by François Masquelier, Head of Corporate Finance and Treasury, RTL Group, and Honorary Chairman, European Association of Corporate Treasurers

The world is changing extremely fast, particularly as a result of the recent huge strides in technology. The business model of many companies has also shifted towards B2C in parallel with it. A consequence of this fundamental transformation is that companies have to collect funds (i.e., incoming payments) using new payment methods (i.e., e-payments). They need to embrace these diverse and varied payment methods if they are to the collect funds due to this business transformation and make their new operating models viable in the long term. The difficulty often derives from the high volume of receipt transactions and their low, or even tiny, value. This throws costs and other expenses into sharp relief. These new niches are encouraging many service providers, (such as banks, e-traders, software houses, technology companies, search engines, etc.) to develop and offer alternative solutions, which are genuine competition for traditional banks. Some new entities even have banking licences, enabling them to carry out transactions which the banks themselves have always tried to shield from competition.

Without having the same regulatory and financial constraints, with shorter response times and the capacity to develop appropriate IT solutions very fast, these new players are on a course, in time, to gobble up the online payment market. A war has broken out. No one knows who will win it. We cannot say whether the banks will try to adapt their own business model, or whether e-business companies will diversify into neutral ground. But it is absolutely certain that the fighting will be fierce, and that there will be bodies lying by the wayside. The new arrivals will obviously have immeasurable advantages compared to banks – cost structure, speed of response, technology and developers, fewer regulatory restrictions, huge liquidity, etc. Furthermore, e-business companies could, and know how to, make the fullest use of customer information (i.e., bog data) to profile them, target them and finally hook them, like a skilful angler. [[[PAGE]]]

These electronic payment solutions exist or are being brought into existence as we speak. For them, too, size and scale will be crucial in building a business that will last. Security, interfacing, flexibility and price will be the key challenges to be overcome to be able to attract new users. The survival of e-payment companies will come at a high price. This no longer scares technology companies, which are awash with cash. The portability and mobility of payment devices and methods will be crucial advantages to be capitalised on in attracting new people to sign up. Can treasurers decide they don’t need to bother about this development, this genuine tsunami and market trend? These new ‘e-companies’ will provide access and solutions, because their very survival depends upon it.

