After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: May 01, 2012

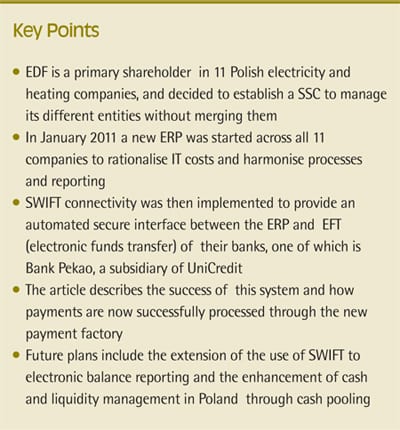

Ever since EDF began its operations in Poland in 1998, we have been committed to adopting efficiencies and best practices to benefit customers and shareholders alike. We now have 11entities in Poland, not all of which are operating under the EDF name, although it is our intention that this will change in the future. Due to legal constraints and a large number of different stakeholders in the business, including the Polish state, we recognised that establishing a shared service centre (SSC) would be an efficient way of managing all of our entities in Poland cohesively without merging entities. The SSC includes our finance function, including payments, which we sought to optimise as far as possible. With a relatively young banking infrastructure, Poland has efficient payment instruments, but we wanted to enhance our payments activities further with automated, secure processes and bank connectivity.

We first embarked on a study for a SSC in 2008, and started delivering shared services in finance, purchasing, IT and engineering in July 2010. It is unusual to include engineering in a SSC but we wanted to optimise our resources with the building of the new electricity plant. Since then, we have also added human resources and internal audit. In January 2011, we started to implement a new ERP across all 11 companies in Poland, with a view to rationalising IT costs and harmonising processes and reporting.

In Finance, we wanted to introduce highly automated processes, leveraging existing experience and solutions from across the EDF group wherever possible. We analysed our payment processes, and opportunities to enhance them. Like many companies in Poland, we were using our banks’ electronic funds transfer (EFT) systems. We had no automated, secure interface between our ERP and EFT, which compromised our transaction efficiency and security. We therefore made the decision to implement SWIFT connectivity in order to resolve this issue. Our head office operations were already using SWIFT for our group payments factory very successfully. We recognised that by implementing SWIFT, we would achieve straight-through processing between our ERP and our banks, and leverage the high level of security available through SWIFT.[[[PAGE]]]

We then reviewed how other companies in Poland were connecting to their banks through SWIFT, but found that we were pioneers in this area. As Poland has a relatively young banking system, online banking tools and payment formats are already quite sophisticated. For example, we do not use manual payment instruments such as cheques, and debit cards are commonly used. Consequently, we found that there was no domestic solution or platform in place for SWIFT corporate connectivity. We therefore decided to adapt a proprietary solution developed by EDF known as eSpace that was already used in France. Although this solution has proved very successful, adapting it was a complex undertaking as it had been developed to be currency-specific. We also needed to expand its capabilities to support formats for Polish tax and social security payments.

We approached our two key relationship banks in Poland, one of which is Bank Pekao (a subsidiary of UniCredit). Although they had significant expertise in corporate ERP integration, they did not have experience of SWIFT Corporate Access at that time. It was important firstly to ensure that we had the right formats and text for each payment type, an area in which our banks worked closely with us. Therefore most of the work, that was quite time- consuming, was to configure our ERP and payment platform properly.

Having undertaken this painstaking process, we had a consistent means of processing payments in an automated and secure way. We started with our first bank in June 2011, and went live in October, followed by Bank Pekao at the end of the year. We have automated the majority of our domestic payments through SWIFT, but we still have a few items outstanding: for example, we need to develop the system further to handle payroll, complete our tax and social security payments, and introduce our international payments. We will continue to maintain our legacy EFT systems for disaster recovery and back-up purposes, for example for urgent payments.

The business has had to adapt its payment processes to accommodate our new payment factory system and SWIFT, and it now takes an extra 24 hours or so to process payments. We have therefore had to work closely with users to tell them about the new processes, but we have met little resistance as most people recognise the need for standardised, secure payment processes.[[[PAGE]]]

Unlike other countries with a longer banking heritage, Poland already has efficient payment instruments, so increasing the efficiency of payment processing was not a primary consideration for us. Instead, our primary objective when implementing our payments factory system and SWIFT was to increase the security of our payments processing, which we have achieved very successfully.

Looking forward, we intend to extend our use of SWIFT to electronic balance reporting (EBR) and also enhance our cash and liquidity management in Poland using cash pooling. We would not be able to do this if we were to keep multiple bank relationships across our Polish companies. Therefore, transaction processing is just one element of an efficient banking relationship, and it is our intention to work with our banks on a more strategic basis. Leveraging a bank-independent connectivity platform such as SWIFT supports us in achieving this objective. By centralising not only financial processes, but also cash flow across our Polish companies, we will be in a better position to reduce borrowings, increase investment returns and manage our cash more strategically.

EDF (Electricité de France) started its operations in Poland in 1998 during the first phase of privatisation of the Polish energy sector with the purchase of Elektrociepłownia Kraków. Since then, EDF has become a primary shareholder in many Polish energy companies generating heat and electricity, including Elektrownia ’Rybnik’ (Rybnik Power Plant) and combined heat and power plants in Wroclaw, Gda´nsk, Gdynia, Zielona Gora, Torun and Tarnobrzeg. The group also includes servicing companies: Energokrak – supplying coal and biomass to all companies in the group, Everen – a company for electricity trading owned by the EDF group, and Fenice Poland – outsourcing power and ecological activities in industrial companies. EDF Poland also has production activities managed from Dalkia, mainly in Lodz and Poznan.

EDF in Poland (excluding Fenice and Dalkia which are outside the scope of the SSC) has a turnover of around €1bn and employs 3,500 staff. The company holds 10% of the electricity market, and 15% of the district heating market in Poland. It is pioneering the renewal of energy assets in Poland with the creation of a new highly efficient 900 megawatt supercritical coal-fired power plant.