Case study: POSCO

South Korean steel leader POSCO’s global expansion was being hampered by FX risk concerns. Through a customised composition of financing with an embedded hedge, Standard Chartered structured a bespoke solution tailored to POSCO’s goals, resulting in:

Background

POSCO is a South Korean steelmaker, and the sixth largest globally by production volume. Operations are structured into three divisions: Steel, Engineering & Construction, and Trading. The former is its largest division, generating more than 50% of the Group’s revenue. POSCO’s expanding global coverage includes a wide network of almost 200 entities (sister companies and subsidiaries) across the world.

Challenges and objectives

As POSCO continues to expand its global operations, it decided to shift from USD to local currencies for inter-company transactions. While this removed FX risk from its subsidiaries’ balance sheets, it led to increased FX-risk for the South Korean headquarters. Moreover, POSCO needed to continue paying overseas suppliers in USD, and was facing volatility and high funding costs for its payables due to rising USD interest rates.

As such, POSCO sought a competitively priced, combined trade solution to finance both its inter-group FX receivables (in CNY, THB, and INR) and its USD payables.

Solution

Standard Chartered structured a customised solution tailored to POSCO’s multiple needs. The solution was formed of two main elements:

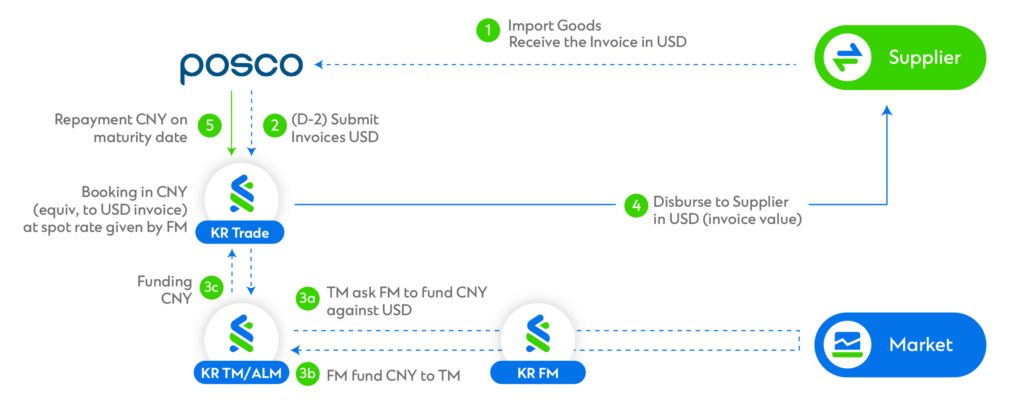

1. Export and import invoice financing:

- The booking currency on invoices issued by POSCO are in either CNY, THB, or INR, with the disbursement currency in USD.

- This effectively provides an embedded hedge (by Standard Chartered) that leverages the onshore/offshore market to bring the cheapest possible funding rate to POSCO.

2. Receivables financing:

- POSCO receives USD invoices for its payables.

- The embedded FX hedge from the invoice financing enables cross-currency funding. In other words, by matching the CNY/THB/INR receivables from POSCO’s clients against its USD payables.

- Once it receives USD invoices from suppliers, POSCO requests local currency financing from Standard Chartered.

- The bank’s FX team then makes a forward deal to fund the local currency against the USD amount.

- On the invoice due date, POSCO repays the relevant local currencies to Standard Chartered and the transaction is redeemed on maturity.

The net result is that POSCO maintains its FX position arising from receivables, not by hedging derivatives but by having liabilities from the receivables currencies.

Flow example for CNY-USD invoice financing

Disclaimer

This material has been prepared by one or more members of SC Group, where “SC Group” refers to Standard Chartered Bank and each of its holding companies, subsidiaries, related corporations, affiliates, representative and branch offices in any jurisdiction, and their respective directors, officers, employees and / or any persons connected with them. Standard Chartered Bank is authorised by the United Kingdom’s Prudential Regulation Authority and regulated by the United Kingdom’s Financial Conduct Authority and Prudential Regulation Authority.

This material has been produced for reference and information purposes only, is not independent research material, and does not constitute an invitation, recommendation or offer to subscribe for or purchase any of the products or services mentioned or to enter into any transaction.

Some of the information herein may have been obtained from public sources and while SC Group believes such information to be reliable, SC Group has not independently verified the information. Information contained herein is subject to change at any time without notice. Any opinions or views of third parties expressed in this material are those of the third parties identified, and not of SC Group.

While all reasonable care has been taken in preparing this material, SC Group makes no representation or warranty as to its accuracy or completeness, and no responsibility or liability is accepted for any errors of fact, omission or for any opinion expressed herein. The members of SC Group may not have the necessary licenses to provide services or offer products in all countries, and / or such provision of services or offer of products may be subject to the regulatory requirements of each jurisdiction.

This material has not been prepared with regard to the specific objectives, situation or particular needs of any particular person, and is not meant to be comprehensive. SC Group does not provide any information technology, accounting, legal, regulatory, tax or investment advice and this material should not be relied on as such. Any comments on information technology, accounting, legal, regulatory, tax or investment matters contained in this material should not be relied on or used as a basis to ascertain the various results or implications arising from the matters contained herein, and you need to exercise your own independent judgment (with the advice of your information technology, accounting, legal, regulatory, tax, investment and other professional advisers as necessary) with respect to the risks and consequences of any matter contained here in. Please note that there have been reports of email phishing targeting bank customers. Please do NOT click on the links in any unusual or suspicious emails, or provide any sensitive personal details, login credentials, PINs, OTPs. We would never ask you to reveal sensitive personal information or passwords, or validate your account over emails, SMSes, or phone calls. If you receive any suspicious emails, SMSes, or phone calls, please call us immediately. Please note that as the recipient, it is your responsibility to check the email for malicious software. SC Group expressly disclaims any liability and responsibility whether arising in tort or contract or otherwise for any damage or losses you may suffer from your use of any fraudulent hyperlinks or use of / reliance on the information contained herein.

You may wish to refer to the incorporation details of Standard Chartered PLC, Standard Chartered Bank and their subsidiaries by visiting the contact us page of our website and viewing our locations.

This material is not for distribution to any person to which, or any jurisdiction in which, its distribution would be prohibited. If you have received this email by mistake, please inform us by email and then delete the message. A translated version in your local language will be made available upon request. Please reach out to your relationship manager to obtain a copy.

© Copyright 2024 Standard Chartered Bank. All rights reserved. All copyrights subsisting and arising out of these materials belong to Standard Chartered Bank and may not be reproduced, distributed, amended, modified, adapted, transmitted in any form, or translated in any way without the prior written consent of Standard Chartered Bank.