- Bas Rebel

- Independent Treasury Consultant, BFRC

- Irma Langeraert

- CEO, ILFA

The days when ESG was a concern only for academics and idealists are long gone. In Europe, ‘the Brussels Effect’ has been driving ESG and sustainability to the top of the agenda for businesses and is also having an impact on treasury.

The phrase, which was popularised by Finnish-American law professor Anu Bradford in a book by the same name, points to the influence the European Union (EU) – with its parliament in Brussels – has had, and will continue to have, in raising global standards and laying the foundation for global commerce.

That’s exactly what has happened with the EU’s green agenda and the Corporate Sustainability Reporting Directive (CSRD), which have both been growing in influence. While the CSRD outlines a phased approach to compliance and many European organisations do not yet need to report publicly, the impacts of this regulation on businesses and financial markets are significant.

It’s no longer external pressure, from activists staging protests and launching lawsuits, that is pushing executives towards greener business strategies. Change is now coming from within. Banks, insurance companies, suppliers, and clients are increasingly demanding ESG-focused business strategies from those they do business with to support their reporting of indirect carbon emissions in their value chain.

ESG strategy a ‘hygiene factor’

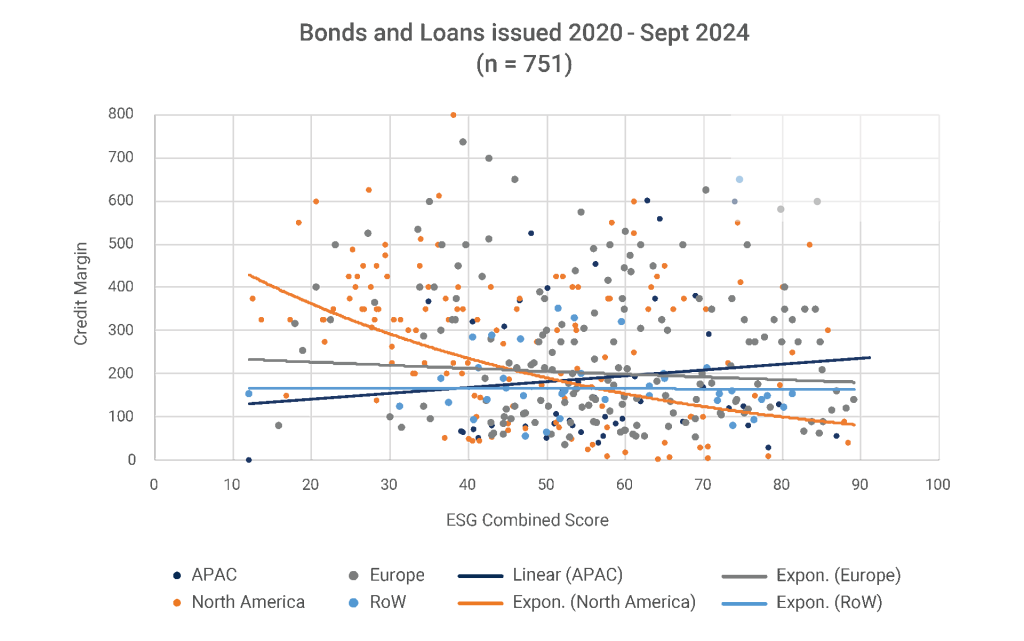

ESG has multiple dimensions and addresses the impact that businesses have on the environment, society, and their stakeholders. While ESG is primarily a business strategic agenda item for senior and core business management, there is a strong case to be made for treasury’s involvement. ESG scores have already affected the cost of funding and access to financial markets for many companies. At the same time the ECB already requires banks operating in Europe to include ESG risk in their portfolio analysis. They are expected to put reserves aside to cover the risk of stranded assets, which will have premature write-downs because of climate change. Consequently, banks are already differentiating loan pricing based on clients’ ESG scores[1]. In particular, US-based borrowers seem to materially benefit from a high ESG score (See Fig. 1).

