After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: January 01, 2000

The use of commercial cards has evolved considerably over recent years, with product innovation, growing corporate awareness of solutions such as virtual cards, and a continuing focus on working capital amongst corporations of all sizes. These trends are contributing to a rapid increase in adoption as professionals in treasury, finance, procurement and corporate travel appreciate the valuable contribution that commercial cards can make to an effective working capital strategy, in addition to their value in terms of convenience, control and reporting.

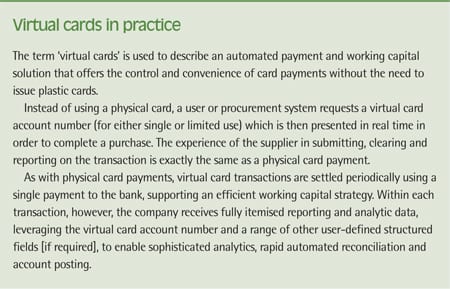

When it comes to payables, purchasing cards are in many ways becoming a misnomer as, virtual cards are increasingly replacing the concept of plastic purchasing cards offering sophisticated, end-to-end payment and working capital solutions. Not only are payment transactions both convenient and controlled, but the entire workflow is automated from transaction to reconciliation, together with a predictable transaction date, a single external payment to cover card transactions, and full visibility over the detail of each transaction.

Virtual cards are becoming increasingly popular for B2B payments as a means of enhancing working capital and improving visibility, control and granularity of information at a supplier level. This helps to accelerate and automate bank account reconciliation and posting to the accounts. Customers are also using virtual cards as an alternative to lodge cards. Using virtual cards to book business travel and accommodation makes it easier to record and store additional reference information on travel bookings that is often problematic to tie back to individuals with a traditional lodge product.

While virtual cards have existed for a number of years, there has been a steady shift in focus from exploring the concept to embarking on practical deployment of virtual card solutions. So far, there has been greater adoption in the United States, which mirrors the evolution of card programmes generally, but we anticipate that treasurers in other regions such as Europe will quickly catch up given the universal value proposition.

Many companies have been successful in implementing in-country or regional card programmes, both physical and virtual, for a variety of purposes, from travel and entertainment through to projects, events and regular purchasing. Treasurers and finance managers are beginning to see the opportunity in extending these programmes globally. A global card programme, delivered by a single provider, offers a variety of advantages, as follows:

These advantages apply whether or not a company’s purchasing and/or programme administration is centralised at a global or regional level, or takes place in-country. This means that companies can structure the administration of their card programmes in a way that meets their business organisation and culture without compromising on efficiency, control or quality of reporting and analytics.[[[PAGE]]]

However, these advantages can only be realised with the right approach to implementation. Some companies have achieved global coverage of card programmes through a patchwork of regional programmes, which makes it difficult to achieve the standardisation and comprehensive reporting that a truly global programme can deliver. In other cases, companies have worked with a single provider, but end up with multiple contracts, systems and relationship managers which again impede the value.

At Bank of America Merrill Lynch, we have a cohesive approach to delivering a global card programme to our clients with a single contract and a central point of contact. By doing so, we can support clients in achieving their global objectives, whilst taking appropriate measures with a goal of ensuring compliance with operational and regulatory requirements in each country.

We recognise that companies are at different stages in the maturity of their card programmes. While those with a long heritage in using commercial cards, whether domestically or regionally, are familiar with the benefits, they can now seek to extend the value globally. Those with less experience in using commercial cards may need to spend more time on educating users and suppliers, which may require a slower, step-by-step approach to implementation. Irrespective of the level of experience or sophistication of a customer, however, we recognise the importance of depth of regulatory knowledge, cultural sensitivity and the need to support local, regional and global objectives when delivering a global card programme.

As a result of our proven success in implementing cohesive card programmes, both globally and domestically/regionally, and for a variety of business purposes, we are seeing a substantial increase in adoption. Virtual card solutions continue to grow in popularity too, with an increasing trend towards global programmes to replace the patchwork of domestic and regional programmes that have developed in some organisations. We will continue to invest in innovation and geographic expansion of our card offering to meet the evolving needs of our clients, both in commercial card programmes and to support the wider relationship to meet their needs.