- Thomas Dolenga

- Global Head of Product Development Cash Management, UniCredit Bank AG

by Thomas Dolenga, Head of Cash Management Products, Global Transaction Banking, UniCredit

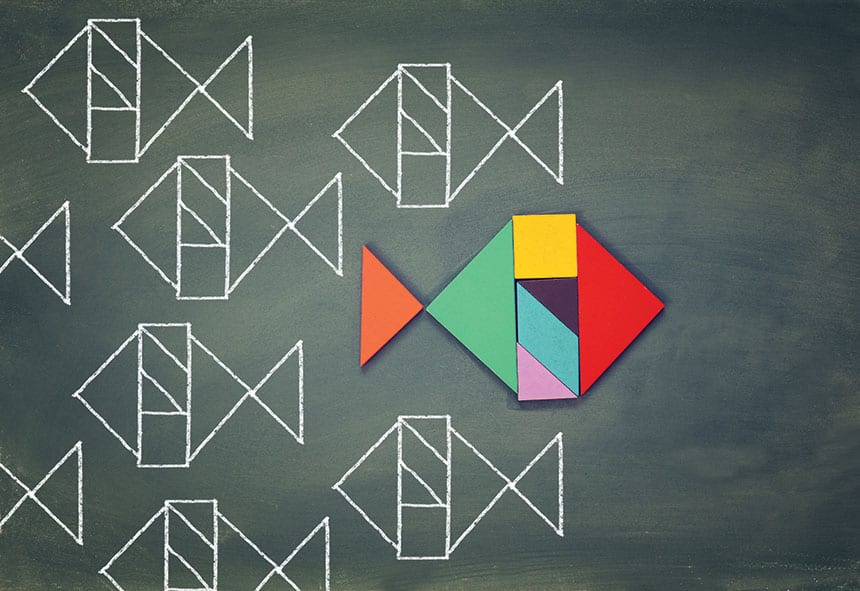

Technology has always been at the heart of how banks deliver cash and treasury management solutions to their customers: today, however, we are seeing rapid transformation in the way that financial systems – and the data that they produce – are being used to tackle financial and operational challenges, and facilitate new ways of doing business. Some of this technology is new, while in other cases, banks and corporations alike are simply getting better at using what we already have.

Big data: harnessing intelligence

‘Big data’ is cited regularly as an innovation across a range of industries, including treasury and transaction banking, but in reality, big data involves harnessing data we already have to extract and combine it in more intuitive, useful and creative ways. As a bank, we process enormous amounts of data, so we are finding new ways to use this data to add value to customers. By combining flow data with customer invoice information, for example, we can help customers to create more accurate cash flow forecasts based on empirical data and statistical analysis to improve intelligence and refine decision-making.

Working with customers on big data projects is delivering enormous value; however, at the same time, security and privacy of customer data continues to be our top priority and we take our responsibility very seriously. We are fully transparent about what data we use, and how we use it, so that customers can be confident that the use of data is being optimised, not compromised. Furthermore, many customers are becoming more concerned that while new and evolving technologies continue to deliver value on one hand, the growing reliance on digital processes, transactions and analytics increases the risks associated with cybersecurity and external fraud. This is a key area of focus for UniCredit; however, although cybersecurity and external fraud are global threats, the nature of the threat differs across countries, so it is essential to tailor our response and investment accordingly. Furthermore, the risks and mitigating steps vary across channels, so again, investment needs to be targeted precisely. While big data projects do not necessarily change the risks posed by cybersecurity threats, the volume, sensitivity and potential exchange of critical information between organisations or parts of an organisation exacerbates the need to manage and protect data very responsibly.

Distributed ledger, distributed value?