FIG 1: ESG scores already impacts cost of funding

Source: Refinitiv Eikon / LSEG Workspace

The cost of funding and access to financial markets are also impacted indirectly: credit rating agencies are incorporating ESG risks into their corporate rating models. For instance, a recent report from Fitch Ratings indicates that one-third of 94 industry sectors have a climate vulnerability score (known as the Climate.VS level, which ranges from 0 to 100) higher than 45 for 2035.

According to Fitch Ratings’ methodology, the higher the level, the more vulnerable the sector is to climate transition risks. When a sector or issuer reaches 45, it receives further scrutiny from their analysts. In the same report, the researchers estimate that in 2050, 50% of all the sectors it rates will have a Climate.VS score above 45.[2]

Other financial market participants, such as investment and pension funds, are required by the Sustainable Finance Disclosure Regulation (SFDR) to be fully transparent about how green their investments truly are. By mid-2025, if they cannot substantiate their claims, funds referencing sustainability, green, or social responsibility will need to change their names if they don’t have enough investments that support these causes on their balance sheets.

ESG strategy is becoming a hygiene factor, relevant to all organisations. Subsequently, treasurers should take note and become involved in their organisation’s ESG policy as it not only drives business opportunities but also the cost of funding and access to financial markets.

Treasurers in the driving seat

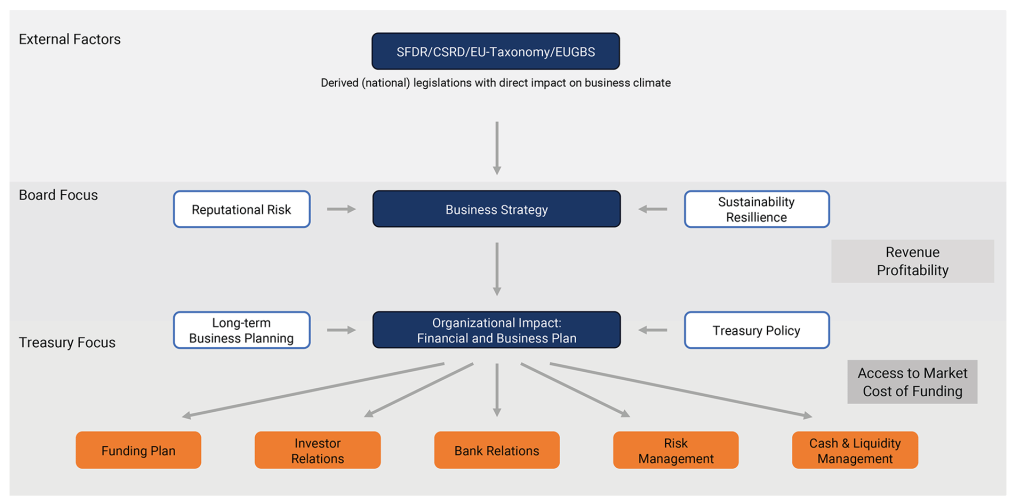

The ESG agenda is owned by executive and core business management, not by treasury. However, given the impact that ESG performance already has on the cost of funding and access to financial markets, treasurers have to engage sooner rather than later. ESG adds new kinds of exposures that impact funding strategies and access to markets.

ESG also requires different hedging strategies and new derivatives for managing ESG exposures. At a minimum the treasury policy should be updated and detail how the organisation identifies, manages, and addresses these risks. Such an update is relevant, as it defines the mandate of treasury regarding ESG as well as the expected collaboration from other departments within the business aimed at creating a successful master plan. All has to be incorporated in the treasury policy.

Even though treasury is not in the lead, treasurers have an active part to play in the ESG agenda. The role of a treasurer is both external and internal. Externally, ESG is an additional dimension of regular investor and bank relationship management. As the organisation’s ambassador to financial counterparties, a treasurer has to understand and explain the company’s ESG efforts and plans.

