After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: April 10, 2013

Separately managed accounts can provide an attractive alternative for treasurers looking to generate higher yields on their excess cash than are available from money market funds. In this article, Jim Fuell discusses how these accounts can be tailored to meet specific risk and return objectives, giving treasurers not only the potential to earn more on their cash, but to exercise greater control over what they invest in and their investment horizon.

While treasurers in the US have been using separately managed accounts for some years, only recently has their popularity grown in Europe. During the credit crisis, the priorities for many European treasurers were to preserve capital and ensure significant liquidity to meet business needs. However, today, many companies are flush with cash and do not have the same restrictive liquidity requirements. The protracted period of low interest rates and exceptionally low money market fund yields has further encouraged companies to broaden their search for additional yield, while still remaining relatively risk averse.

Separately managed accounts invest in individual securities on behalf of a corporation, insurance company, pension fund or various other institutional investors. As separate accounts are tailored to meet an investor’s risk appetite, yield target and liquidity needs, the expected investment return can be larger when compared to other short-term investments such as money market funds or bank deposits. Conventionally, aiming for higher returns requires investors to assume additional risk, therefore making separate accounts suitable for cash balances that are not needed for at least six months. The cash amount should also be higher compared to a money market fund investment to ensure adequate diversification is achieved in the underlying securities.

The biggest benefit of a separate account is the ability to customise the investment guidelines to meet a specific objective. For example, restrictions on the types of securities to be purchased, the maximum allocation per issuer and the minimum issuer rating can all be set depending on differing return targets and appetites for risk. As such, separate accounts can provide an attractive alternative for treasurers looking for a greater level of control over their investments.

Exhibit 2 illustrates sample portfolios that meet different objectives. The first portfolio, for example, has a mix of money market funds, commercial paper and certificates of deposit, agency debt and time deposits, and offers a tailored solution for an investor whose primary objective is liquidity and for whom principal preservation is a top priority. The second portfolio, which includes a greater allocation to corporate bonds, may suit investors looking for a balance between liquidity and return. The third portfolio, allocated across commercial and residential mortgage-backed securities, and corporate bonds may be more suitable for an investor whose primary objective is total investment return, who has a time horizon of at least 18 months and is comfortable with a moderate degree of volatility over short time periods.[[[PAGE]]]

In a separately managed account, the treasurer will legally own the underlying securities but will appoint a custodial bank to act as safe keeper and an asset manager who will be responsible for ongoing security selection. Many large financial institutions provide both custodian and asset management services, although different institutions may or may not be selected for a single account.

As separate accounts are not regulated to the same extent as money market funds providers may differ significantly. Setting up a separate account therefore requires a higher degree of due diligence than investing in a pooled fund, to ensure a manager with the necessary resources, experience and qualifications is selected. Some firms may also offer monthly accounting reports, online web access to portfolio data, dedicated client portfolio and account managers and access to economists, sector specialists and credit analysts.

To establish a separately managed account also requires time. While money market funds can be set up in the space of a couple of days, separate accounts require between one and two months to do the necessary paperwork.

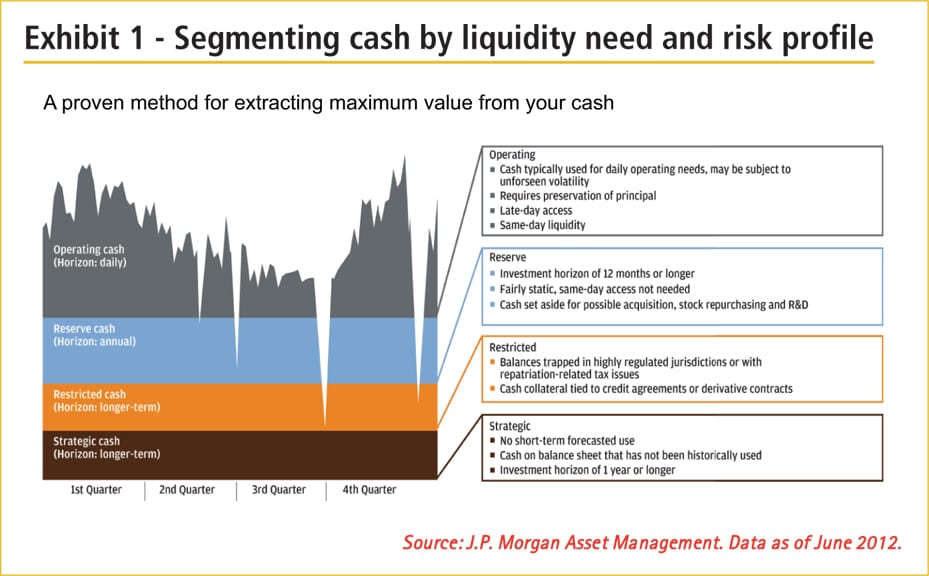

Separate accounts are not a catch-all solution but for investors with specific requirements and characteristics they can provide an attractive alternative to some of the more established investment vehicles. Treasurers must determine whether their balance sheet cash can be segmented to allow for a portion to be allocated outside of their daily working capital requirement. If so, a separate account may be suitable to allow them to generate additional returns by lengthening their investment horizon.

The scale of J.P. Morgan Asset Management (JPMAM) ensures we have the resources necessary to manage separate accounts successfully. Clients benefit from our robust credit process and investment expertise, large and experienced team of credit analysts and portfolio managers, and dedicated client servicing professionals located around the world.

JPMAM delivers a wide range of exceptional investment solutions across a diverse array of currencies, strategies and jurisdictions, and has the flexibility to manage tailored portfolios designed to suit each client’s risk and return preferences.

[[[PAGE]]]

When establishing a separate account, our teams work closely with the client to set a clear mandate. The client service manager, in conjunction with our legal staff, reviews and/or prepares an Investment Management Agreement, which outlines the responsibilities of JPMAM as a discretionary manager of the portfolio.

The portfolio management team holds detailed discussions with the client to establish the desired investment objective, benchmark, expected risk/return characteristics and other requirements of the new account. Based on these in-depth conversations, an investment strategy is developed, as well as a set of investment guidelines. These guidelines will be understood by all team members and closely followed at all times in order to successfully execute the investment strategy on the client’s behalf.

Key features of separately managed accounts:

Notes

* For Non US Investors. Source: iMoneyNet as at 31/08/2012

** JPY for qualified Japan domiciled investors only and RMB for qualified China domiciled investors only. The RMB fund is managed by China International Fund Management Co. Ltd (CIFM), a joint venture with JPMorgan Asset Management (UK) Ltd in China.