After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: April 10, 2013

‘Fun‘ is usually not the first word that comes to mind when you think about controlling bank fees. ‘Frustrating‘ and ‘time-consuming‘ usually head the list. That is hardly a surprise given the current situation in many companies. Bank fee statements are usually paper-based and there is no information about agreed fees to facilitate comparison. Very often this task ends up with a new colleague or an intern who fight their way through stacks of paper and endless spreadsheets. Inevitably, given this approach, a professional monthly check of all fees is simply not feasible.

This is rather unfortunate, since bank fee statements contain a wealth of information that can be used by the treasurer. Let’s take a look at them in turn:

Click here to see a guide on how to process electronic bank fee statements

As a rule of thumb expect savings of between 5% to 10% of your banking fees.

To take advantage of all these points you need ask your bank for a bank fee statement in electronic form. In the US and Canada this is already standard, using the ANSI 822 format. In other areas of the world not all banks are yet able to provide the bank fee statements. If they provide them, the statements are usually in the format ‘TWIST BSB‘ or ‘camt 086‘. In the worst case, you can also accept spreadsheets as an intermediate solution.

I strongly recommend that you do not agree to pay for the provision of these statements. It should be part of a fair relationship to get the information about services and associated costs without having to pay extra for it! After all, in the normal corporate world it is usual to get a discount if you accept electronic fee statements from your vendors. If you want to play it hard you could only pay bank fees for which you get electronic statements.

[[PAGE]]]

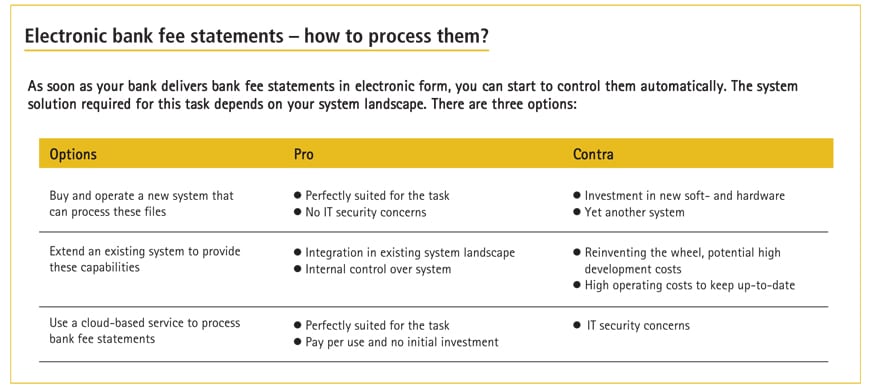

Well, you have three options.

The table on the previous page highlights the pros and cons of each solution. Which one is right for your company really depends on your existing system landscape and the costs associated with each solution.

If you want to find out more about bank fee controlling, simply get in touch with me at [email protected]. Based on your files we provide a free-of-charge prototype that will show you the benefits of automated bank fee controlling.

Hubert Rappold is CEO of the TIPCO Treasury & Technology GmbH, a leading software provider for treasury reporting in Germany, Austria and Switzerland. Since 2004 he is substantially involved in the functional and technological development of the Treasury Information Platform TIP. More than 100 corporations worldwide are using TIP to create flexible and comprehensive financial reports.

TIPCO Treasury & Technology GmbH

www.tipco.at

[email protected]