After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: October 01, 2014

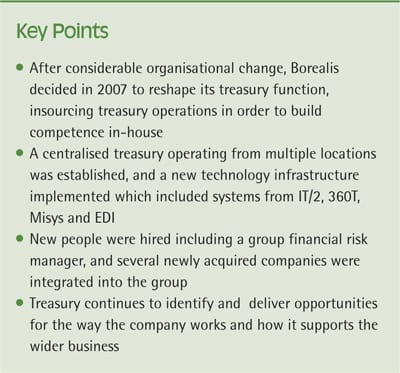

In 2007, leading chemicals group Borealis made the strategic decision to insource its treasury transaction execution and processing from a bank’s agency treasury. This ‘ground-up’ restructuring of the treasury function has initiated a transformation in the treasury organisation, culture and activities for which treasury is responsible, as Jan-Martin Nufer, Director of Treasury & Funding outlines in this article.

Borealis has experienced considerable changes in its organisational set-up over recent years. Until 2006, the group was headquartered in Denmark, but following a change in ownership, we relocated to Austria. At that time, our treasury front-office and back-office functions were outsourced to a bank’s agency treasury centre in Dublin. Group treasury focused on financing and decision-making, while transactions were executed and managed by the agency treasury using their treasury management system (TMS).[[[PAGE]]]

We conduct treasury reviews regularly, formally roughly every five years related to usual tendering cycles for TMS, cash management and others. We hence continuously amend our systems, processes, organisation and responsibilities to reflect evolving business and market conditions, new technology opportunities and the strategic plan for the business. In 2007, we made the decision to reshape the treasury function, insourcing our treasury operations in order to build competence in-house. Overall, we have seen a decline in the use of treasury outsourcing services, but there were a variety of reasons for our decision:

The decision to insource treasury had a variety of implications, and in some respects, it was a ‘blank canvas’ and hence a great opportunity for change. We first reviewed our organisational setup, including roles and responsibilities, reporting lines, policies and processes. As it was important for us to use this opportunity to implement industry best practices, we benchmarked our activities against other organisations; at the same time acknowledging that every company has its own specific needs. A particular consideration was the need to establish a centralised treasury function that operated from multiple locations: for example, our cash, banking operations and payment factory are based in Belgium, while our headquarters is in Austria. We wanted to allocate tasks to the people best equipped to conduct them; at the same time, segregation of duties on a four-eye or six-eye principle was a priority, including enabling approvals to be done by people in different locations with the help of integrated systems and workflows.

We needed a new treasury technology infrastructure, and selected IT/2 which was different from the system used by the agency treasury. We were able to implement our necessary functionality and bespoke reporting while configuring it so that we could achieve most of the automation and additional benefits that we were seeking at that stage. We also implemented 360T for electronic dealing, Misys for confirmation matching, EDI for bank connectivity and interfaces with Bloomberg (for market rates) and our internal SAP system.

Having implemented the core system infrastructure, we could then refine our processes and reporting, and expand the scope of the system so that we now manage all of our instruments through IT/2. Given IT/2’s recent change of ownership, we regularly monitor whether the system will continue to be developed in line with our needs, and we are keeping in touch with other system users.

Treasury insourcing also meant that we needed to hire new people. This was an opportunity to develop skills across the department; for example, we strengthened our risk management function, which had not fully existed previously. We have an energy trading function that hedges commodity prices; however, fixing a commodity price has an immediate FX impact as we are essentially locking in our USD exposure. Therefore, we cannot consider commodity risk management in isolation. We have appointed a group financial risk manager who is responsible for managing all financial risks, policies and processes, and provides a link between energy trading and treasury. He, together with our middle-office function, has a dual reporting line to our group risk manager, while we have also implemented a dotted line to internal audit to ensure appropriate segregation of duties.

In addition to formal reviews, we constantly review and actively seek out opportunities to improve efficiency or enhance the way that we support the group. For example, in some organisations, treasury is responsible for issues such as insurance and commodity risk management. At Borealis, we already had close links with credit and collections, which is a major focus area for the business, and we have now integrated this function within treasury. We have also integrated trade risk management and most recently in 2014, we centralised accounts payables into treasury.

Bringing together different functional areas necessitates new structures, as people from each area often have similar professional profiles. This means that we can restructure our activities to establish cross-functional resourcing, allowing people to develop their careers by gaining wider experience. This is an important area of focus for us, as we are keen to support our employees through career development. As well as the staffing implications of integrating new business functions such as credit and collections and accounts payables into treasury, new technology needs also become apparent. For example, we recognised the need to set up a global customer credit management platform based on one integrated system for both customer exposure and relationship management within finance as well as tracking credit and collections.

This philosophy in treasury of constant improvement focus is well embedded in the company wide ‘Winning through Excellence’ approach leveraging on the principles of connect, learn and implement.

As part of our ongoing process of review and enhancement, we are also now integrating the newly acquired companies into the business, as Borealis has made a number of acquisitions in recent years, such as Total’s fertiliser business, which mean that we had a new French business to manage, in addition to acquisitions in Belgium and the Netherlands. Acquisitions have a major impact on treasury due to the need to integrate and reshape treasury the funding operations, credit & collections and risk management reflecting the cash and treasury needs and the different business models and markets of the acquired business. When making an acquisition, we follow a process to assess the efficiency of the incumbent treasury function, its cost structure, review reporting lines and connect the new treasury into the group financial risk function.[[[PAGE]]]

Looking ahead, we continue to be proactive in identifying and delivering on opportunities for improvements in the way that we work, and how we support the wider business. Inevitably, it is not possible to anticipate every change both within our business, and the wider markets, so we need to remain flexible and reactive given the growing complexity and unpredictability of international business. Velocity is the key word in this respect, the ability to move fast but properly prepared. One of the ways in which we do this is to ensure that we have a full range of skills and experience across treasury to allow us to be responsive to change and handle different eventualities. We continue to develop and maintain close relationships with other internal departments and business units, financial counterparties and joint venture partners to ensure that we continue to understand and respond to business and market changes and learn from each other. With regulatory changes such as EMIR, Basel III, Enforcement Act and many others coming into effect this is an area to watch and respond appropriately.

We expect to continue to diversify our funding sources further in order to maintain competitiveness. We will also review our global cash management structures now that SEPA has been fully implemented in the Eurozone, and see whether there are new initiatives and structures from which we can benefit.