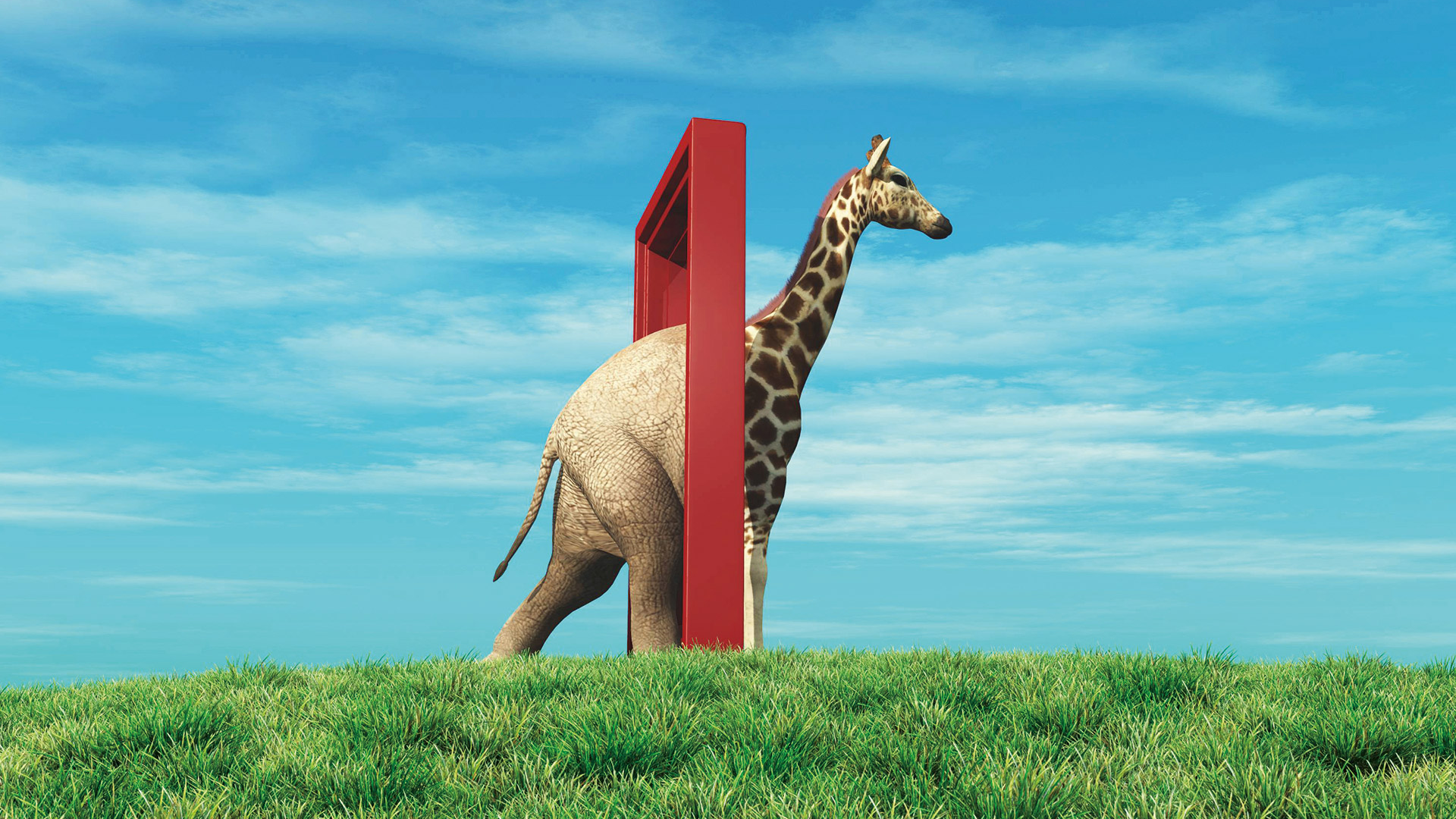

Banks and Vendors Take Treasury to New Heights

Bank Awards

Where better to start this celebration of innovation and excellence than with the Global Bank of the Year for Cash And Liquidity Management – HSBC. Throughout 2020, the bank added to its digital capabilities, with a new cash flow forecasting tool and an enhanced mobile proposition. HSBC also went out of its way to make business as normal as possible for corporate treasurers, even during the most challenging times – and continued core functions at speed – processing more than 139 payments per second throughout 2020.

HSBC also won two Awards in the North America region, the first for Best Bank for Cash & Liquidity Management. Here, the bank launched its Paycheck Protection Program to help clients facing short-term cash flow issues as a result of the pandemic, and Beneficiary Self-Management (BSM) proved to be an award-winning self-service portal. A further initiation during 2019 was real-time payments via HSBC Bank USA NAs RTP Network, where real-time payments of up to $25,000 can be cleared and settled on a 24/7/365 basis.

