After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: October 06, 2014

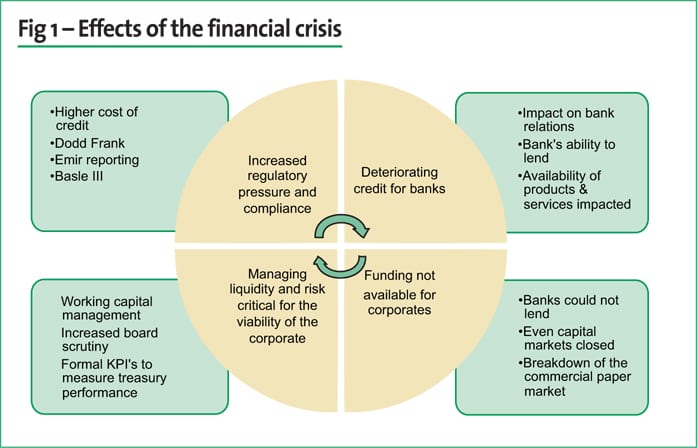

The global financial crisis had a significant impact on the corporate treasurer in terms of responsibilities and expectations. Before the crises the primary focus of the treasurer was to manage volatility and risk with regards to cash and liquidity, foreign exchange and interest rates. Over the last couple of year this role evolved from purely risk management (execution) to being a ‘partner to the business’ and having a ‘seat at the table’ with regards to strategic decision-making. This broader and more important responsibility has been reinforced by the financial crises and its impact on the corporate environment.

Some of the key lessons for the treasurer from the financial crisis include:

Strategic lessons

Operational lessons

The 2014 AFP Strategic Role of Treasury Report reveals that the role of the corporate treasurer has transformed from a traditional cash management function to one that is significantly more visible. The recent AFP report showed that:

This higher visibility means that the treasurer needs to be forward looking, pro-active (not reactive) and work closely with other functions e.g., business units, tax, accounting etc.[[[PAGE]]]

The treasurer has responsibility for the departments shown below within treasury. Note that in very large corporates, the M&A, strategy and valuations may be a separate group. In addition, some treasuries may have responsibility for investor relations, pensions etc.

Highlighted below are the treasurer’s responsibilities, recognising that they can differ slightly depending on the business model, risk appetite and sophistication of the corporate.

a. Cash and liquidity management

b. Capital markets & funding

c. Corporate financial management

d. Risk management

e. Operations, controls and accounting

[[[PAGE]]]

Measuring the performance

As treasury takes on more responsibility and assumes the lead in many areas, it is under greater scrutiny and therefore compelled to develop metrics and track its performance – see some examples below. The metrics should show how treasury adds value to the organisation. Measuring treasury’s contribution to areas such as ERM, insurance and M&A is less precise.

Apart from the skillsets required, the treasurer will use his own work experience and ‘lessons learned’ from peers to meet and overcome challenges. The treasurer operates in a dynamic environment, therefore working off ‘checklists’ is too rigid and inflexible, but some basic principles can act as a useful reminder when new situations are faced. Below are some of these ‘principles’ that may be useful (the list is not intended to be exhaustive and may differ in its relevancy between corporates).

Be forward looking

Strategy

[[[PAGE]]]

Managing risk

Relationships

Execution of transactions

People

General

The treasurer’s role was previously seen more as a support function, protecting the corporate’s resources as opposed to creating value. But all this changed over the last five or six years as the treasurer had to deal with significant challenges – the financial crisis, euro crisis, sovereign debt crisis, re-regulation of financial markets etc. This meant that the treasurer had to adapt and think differently - what worked in the past did not or will not necessarily work in the future.

As the profile increased this led to greater visibility but also increased accountability. This means the skillsets required have to be more rounded – from having a clear vision and thinking strategically, to being a team player with excellent communication skills. The greater responsibilities put pressure on the treasurer to ensure the treasury systems provide reliable, quick information and that the processes are effective in terms of maintaining strong governance and controls. In addition having strong bank relationships and ensuring long-term funding and liquidity for the corporate remains key objectives.

Nothing suggests the strategic importance of the treasurer will decrease any time soon – in fact the environment the treasurer will have to navigate is becoming increasingly complex - complexity and economic uncertainty is the ‘new normal’.

In a way the treasurer role can be likened to intelligence agencies – when things go well, you never hear about the successes but when things goes wrong then it is front page news. For anyone aspiring to be a corporate treasurer, the role has never been as interesting and challenging as now. The treasurer should take advantage of this and ensure that the corporate recognise and use the department’s full skills and talent in order to optimise financial performance.