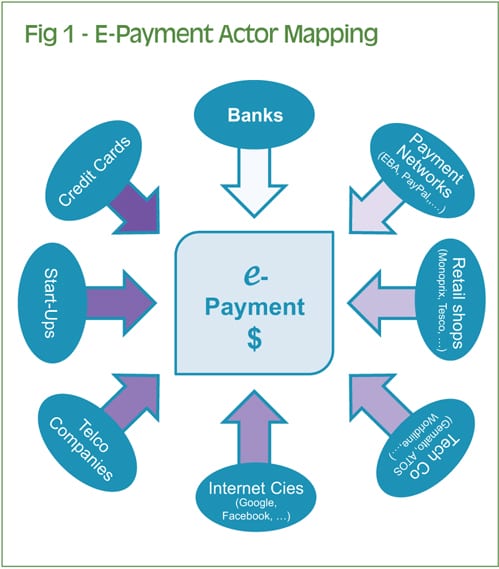

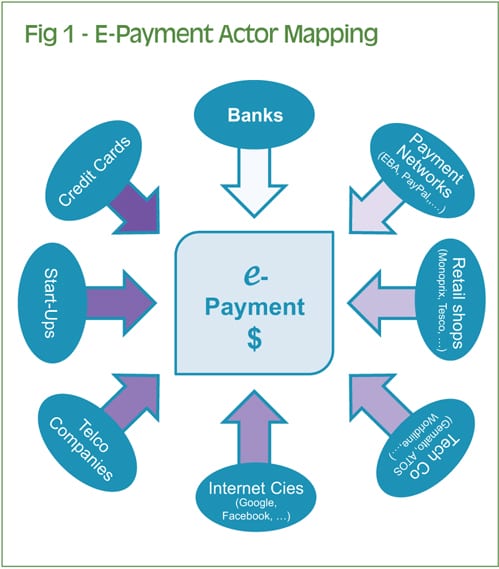

Multiple players

Click image to enlarge

Click image to enlarge

There is a profusion of players: there are the banks which are trying to become more ‘virtual’, the internet giants always ready to swoop and the trading companies themselves which may wish to grasp opportunities or find their own solutions to problems without needing to rely on others. For example, the French retailer Monoprix announced that it would be agreeable to adopting the Bitcoin from 2015. Major retailers will certainly take an interest in these new virtual currencies. Since technology is evolving faster than the economic and regulatory environment, you need to be able to adjust to make sure that you don’t miss the bandwagon. Company diversification is a way of protecting your business and a strategy. The ICT revolution is under way. People are changing their consumption habits. The world itself, perhaps, is not changing; it is, rather, undergoing a transformation. The plethora of companies ready to pounce on these e-payments makes it even harder to decide on the best approach. Today we see the arrival of Alibaba, iPay, Monitise, PayPal, Discover, TrueMoney (the list is long) – full of ambitious projects. You need to choose carefully and decide on your strategy, faced with the arrival of so many players. You need to think prepayment, payment now and payment later, which are the three main forms. Alternative payment methods are proliferating. They come in various forms. The e-wallet concept has made its appearance, with the idea of holding plenty of other data on a single medium.

Lurking at the back of all these media and solutions are the potential problems of the tests to be carried out to avoid and prevent hacking, intrusion, data loss, etc. Here again, companies are emerging to offer solutions for testing and protecting systems. Access to information, not currently being used by banks, on our consumption habits might in the future provide the means and incredible strike power for companies operating over the internet. Algorithms and robots are coming on stream and providing new functionalities and selection criteria – for example, having a lot of Facebook friends is thought to increase the likelihood of you repaying a loan, while other databases detect people with impulsive behaviour to prevent institutions making loans to them. Technology has no bounds, and transparency can be immensely positive as well as negative for customers. Control of the parameters may slip beyond our reach. That is frightening, surely?

Click image to enlarge

Click image to enlarge

Challenges for retail and commercial banks

With virtual currencies, mobile wallets, Facebook transactions and many other novelties, retail banks are trying not to be left behind on the road to digitalisation, or left stranded by new social networks or mobile devices. Some banks are already offering rebates or discounts based on the number of ‘likes’ that you have. These banks are developing a new innovation strategy to stay in the game and to avoid being thrust aside by big internet names such as Google, eBay and Amazon. Banks must increase their innovation capacity to adapt to the changing needs of internet users and B2C trading companies. They look enviously at the likes of Facebook and online lending systems, and at the peer-to-peer loans made by Zopa and others. Private users can influence developments through their wishes, desires and needs. Everyone will have to adapt. They want a social media-type banking experience.

Banks must increase their innovation capacity to adapt to the changing needs of internet users and B2C trading companies.

If that is the way the market is going, we need to prepare ourselves for it fast. The banks – some of them at least – have set up mobile peer-to-peer payment solutions. Private individuals are looking for virtual banks which they never have to visit, and are seeking mobile solutions and portability. Everywhere, for everyone, on all devices, 24/7 – that is the service standard that young internet users are looking for, and therefore what customers of trading companies will eventually be looking for.

This basic fact needs to be incorporated into trading strategies. An extreme would be installing video games outside the branches of banks. There is nothing that goes too far if it attracts customers. Others use Facebook to promote products and services. Finally, some institutions such as BBVA invest in funds which acquire start-ups working in Silicon Valley on transforming the financial services industry. But Google is still the main threat, a monster out to grab any prey, even banks. The challenge for tech companies will be that of becoming banks or something very like it while at the same time avoiding the restrictions imposed on banks. There will be a very narrow area between the traditional banks under regulatory supervision and control, and the new e-banks which will try to sidestep these restrictions. There is a risk of there being a technical no man’s land to be filled. It will be a bitter struggle, and the stakes will be awesome.

