- Katja Zimmermann

- Head of Corporate Treasury, Heidelberger Druckmaschinen AG

by Katja Zimmermann, Head of Corporate Treasury, Heidelberger Druckmaschinen AG

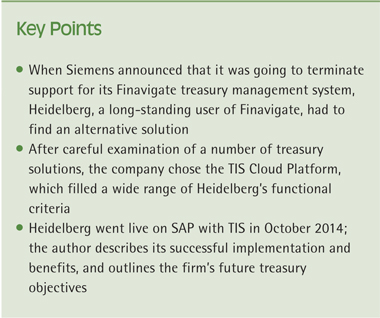

Heidelberger Druckmaschinen Aktiengesellschaft (‘Heidelberg’) has a highly professional approach to treasury organisation, processes and technology, with a view to maximising efficiency and control, and reducing costs. In 2012, Heidelberg’s existing treasury technology provider announced the termination of support for the platform, prompting Heidelberg to seek an alternative solution. In addition to managing the selection and evaluation of a new treasury solution successfully, the project has been a catalyst for enhancing bank connectivity and extending the reach of the Group’s financial shared service centre (SSC).

[[[PAGE]]]

Treasury organisation

Heidelberg is a global company with annual sales of around €2.4bn, of which 85% is generated outside Germany. Nearly half of this comes from activities in emerging markets, including Middle East and Africa, Asia Pacific and Central & Eastern Europe. The international scope of our activities, often in challenging markets, leads to considerable complexity in our treasury and risk management requirements. For example, we operate in 14 currencies, so FX risk management is a particular priority.

We aim to demonstrate industry best practices in our treasury organisation, policies and processes wherever possible. For example, we have three distinct treasury functions: front office (internal and external dealing); risk control (monitoring and reporting, e.g., exposures and hedging analysis, liquidity positions etc.), and back office (administration and transaction processing). We also deal with a variety of special projects such as refinancing, capital markets financing, rating agency relationships and others. We have 12 treasury professionals across these functions who provide centralised treasury services to the group from our head office. We conduct treasury activities locally only when regulations prevent intercompany lending. In these cases, subsidiaries set up local bank financing arrangements, but otherwise, group entities (of which there are 50-60) are financed from central treasury via our in-house bank.

Treasury requirements in China

Our business organisation in China is different from other parts of the world, as we have production facilities located there. We therefore produce and sell in China, although we have some imports into China from Germany. Our customers in China are very sensitive to currency fluctuations, which plays an important role in sales negotiations, so we manage the impact of movements in EUR-RMB and EUR-USD carefully. We have a number of subsidiaries in mainland China across various cities, all of which are connected via the in-house bank. We use RMB for domestic sales, but also some cross-border activities. This is likely to become increasingly important as regulatory restrictions in China continue to be relaxed, as we have cash surpluses in China that can be lent to group treasury to benefit the wider group. So far, we have implemented a domestic cash pool in China, and the next step is to link this into an international cash pool.

Reviewing the group treasury technology strategy

Heidelberg had been a long-standing user of Finavigate, a solution developed by Siemens for its own treasury purposes, that was marketed to other corporations in Germany for a period of time. This solution had met our cash and treasury requirements, including in-house banking, very satisfactorily since 2005. Users valued its ease of use and ability to leverage a single solution across the group. In 2012-13, however, Siemens announced its decision to terminate support for third-party users of Finavigate, so we needed to replace this with an alternative solution.

Technology priorities

We issued a request for proposal (RFP) to a long list of five treasury solution vendors and finally shortlisted three. Ultimately, we chose the TIS Cloud Platform, which supports payments, liquidity, bank connectivity and ERP integration, alongside SAP’s In-House cash module.

This solution fulfilled a wide range of our functional criteria. For example, bank connectivity had been challenging in the past, as the process of setting up new interfaces was cumbersome, and often based on trial and error. As we were keen to extend our financial shared service centre (SSC) from Germany more widely across the group, the ability to set up connections to new banks quickly and easily was particularly important.

We were therefore looking for a ‘one stop’ solution for connectivity. Some treasury solutions we considered had a ‘pay per bank’ commercial offering, which was not an appropriate model for us given our SSC objectives. We also considered SWIFT, but this was not a cost-effective connectivity option for us, and lacked some of the other services of alternative solutions. In contrast, TIS had demonstrated credibility and expertise in this area throughout the evaluation process. We had also received good references from comparable corporations, which gave us reassurance about our chosen solution.

Implementation in practice

We formed a dedicated project team, some of whom had been involved in the implementation of Finavigate a few years previously, so they already had a good understanding of treasury software implementation, and how to translate our business needs into system definition and tasks. Treasury personnel were also supported by representatives from accounting, our shared service centre (SSC) and IT.

Adding value

We went live on SAP with TIS in October 2014, and after the inevitable preliminary issues, our solution is now running very well. By introducing the TIS platform, we have achieved the ‘one stop’ solution that we were looking for. In particular, we have outsourced the complexity of bank communication, connectivity and format mapping to an expert, who offers a standardised approach to integration via a software as a service (SaaS) solution. As a result, the time and effort required to manage existing interfaces and implement new ones is far less than in the past.

Furthermore, our SAP and TIS solution has enabled us to automate and standardise the entire payment transaction lifecycle with a high level of straight-through processing (STP), therefore increasing efficiency and control. In addition, we have up-to-date visibility over the status of all payment processes across our business, adding confidence and facilitating better decision-making.

Now that we have established a robust bank connectivity platform, we continue to add new banks and ultimately expect to retrieve balance and transaction information from all of our banks. Once we have completed this, the next objective is to extend the scope of our SSC to manage all debtors and creditors centrally, which again will be a phased process.[[[PAGE]]]

Sharing insights

Treasury technology selection and implementation projects will differ according to the scale, complexity and organisation of every treasury function. For example, the needs of domestic versus multinational corporations, centralised or decentralised treasury functions will create different requirements. However, based on our experiences so far, we are confident in both the evaluation and implementation process that we went through, and the ultimate choice of solution and technology partner. Looking ahead, we intend to complete the connectivity and SSC elements of the project, and expand our use of SAP and TIS globally. We have already achieved a high level of straight-through processing, which is an important milestone, and we will continue to deepen our use of the solution over time and further increase the range and sophistication of reporting.