- Niamh Hourican

- Treasury Recruitment Consultant, Robert Walters

by Niamh Hourican, Treasury Recruitment Consultant at Robert Walters

This survey was carried out in 2014, in co-operation with TMI.

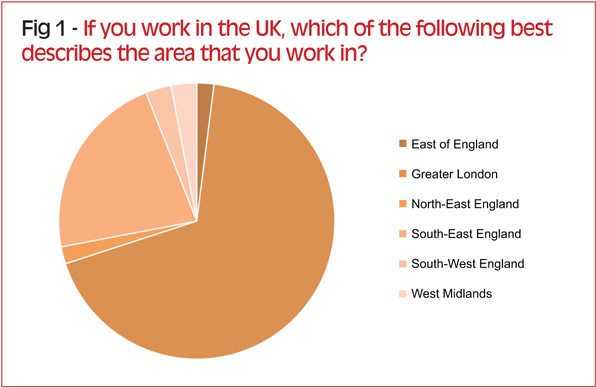

The vast majority of treasury roles in the UK are based within the M25, and a good percentage of these within the centre of London. Indeed, the graph on figure 1 tells us that 68% of treasurers are based in Greater London. With a majority of larger companies gravitating towards the capital and its reputation as a centre for business, roles outside London tend to be scarcer.

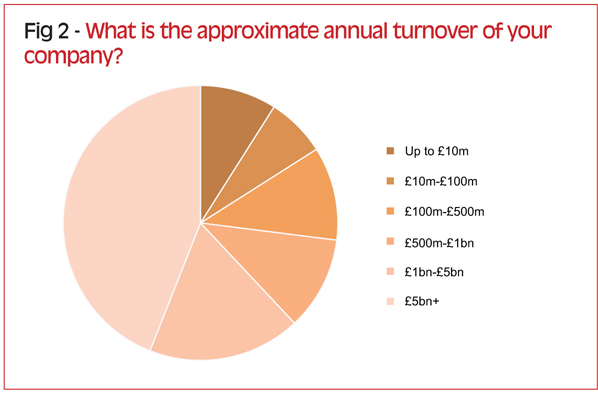

Backing this up is figure 2, which shows that 62% of treasurers surveyed work for a company with an annual turnover of £1bn or higher and 44% for businesses with a turnover of £5bn or higher. Larger businesses are often those most likely to be able to afford treasury specialists and be of an appropriate size to benefit fully from this expertise, so these figures are perhaps unsurprising.

While a good proportion of respondents do not yet hold a treasury qualification, nearly a quarter are AMCT qualified, a number that is expected to rise as more junior candidates look to build on their skill sets. Our observation is that registration and demand for this qualification is on the up.

Regarding salaries, figure 3 shows that the bulk of treasurers are earning between £60,000-£99,000 per annum, with 43% of respondents falling into this bracket. More than one in ten- 14% - take home annual salaries of over £150,000, demonstrating the potentially lucrative opportunities that arise from a career in treasury.[[[PAGE]]]

However, after a few years of low job flow levels, the improving economic situation means that treasurers are starting to look around for their next opportunity. As detailed in figure 4, more than two-thirds of respondents are looking to move jobs, with 55% seeking to leave within the next twelve months and nearly half in the next six months.

While improved pay is cited by a fifth of treasurers as a key motivating factor in moving jobs, half of respondents say they are most likely to be influenced by opportunities for career progression. The prospect of an improved work/life balance (13%) and improved job security (11%) are also cited by some as important, though at an overall level, it’s clear what the biggest driver in moving jobs is likely to be.

Salary and bonus expectations

Figures from the survey tell us that while 31% of treasurers received no pay increase last year, 58% earned a rise of up to 10% of base salary. A further 10% managed to secure a rise of over 11% of base salary, illustrating that employers have been looking to prioritise retention of high quality, experienced treasury professionals.

Salaries have not seen large jumps over the last few years, with many organisations freezing salaries. However, sentiment is improving, with only 18% not expecting to earn more this year. A quarter are expecting to receive a salary increase of between 4% and 6%, double the proportion who said the same twelve months ago. On the whole, job seekers will be looking to obtain bigger rewards for their services, and if this doesn’t materialise we anticipate pay becoming a more important factor in the decision to look for a new role elsewhere.

Furthermore, the survey suggests that more treasury professionals are confident about receiving a bigger bonus. In the last financial year, one-third of respondents told us they did not expect to earn a bonus, a figure that drops to 25% when questioned about expectations in the year ahead. The proportion hoping to secure a payment worth up to 20% has also climbed, from 43% to 46%. Performance related bonuses remain the norm, with only a little over a tenth of bonuses awarded on a discretionary basis.

Against the backdrop of improving confidence, treasurers are increasingly hopeful of securing an improved financial package.