After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: November 04, 2013

Real interest rates have been negative in the US following the 2008 sub-prime crisis. A similar experience holds in many countries, including emerging markets such as South Africa. If we follow recent guidance from the US Federal Reserve it is clear that this situation is set to change given the end of the so-called Quantitative Easing 3 monetary policy stimulus programme, although the timing is uncertain. We investigate the effect of real interest rates on equity performance.

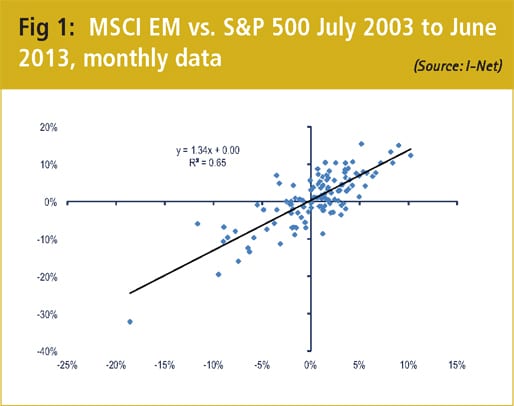

At face value emerging equity markets are simply a play on the performance of the S&P 500 index. If we perform a linear regression analysis of monthly MSCI Emerging Market (MSCI EM) returns vs. S&P500 returns over the past ten years we find a beta of just over 1.3 with a respectable R2 value as indicated in the graph below.

For any given positive expectation of returns for the S&P 500, the expected return for the MSCI EM in USD should be greater to compensate for the greater systematic risk inherent in investing in emerging markets.

There are a number of economic variables that influence expected returns for the S&P 500, and consequently the MSCI EM index. However, at face value, 10-year real rates, as measured by the US TIPS market, is not one of them. When comparing the monthly changes in the US 10-year real yield to changes in the S&P 500 over the past ten years one observes something quite unusual: an R2 of 0 with a beta and constant of 0 (when fitting a linear regression to monthly returns).

The relationship between real yields and the MSCI EM is not much better.

While the changes in real yields are not related to either the S&P500 or the MSCI EM, they are related to the relative performance of the two series. We partition the data into periods when real yields are rising and when real yields are falling. On average the MSCI EM index outperforms the S&P 500 by over 1% in months when real yields are declining, and underperforms by just over 0.6% when real yields are rising. The difference in performance is statistically significant at the 5% level and we would suggest it to be economically significant as well. [[[PAGE]]]

The implication is that while a view of where real long bond yields are likely to go in the US may not inform the expected absolute return for either of the S&P 500 or the MSCI EM, it should inform one’s opinion on the relative performance of the two indices.

We have a possible explanation for this phenomenon. Low developed market real rates have kept real rates depressed globally. This implies that the cost of capital for emerging markets was largely driven by yields in the US. As the US economy recovers, it increases competition for capital, leading to an increase in real rates. This is not necessarily a problem for US equities as the expected growth rate and the discount rate go up simultaneously. However, for the rest of the globe all that has happened is that the cost of capital has gone up. The expected emerging market growth rates would need to rise by as much as the US in order to avoid underperforming and the result above would suggest that this is not typically the case.

The analysis above becomes relevant in the context of a potential rise in real interest rates. The consequences in the equity market can be seen in debt markets also – our funding strategies and views on markets should be adjusted accordingly.