HSBC’s Award as Best Bank for Trade and Supply Chain Finance in North America recognised one of its major strengths: its geographic footprint provides access to 90% of global trade flows and it facilitates $760bn of trade annually. The bank’s Global Trade and Receivables Finance (GTRF) function engaged proactively with North American and Canadian clients to engineer solutions to optimise their working capital, ensuring that both they and their critical suppliers had access to liquidity during the pandemic. Examples include optimising liquidity for a leading US marketer of baby and children’s clothing, and supporting a global manufacturer and distributor of medical products for the military as it responded to the US government’s appeal for private sector production of medical equipment for civilian use.

HSBC also received two Awards for outstanding achievements in China. Best Bank for Cash & Liquidity Management recognised a range of new solutions developed by HSBC China, which all supported the bank’s broader strategies. Better account rationalisation was made possible by its E-Tax Proposition: HSBC’s years of investment in city tax bureaus’ connectivity enabled more corporates to take advantage of the full payment spectrum available under China’s nationwide tax direct debit system, and the bank’s Omni-Collect Proposition made more e-wallet collections possible.

HSBC was also selected as the Best Bank for Trade and Financial Supply Chain Management in China. The bank notes a shift in supply chains from West to East, pivoting towards Asia and growth in intra-Asian trade, where 60% of Asian trade is now intra-regional. With an extensive network covering 19 markets in Asia Pacific (APAC), HSBC is well placed to provide its clients with supply chain finance (SCF) solutions – one example being its provision of the first SCF for an online video company whose suppliers, mainly local Chinese media companies, faced serious working capital problems owing to Covid-19. Based on the buyer’s credit relationship with HSBC, the suppliers could obtain operating liquidity at very competitive prices and without using existing or additional bank credit lines. (Read more about the bank’s achievements on the free to access Treasury App - download here for iPhone and here for Android.)

BNP Paribas was once again voted Global Bank of the Year for Trade and Financial Supply Chain Management. Trade finance is key to the bank’s strategic development and it is recognised as a European market leader, with a strong presence across APAC and the Americas too. The bank’s global network encompasses more than 100 trade centres and 350 experts around the world. BNP Paribas provides a full range of trade finance and receivables solutions, with a strong focus on sustainability. The bank is also participating in a number of important distributed ledger technology (DLT) consortiums and initiatives that automate end-to-end financial transactions.

The second Award won by BNP Paribas was Best Bank for Cash and Liquidity Management in Europe. While US banks pulled back from lending to European companies during the pandemic, BNP Paribas has been proactive in supporting the European economy – notably, the bank was sole underwriter on a $10bn credit facility in April 2020. In June, it extended its SWIFT gpi capabilities with the launch of the g4CPay and Trace service, which permits corporates to generate their own UETR – the end-to-end transaction reference used to track payments across the SWIFT network. Another notable development is BENEtracker, a solution that allows payment beneficiaries to track the status of international payments due to them. With the rise of e-commerce during the pandemic, the bank also set up AXCEPTA BNP Paribas Lynk2Pay, which enables merchants to accept more than 350 different payment methods while creating new sales channels. (Find out more on the free to access Treasury App - download here for iPhone and here for Android.)

Meanwhile, Citi was the recipient of three TMI Awards in 2020. As Best Bank in Middle East and Africa for Cash and Liquidity Management its continuing investment in digitisation proved a real differentiator as clients’ use of its digital channels during the Covid-19 crisis grew significantly across the entire region. Its presence in 23 countries in the Middle East and Africa (MEA) region means that it serves as a core transactional bank to more than 4,000 top-tier corporates in the region and it is the market leader there in US dollar clearing. A number of successful solution enhancements launched in MEA during 2020, including CitiDirect BE Digital Onboarding, Citi Cross Border Payments Voyager and Citi Smart Match, helped the bank win this award.

Also in the Middle East and Africa, Citi carried off the Best Bank for Trade and Financial Supply Chain Management Award. The bank has recently launched SCF capabilities out of Citi Abu Dhabi Global Markets and extended its regional footprint to include new markets such as Oman. And here again Citi has introduced significant new enhancements such as the expansion of the Citi Supplier Finance/World Link where clients can access a single platform to support foreign exchange (FX) payments within supplier finance programmes.

In addition to the above accolades, Citi was named Best Bank for Cash and Liquidity Management in South America. Despite the fierce impacts of the pandemic on the region’s economy, the bank’s transactional performance indicators continued strongly. Citi also deployed a new One Receivables module, Citi Electronic Invoice Presentment and Pay (EIPP), allowing its biller clients to have their own white-label collection portal, and automated and enabled its Passive FX Cross Border capabilities for 16 countries to provide clients an enhanced operational experience. A further innovation was Citi’s two-day, end-to-end digital onboarding solution with electronic signatures and streamlined documentation, which has transformed the onboarding process and helped clients overcome obstacles due to the pandemic both at home in Latin America, and overseas.

