After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: August 01, 2012

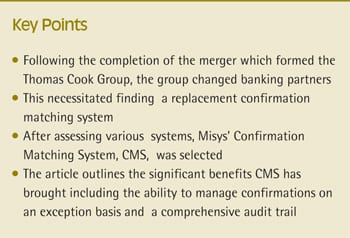

The Thomas Cook Group was formed in 2007 as a result of the merger between Thomas Cook AG and MyTravel Group plc. One of the outcomes of this was that the Group Treasury function, which has primary responsibility for risk management and financing, moved from Thomas Cook’s former headquarters in Germany to the UK. Front office is based in London and back office in Peterborough. In addition, the group has five regional treasury centres that report to local CFOs. In recent years, Group Treasury has undergone substantial change and enhancement, one element of which has been the replacement of its confirmation matching system.

Following the completion of the merger, we embarked upon a banking tender in 2009, which resulted in a change of banking partners. As the existing confirmation matching system had been provided by one of our incumbent banks, we needed to find a replacement system that would replicate our existing functionality as a minimum, and contribute to a high level of control and straight-through processing for treasury transactions.

We were seeking a bank-independent solution that was deployed online. We had rigorous security and audit requirements, and sought a solution that would work with our treasury systems environment. We use Kondor + for front-office dealing and IT2 for cash management.

After looking at a number of systems, we made the decision to implement Misys’ Confirmation Matching Service (CMS). There were a variety of factors behind this decision. We recognised CMS’ market-leading position and Misys’ experience of working with corporates of a similar profile to Thomas Cook. The system was robust, easy to use and demonstrated the audit and security features that were essential to us. Furthermore, CMS is deployed as a SaaS (software as a service) solution, minimising the effort required to implement, maintain and upgrade the system over time.[[[PAGE]]]

We went live on CMS in September 2009, following a very swift and straightforward implementation process. We received very competent support throughout the process from Misys. For example, they provided us with a standard format and test files, and helped us through the testing phase. They also gave us a standard template letter to send to our counterparty banks informing them of our move to CMS.

Having implemented CMS, we immediately benefited from a higher level of automation than we had been accustomed to in the past. As a result, we are able to manage confirmations on an exceptions basis, following up on unmatched items. This has resulted in a reduced amount of manual effort, and we also have fewer confirmation matching errors, missed deals or exceptions as the matching process is more reliable and accurate. The audit trail is comprehensive, and documents every action relating to the confirmation status. We have also found that the solution is cost-effective as pricing is scaled by transaction volume.

Looking ahead, we would like to be able to confirm fuel transactions through CMS, which is more difficult than more commoditised instruments such as money market and FX deals as the format of each fuel confirmation can vary from bank to bank. We are also seeking to improve the integration of CMS within our treasury systems environment, to enhance our straight-through processing even further.