After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: January 01, 2000

An in-house bank (IHB) can be the pinnacle of treasury centralisation, and more companies are choosing to take this step. However, diligent planning is required to make the implementation a success. For some companies, having a part of the structure managed by a dedicated provider can deliver further efficiency and cost benefits.

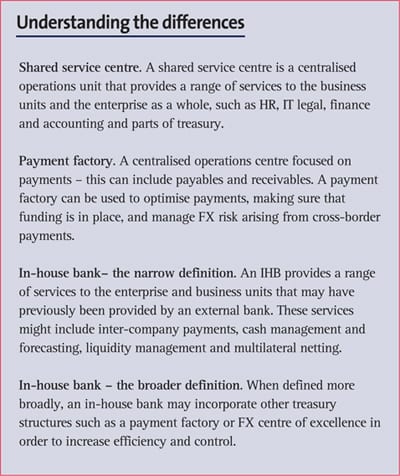

Bringing together disparate processes is a cornerstone of any efficiency drive – and a number of different tools and techniques are available which can help corporate treasurers achieve this. Where a high degree of consolidation is required, treasurers will often consider adopting a centralised structure such as a shared service centre, payment factory or IHB.

While an IHB tends to be a latter step in the maturity pathway of treasury centralisation, the operational and organisational structures that a company implements, and the order in which they do so, will be heavily influenced by a range of factors including – legal, regulatory, operational capability and business drivers. Shared service centres, payment factories, centres of excellence and/or regional treasury centres all have defined purposes. An IHB will always have a pivotal role in conjunction with these structures – either as a operational centre which has direct responsibility for some of these other structures, or as a key enterprise partner.

Whereas a shared service centre can incorporate multiple functions across the organisation, such as IT and HR, IHBs are primarily treasury structures. Payment factories centralise the execution of in-scope payments, which can include both payables and receivables, and can be located within a shared service centre or a stand-alone treasury organisational unit. An IHB can have a broader remit and provide banking services such as daily cash management, liquidity management and multilateral netting – which may incorporate oversight and management of a payment factory.

In pursuit of best practices, companies may typically implement an IHB in order to increase efficiency, standardise processes and improve control and compliance across their treasury operations. One of the primary functions of an IHB is to manage the liquidity process, providing ‘banking’ services to the business entities. Improving risk management capabilities is another common goal and consequent output of implementation.

Interest in this type of structure has risen in the last couple of years, driven by developments in technology and by the arrival of the Single Euro Payments Area (SEPA), which has assisted in companies being able to increase harmonisation of their treasury operations.

An IHB can give companies the opportunity to improve their treasury performance, but adopting this type of structure is a major undertaking – and it is not suitable for every company. The first step is to determine whether an IHB will be an appropriate solution to fulfil the company’s needs.

While the size of a corporation is certainly relevant – the larger the organisation, the greater the potential benefits tend to be – it is not the only consideration. The nature of the business and its geographical footprint should also be factored in. For example, a smaller corporation may be a better candidate for an IHB than its larger counterparts, particularly if the corporation has a large number of inter-company transactions, numerous bank accounts and is spread across multiple countries.[[[PAGE]]]

Highly centralised companies may have little to gain by adopting an IHB, so it is important to analyse the expected business gain in detail before embarking upon the project. Alternatively, a company that is very decentralised, and which has disparate enterprise resource planning (ERP) and treasury management systems, may struggle to adopt an IHB structure within a set timescale. The design of a global treasury operating model should be driven by both a top-down and a bottom-up approach, leading to the optimal organisational and process structure.

If the treasurer believes that an IHB is appropriate for the company and will deliver the desired benefits, before a final decision to proceed is made, implementation factors need consideration.

The tax implications of setting up the structure should also be carefully explored and, as such, internal tax resources should be involved in the project at an early stage. Regulatory factors will need to be taken into account, from central bank reporting requirements to the types of liquidity management structures permitted in the relevant markets. Companies should also determine at the outset how the value of an IHB will be measured and managed.

If the treasurer believes that an IHB is appropriate for the company and will deliver the desired benefits, before a final decision to proceed is made, implementation factors need consideration. A critical factor is the access to the necessary resources: the right people, project management skills and bank providers are needed to support the project – in addition to the right level of investment in technology.

A project of this size doesn’t always go to plan, so it is important to learn from others who have completed a similar exercise. Global banks have significant experience in helping corporate clients set up IHBs and can provide valuable resources to support companies in the process. Companies may also seek advice from peers and external consultants.

When resourcing the project, it is important to make sure that someone with relevant experience is managing the project and that they have access to the necessary support. It is best to assign a dedicated resource to manage the IHB project. Typically led by the group treasurer or assistant treasurer, an IHB project will require executive support from the chief financial officer (CFO) and should include oversight by a steering committee. It is also helpful to obtain project buy-in from in-country finance directors at an early stage.

Insufficient planning is a common pitfall: if companies don’t do their homework, or spend enough time on the planning and design stage, there is a risk that the structure will fail to deliver the required benefits. It is important to identify all of the data required from the regions before embarking upon the project. Once the relevant data has been collated, the next step is to create a high-level design and business case, outlining the rationale of the project, and how it relates to other projects, and seek approval from senior management and the steering group.

After deciding which processes will be managed by the IHB, a further consideration is the governance structure required to manage it. Some examples of key questions to ask are:

Most companies may have a mandate requiring business units to use the IHB. That said, if an IHB fails to deliver the necessary services to the required level, there is a risk that business units may gradually revert to doing things their own way or make execution of the IHB functions difficult. It is essential not only to implement the structure correctly in the first place, but also to provide added value to the business and company.

Once the IHB is fully implemented, it will need to be managed and maintained. For some companies it may be beneficial to consider outsourcing some or all of the structure to a dedicated provider. An external provider may be able to undertake processes such as cash and liquidity management, intercompany loan administration, FX management and multilateral multi currency netting on behalf of the company, as well as produce management accounts and reporting on the activities flowing through the structure.

This type of approach might be suited to companies which require capabilities within a particular location, are looking to speed up a particular process – or simply see the value of moving some functions and processes to a managed operation. Having a managed IHB can enable the company to minimise both the implementation process and the daily operations, and reduce the time taken to implement the structure. Managed service providers can offer increased operational capability through access to market leading expertise, providing greater economies of scale and can run several parallel processes if needed. As such, more companies may now be considering this approach as a continuum to an IHB project.[[[PAGE]]]

The way in which corporations optimise their treasury operations continues to evolve: increasingly companies appear to be defining their organisational model by assigning different parts of a global process to the team that is best placed to execute that sub-process, and not wholly determined by location. For example, a company’s accounts payable process may span across individual business units, a shared service centre and a treasury centre, with each structure located in a different country or even region.

This shift is being facilitated by having a standard process underpinned by common technology, enabling companies to locate different parts of a process in different locations depending on factors such as regulation and even time zone. As more companies choose to set up IHBs, managed services are another option which can fit within the connected ‘virtual’ organisational model.

Bank of America Merrill Lynch offers advisory services and specialists to help corporates assess whether an IHB solution is appropriate, how the treasury processes can be further optimised and manage core transaction execution on the company's within an experienced and controlled environment.