While big data can perhaps be seen as an extension of an existing trend, blockchain distributed ledger is an example of an entirely new technology that has the potential to change financial services as significantly as the internet has transformed media and entertainment. Already proven as the technology on which bitcoin is based, banks, industry bodies, technology vendors and corporations are now engaged in both collaborative and individual initiatives to identify and exploit use cases to leverage blockchain. Although many of these initiatives are at an early stage, there is considerable momentum building. UniCredit is a participant in the R3 bank consortium, for example, which brings together more than 50 financial institutions to design and deliver advanced distributed ledger technologies to the global financial markets. It is difficult at this stage to predict exactly how these initiatives will crystallise into real-life solutions, and there are still some obstacles to the widespread use of blockchain in financial services, not least issues of scalability, such as for mass payments, and capacity. However, the potential across transaction banking, including both cash management and trade finance is considerable, and arguably, the whole concept of transaction banking could change dramatically. For example, today, if there is an error on the bank account instructions, a payment needs to be transmitted, then rejected, returned and corrected before being re-sent, which therefore leads to delays. In contrast, by using blockchain, a payment with an incorrect bank account instruction would be identified as such before it has even been initiated, while a transfer of value based on a correct instruction could be processed almost instantaneously.

Instant payment initiatives

The concept of instant payments is not reliant on blockchain, however, nor are banks, industry bodies or corporations waiting for distributed ledger technology to mature before taking steps to deliver 24/7/365 payments with real-time or near-real-time settlement. The need for instant payments has grown substantially in recent years with the rise of eCommerce, mobile banking and an increasing demand for ‘just in time’ payment across complex supply chains. While consumers are often cited as the most immediate beneficiary of instant payments, there are a number of industries that will benefit, not least B2C industries and those that need to make or receive operate payment on delivery of goods, services or components. To use a simple example, for a consumer making a large value purchase such as a second-hand car, a card credit limit may not be sufficient (and the vendor may not accept cards) which currently encourages the use of cash; however, an instant credit transfer would suit the purpose precisely. Therefore, instant payments are not a replacement for existing payment instruments such as cards, credit transfers and direct debits, but complement them.

[[[PAGE]]]

Instant payments schemes are already established in 18 countries, including Japan, Singapore and the UK, with a further 12 in a planning or development phase (source: The Global Adoption of Real-time Retail Payments Systems, SWIFT, 2015). In addition, the European Payment Council is currently defining a new instant payment scheme, SCTinst, which builds on the existing SEPA instruments to deliver real-time euro payments. UniCredit is one of the leading pilot banks supporting EBA Clearing in developing and implementing a settlement system for SCTinst, which is expected to go live by November 2017.

Meanwhile, we are also heavily involved in SWIFT’s global payments initiative as a pilot bank. While other instant or near-real-time payment initiatives are focused on domestic payments, the first phase of SWIFT’s initiative, in which more than 70 banks are now engaged, is concerned with cross-border payments. The aim of the first phase is to implement a common set of standards to achieve same-day clearing of cross-border payments with transparent, predictable fees and real-time transaction tracking. The pilot phase is currently nearing completion, with the initial results due to be announced at Sibos in September 2016.

Targeting transparency

Ultimately, whether new technology opportunities in the financial services sector are based on entirely new capabilities, or engage existing technology and data in novel ways, the common aim is to improve transparency, whether over transaction status, costs or behaviours. We are seeing unprecedented motivation for experimentation and collaboration amongst banks, industry bodies, technology companies and corporations that we can expect to bear fruit, influenced, shaped and supported by banks such as UniCredit. It is important to be realistic and responsible, however, when applying technology innovation to customer challenges. For example, a key priority for the bank in all these initiatives is that transparency, whether of data, transactions or decision-making, remains at the forefront. Most importantly of all, innovation and value creation must be tempered with accountability to customers and respect for the security and privacy of their data and transactions at all times.

|

Thomas Dolenga Before taking up his current position, Thomas was from 2005-2014 Global Head Product Development at Standard Chartered in Singapore where he was responsible for Product Development for Cash Management, Clearing, Securities Services and Trade Finance. Prior to this, he held the role of Director Wholesale Bank at ING Bank in Amsterdam and Singapore, having previously held several positions in IT with the Government of Singapore, West LB and Hypo Bank and DG Bank in Singapore, New York and Munich. |