Deutsche Bank was this year’s winner of the Award for Best Bank of the Year for Trade and Financial Supply Chain Management in Europe. Its global trade and SCF network today covers more than 80 locations in 40 countries and the bank’s SCF business grew significantly in the last three quarters of the year, far exceeding the market average. The judges were particularly impressed by the bank’s strong partnership with the German Government to help companies struggling with the impact of Covid-19 by administering the €750bn governmental loan scheme.

Standard Chartered received two awards for its operations in Asia Pacific. Voted Best Bank for Cash and Liquidity Management in the region, the bank’s achievements during the year included the launch in Hong Kong of a new scalable payment processing platform which is able to sustain a peak load of 150 transactions per second; the establishment by Standard Chartered China of more than 100 corporate cross-border cash pools in China; and a digital ASEAN proposition integrating a comprehensive value-added solution with Straight-to-Bank (S2B) Pay. Among new solutions developed by Standard Chartered in the past 12 months were a Faster Payment System (FPS) for the Hong Kong Council of Social Service (read more on the TMI Treasury App) and a bespoke, industry-first multi-currency notional pool (MCNP) automation devised in conjunction with UPS, giving UPS an increased yield on cash at lower risk without dedicating additional resources.

The bank’s second award in APAC was for Best Bank for Trade and Financial Supply Chain Management, a category in which it has developed a clutch of notable solutions. Standard Chartered delivered an electronic supplier finance solution for Puma, a global leader in sportswear manufacture, based on a Vendor Prepay (VPP) programme running on Infor Nexus to support procurement from Asian markets. Another innovative solution was blockchain based: working with Bao-Trans Enterprises, a wholly-owned subsidiary of China Baowu Steel Corporation Ltd, the bank issued the world’s first live blockchain RMB-denominated international letter of credit on Contour, enabling a digital end-to-end process at a time when physical delivery of documentation is challenged by Covid-19. And the bank moved the Nissan Motor Group, the multinational automobile manufacturer, to digital via the India Go Digital trade initiative, which covered all the client’s regulatory requirements and was core to the ‘go green’ and sustainability initiative led in conjunction with Nissan.

Santander was voted Best Bank for Trade and Financial Supply Chain Management in South America. This is a bank which embraces innovation as a key driver of its understanding of business and invests in technology to provide clients with the simplest method of improving their day-to-day operations. In Chile, the bank instituted 20 new financial supply chain programmes during the year and in Colombia in May it launched the ‘Confirming’ campaign, which brought SCIB Colombia the remarkable result of 129% growth in one year. Some of the solutions developed by Santander during the year include integrating the global and local payments platform to provide clients with an improved operational experience, and a new supplier payments process. The latter enables clients to upload a variety of formats in which to pay their suppliers and discuss new payment terms and conditions with them, which in turn increases their liquidity and boosts their cash flow.

Technology Awards

Without doubt, 2020 saw a hotbed of innovation among treasury technology vendors too – and the banks also got in on the tech act. It was no surprise that the Award for Best Accounts Payable Solution & Receivable Solution went to Serrala for the sixth year in a row. The experts in this field, Serrala launched two new cloud-based solutions that digitise accounts receivable/accounts payable (AR/AP) processes and support remote working perfectly: Serrala Alevate AP and Serrala Alevate RTP. These have added immense value to corporate treasurers during the pandemic, and will continue to do so long afterwards – by making AR/AP processes ‘touchless’.

The Bank Connectivity accolade went to Fides. The multi-bank solutions that the company provides mean that treasurers can simply eliminate hours of manual spreadsheet work – and say goodbye to any concerns around file formatting, multiple data sources, and regulatory compliance. The client testimonials that formed part of the organisation’s Award nomination were unbeatable – and the benefits undeniable. Fides’ solution set is too extensive to describe in detail here (find more details on the TMI Treasury App), but the vendor has plans to expand its solutions even further and the TMI judges cannot wait to see what happens next.

The Best Cash & Treasury Management Solution accolade, meanwhile, went to FIS. The vendor has been extremely busy, with projects including the reinvention FIS Integrity SaaS (software-as-a-service) solution (find out more on the TMI Treasury App). Other improvements have been added at speed to help clients battle the Covid-19 knock-on effects, including integration with the FIS receivables management solution, GetPaid, to facilitate a more holistic view of cash flow forecasting. The TMI judges also appreciated the effort that FIS is making in assisting treasurers meet interbank offered rate (IBOR) transition by introducing new formulas, interest rate calculators and accrual methodologies.