By the same token, a treasurer should also understand the counterparties’ ESG priorities and policies and their potential impact on the bilateral commercial relationship. This is important because the organisation’s plans are relevant to the bank’s mandatory Scope 3 reporting, which discloses the carbon emissions of the other parties in their value chain. The more ambitious a firm’s plans are, the more interested banks will be in maintaining the relationship.

FIG 2: Impact of ESG / CSRD on day-to-day treasury management

Source: ILFA

Learn from banking partners

Given the external role of treasury, the most obvious contribution that treasurers can make is sharing the relevant internal ESG information, strategy, and objectives with financial counterparties, enabling them to assess the corporate’s ESG risk. This includes creating the ESG reports that banks and insurance companies may require. Although this may seem straightforward, ESG reporting is far from simple.

ESG is a rapidly evolving field with few mature and common standards, making data collection and reporting a complex challenge, especially when dealing with multiple geographies. Furthermore, and unlike more traditional financial performance measurements, ESG KPIs cannot (yet) simply be retrieved from standard ERP applications. Often it requires installing a multitude of sensors and new processes and data fields for collecting and recording data, as well as innovative calculations based on a variety of assumptions.

To further complicate matters, definitions and benchmarks may differ widely, and benchmark data is sparsely available, if at all. Benchmark data oftentimes require deep cleansing before it can be of any use. Adding to this conundrum is the fact that to some degree, ESG KPIs are aspirational as they are concerned with a projected reduction in energy consumption or more efficient use of natural resources. Missing these targets will have direct and indirect financial consequences.

Given the impact of ESG risks on cash flow, treasurers should add an ESG dimension to exposure management reporting. ESG risk may have a direct impact on projected cash flow. This, for instance, could be on interest expenses, or an indirect impact due to loss of preferred vendor status if the organisation does not contribute positively to the client’s Scope 3 performance. In working out how to do this, treasurers could learn from their banking partners as they are already confronted with the challenge. Mirroring what banks are doing has the additional advantage of increasing the understanding of how future funding costs will correlate with the corporate’s ESG efforts.

Treasurers should also engage early on in CapEx investment projects. The involvement could be limited to explaining the relationship between an ESG score and funding costs or making sure that ESG-related KPIs preferred by funding partners are included in the project scope. Treasurers could also push for their companies to make investments that improve the ESG scores and lower the absolute cost of funding.

FIG 3: Treasury feedback loop

Source: ILFA

Taking the involvement with CapEx one step further, treasurers could also add an ESG dimension to internal calculation of funding costs and project discount rates. Arguably, investment opportunities with a positive impact on ESG score will also contribute to the firm’s sustained access to financial markets and (future) cost of funds. One could think of calculating the project discount rate dynamically on the project ESG score relative to the corporate’s overall ESG score. The ESG bonus awarded to the project then is added to the funding cost of projects that do not impact the overall ESG score or have a negative impact on the business’s ESG score.

Compensation is another area where treasury can have an impact on its organisation’s ESG strategy. The markets for emission rights and climate-change-related derivatives are evolving and managing such instruments is similar to managing commodities and FX and interest derivatives.

Buying carbon credits and climate derivatives does not address the characteristics of the underlying exposure; they only reduce the volatility of the possible financial impact of the exposure, albeit at a predefined transaction cost. Similarly, should a CapEx or OpEx project yield, for instance, carbon credits, treasury could be key in monetising the obsolete emission rights in the forward and option markets.

Collaboration is crucial

ESG is no longer optional for treasury; it is essential for maintaining market access and securing favourable financing. Treasurers and CFOs must take a proactive role in aligning treasury policies with ESG goals to mitigate risks and capitalise on opportunities.

Cross-departmental collaboration is crucial to achieve these objectives. Treasurers should work closely with internal teams exploring ways to improve efficiency in funding and access to financial markets. Treasurers should also work across departments to ensure consistency and accuracy in ESG data and reporting, as financial institutions and investors are demanding greater transparency.

By acting now, treasurers can ensure compliance and also contribute to the long-term financial and sustainable success of their organisation.