With its electronic wallet, Google is making major inroads into the mobile payment industry, enabling its users to store debit, credit and loyalty cards and gifts, to send funds by email, to shop online and to touch the phone onto any PayPass-enabled terminal. Google still requires a traditional bank account, but for how long? Are there many of us who do not use PayPal to pay the owner for the rental of a holiday property? This is business which the retail banks are likely to lose. Consumers want apps that are ever smarter and more ingenious than the rest. We have set off down a winding and chaotic road. The traditional banks need to pull out all the stops to stay in the race and not lose this share of the market. Unfortunately, banks are weighed down by administrative burdens, slow-moving IT departments, risk aversion and a shortage of entrepreneurial spirit. They need to get moving, however, and quickly.[[[PAGE]]]

Click image to enlarge

Ferocious e-competition everywhere

Facebook is moving to electronic payment by linking an account to a profile. It plans to obtain a licence in Ireland. As Facebook seeks to reinvent itself, e-payment could be its saviour against user attrition. So it is entering into partnerships with TransferWide and Azimo to capitalise on and retain its 250 million ‘friends’. Solutions for payments between users without going through the intermediary of a traditional bank will be the challenge for e-industry, and the risk for overly conservative financial institutions. Clearly, one of the challenges will be fraud, which will have to be stopped. The issue for e-industry companies will be the cost. And the same risk emerges on other fronts. For example, CurrencyFair offers a P2P currency solution at a really attractive price, and there is also crowdfunding, which is appearing as an alternative financing solution. We are therefore already up to the neck in the digital revolution which will turn the world upside down. New products are appearing and the old ways of doing business simply no longer work. The speed of innovation is frighteningly high, and the currency is now ‘adapt or die’. Goodbye analogue, long live digital. The boundaries between businesses are disappearing and everyone may end up being each other’s competitors. The old value chain has been dismantled, and its length constantly shortened by technological developments. The ‘four-corner payment model’ is under challenge. Hitherto unknown names are popping up, such as Yapital or Digicard.

The legal framework has also evolved, thankfully, with Directive 2007/64/EC (PSD Payment Services Directive) and also Directive 2009/110/EC (Electronic money Directive for e-money institutions, with the aim of harmonising the prudential framework and related obligations), transposed into Luxembourg law, for example by the laws of 10 November 2009 and 20 May 2011.

A world of opportunities is opening up to us

To conclude, we can still be optimistic and say that new opportunities are opening up to us in terms of payment. We just have to adapt and plan ahead so that payment methods do not become an obstacle to transactions, but a benefit or a competitive advantage. It will be a huge challenge for the banks. It is claimed that they will lose up to one third of their payment income as of 2020. Even worse, consumers clearly have greater trust in technology companies, preferring them to banks which look less sexy to internet users. New entrants are opening up a gulf between consumers and traditional banks. The banks could end up as enormous back offices. They will be just another link in the chain.

Some of them are reacting, for example, by offering payment solutions via Facebook Messenger for sending funds between private individuals. The credit card suppliers (e.g., VISA, MasterCard, AMEX) have been no sharper or quicker to react. Retailers have been let down, and they are looking for alternatives to be able to manage without them. However, competition is taking a nasty turn in that technology companies are prepared to provide this service as a free add-on, as part of a package. Banks are held back by two dead weights: restrictive regulations and their conservatism and reluctance to embark on IT innovation. Finally, a customer-centred approach is emerging. You can now become a virtual bank without becoming embroiled in the strictures of very burdensome banking regulations, such as KYC, PSD, Basel III, MiFID II, SEPA, ECB and national bank supervisors, for example. We will therefore have to deal with new alternative payment providers and with evolving consumer demands. Tomorrow’s bank will be more ‘virtual’ than ever.