- David Gomez

- Executive Director, Wholesale Payments, J.P. Morgan

Open banking is not just a retail banking phenomenon. This global trend also has the potential to significantly improve the working lives of corporate treasurers – by enabling aggregated, real-time, multi-bank reporting at the click of a button.

Open banking is taking hold across the globe. It forms the foundation of an ecosystem of new and improved banking services. To date, innovation has largely been led by neobanks and fintechs implementing new services and experiences in the retail banking sphere. However, open banking could also bring great benefits to the corporate banking sector. In fact, treasurers could potentially benefit the most.

One of the pressing needs of corporate treasury teams is having accurate oversight of their globally scattered balances in real time. What’s more they require this information to be aggregated into a single interface to enable more efficient cash/liquidity management.

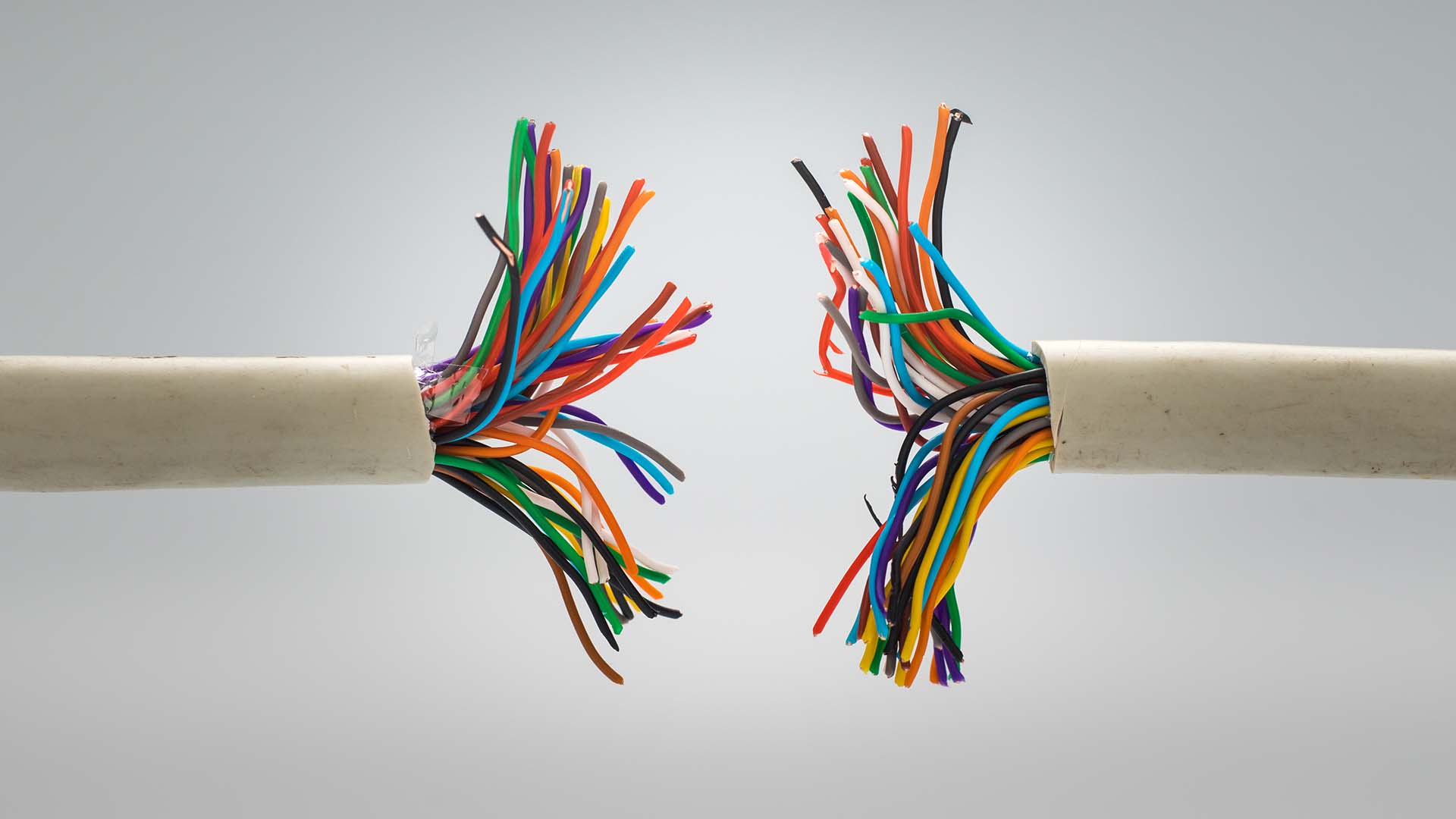

Open banking could potentially deliver the solution, thanks to the ease of integration it enables and the high levels of security and trust involved. As a reminder, open banking empowers banks to open up their application programming interfaces (APIs) and enables permissioned third parties to access financial information, in order to create new financial offerings.

Corporate back-end systems are designed and built with an interconnectivity mindset, also leveraging APIs. The days of monolithic architectures, when a single application was developed by adding more and more capabilities, have evolved to modest components and open architecture. These components use APIs to interconnect and share processes and data with the rest of the applications in the corporate ecosystem. APIs and open architecture provide ease of access for applications to aggregate all the corporate data in a single place. Also, corporates are adopting software-as-a-service (SaaS) solutions where external vendor cloud-based platforms are integrated with the corporate ecosystem.

And corporates’ willingness to share information with external parties is increasing thanks to secured internet and encrypted communications with trust certificates. Indeed, the same security and trust framework that banks build to connect clients to their banking services via APIs can be leveraged by a network of banks to expose data and services. Therefore, with the client’s consent, open banking puts in place the necessary framework to present treasurers with an aggregated real-time view of their global financial data. In other words, an API-enabled multi-bank reporting solution could facilitate connectivity to third-party financial institutions and enable a treasurer to gather and aggregate precise real time ‘as-is’ balances and transactions at the click of a button. This data can be integrated by the corporate with its own systems to fulfil reporting, forecasting and liquidity requirements.

Once treasurers have this aggregated data in a common repository, data analytics and data visualisation tools – ranging from Microsoft Excel to corporate enterprise resource planning (ERP) or treasury management system (TMS) platforms can leverage the data insights to reduce operational overheads. This can be achieved through daily reconciliations, improved exception management with instant notification of any issues, and managing cash balances based on real-time data.

Real-time accurate data at scale

Of course, if a corporate chooses to establish such a multi-bank reporting solution, the set-up must change when new banking relationships are formed and when the corporation expands globally. Treasurers will rightly expect data from any new banking partner(s) to be integrated with the existing channel, rather than setting up a new integration point.

As well as integration, open banking is also about speed and time to market. In the new economy, the expectation is for services to be delivered on demand, in real-time. Until high levels of automation and standardisation are reached among the ecosystem of financial services providers, connectivity partners play a critical role in delivering this instant information. And banks and corporates that are ‘open’ to embracing open banking and working collaboratively will surely reap the rewards.