Citi was the worthy recipient of the 2020 Customer Experience Award. The bank has totally reinvented its CitiDirect platform – turning it into a cloud-capable, micro-services-based modular structure that is intelligently interconnected via application programming interfaces (APIs). This directly reflects the need of the clients and provides hidden benefits such as resiliency and faster recovery, while creating a modern and responsive user experience that is consistent for users of desktop and mobile device alike. At the front end, when a CFO or treasurer logs into the revamped CitiDirect platform, he or she is presented with interactive solutions and market intelligence that support decisions related to business growth, managing risk, preserving capital, optimising liquidity and working capital, and driving efficiencies.

The New Technology Innovation Solution Award went to Goldman Sachs Transaction Banking (TxB). The bank, a newcomer to the transaction banking space, has shaken up the status quo with the launch of its ‘banking-as-a-service’ platform. Leveraging APIs, this legacy-free solution takes the best of digital innovations and Open Banking initiatives to deliver an intuitive experience for corporate treasurers. The platform covers everything a treasurer would expect – and more – ranging from a suite of payments, liquidity, enhanced analytics, escrow products and virtual integrated accounts (details on the free to access Treasury App - download here for iPhone and here for Android.)

Interestingly, the 2020 Mobile Technology Award also went to a bank: HSBC. The bank has made so many advances in its mobile channels that it is hard to pick one area in particular to highlight. Nevertheless, the TMI judges applauded the strict biometric security now in use on the HSBCnet Mobile app. Certain new features have also proved extremely beneficial during the pandemic, including a mobile version of the Liquidity Management Dashboard and mobile cheque deposit capabilities.

The Award for Best Portal Technology was scooped by ICD. The portal is a model in the industry for trading, reporting and analysis with award-winning and industry-first tools. In 2020, ICD continued to extend the value of its portal with integrated workflows, having a multiplying effect on treasury efficiency. From March through August, ICD serviced 38% more integrations than in the same period the year before, including 88% more new client integrations. Driven by client need, ICD also co-innovated with Trovata, HSBC and Bandwidth to establish an API for the free flow of data across cash forecasting, reporting and investments. This API integration helps users of any of these providers meet the need for speed, accuracy and remote access (see the free to access Treasury App to find out more - download here for iPhone and here for Android.)

Kantox was the undisputed winner of the FX Risk Management Solution Award. New processes and technologies have long been called for by treasurers and finance Departments when handling their FX risk. And with the volatility caused by the pandemic, this need has never been stronger. Kantox’s Dynamic Hedging technology answers that call by providing a system that automates the end-to-end FX hedging process. Thanks to Kantox’s ongoing investment in the Dynamic Hedging solution, corporates now have the possibility of a real-time overview of their exposures, full control over their currency management, and reduced administrative loads.

The Solution Innovation Award was picked up by Coupa for its sterling work in reducing the headaches of cross-border payments. To achieve this, Coupa has introduced integrated SWIFT gpi for Corporates (g4C) functionality. This enables faster, traceable and transparent cross-border payments through one platform. In turn efficiency and security are bolstered, helping treasurers optimise their cash management and planning, while remaining compliant with regulations. The solution also provides enhanced transparency, enabling corporate treasurers to make decisions that are even better informed (read more on the free to access Treasury App - download here for iPhone and here for Android.)

Finastra was awarded the Trade Finance Solution accolade. The company offers best-in-class, front-to-back capability for working capital finance, including buyer and seller loans, letters of credit, collections, guarantees, SCF, government support for export credit and SME loans. Finastra’s open, API-enabled solution achieves flexible integration with an expanding world of ecosystem partners – for digitalised documentation, data capture automation and screening. The vendor has made numerous innovations, especially in relation to Covid-19. The TMI judges were particularly struck by Finastra’s work to increase trade inclusion for small businesses. By forming an alliance with Mastercard, SGeBIZ and N-Frnds, Finastra has been helping small retailers to transition away from cash, enabling them to build up a data footprint that enables more effective know your customer (KYC) and onboarding from banks. This also provides retailers with greater visibility over their supply chain and facilitates more effective financing from banks.

Finally, a new Award for 2020, Best Data Management Solution, went to Deutsche Bank for its Corporate Bank Data Quality Platform (DQP). This is the result of a collaboration between Deutsche Bank’s Chief Data Office (CDO) and the Corporate Bank – and revolves around a strategy to drive identification, analysis, prioritisation and remediation of data-quality issues. The solution was built entirely in-house and recognises that in corporate banking, the crux of intelligent decision-making lies in the quality of its data. The TMI judges were impressed to see Deutsche Bank leading the way in creating a comprehensive global approach to data-quality management, and recognise this as a turning point in the industry (see the free to access Treasury App to find out more - download here for iPhone and here for Android.)

2020 TMI Awards for Innovation & Excellence

Discover the other winners: