by François Masquelier, President of the Association of Corporate Treasurers in Luxembourg (ATEL) and Honorary Chairman of the European Association of Corporate Treasurers

This article addresses the problems of the way in which ESMA plans to apply the exemption granted to corporate treasurers for dealing in OTC type derivative products. Over three and a half years after the start of the long-drawn out financial crisis, the regulators have still not delivered this reform. We find this time lag and the first indications of the content of this reform worrying, at a time when many of us thought that victory was in the bag. The battle may perhaps be won, but certainly not the war. And yet again, judging from the first round, we may fear that victory could be relative. However, the second draft proposed by ESMA was much better.

Already over three years

In spite of the long-drawn out crisis that we have experienced since September 2008, the new post-G20 regulations are taking a long time to appear. The regulators are cogitating, consulting, debating endlessly and trying to devise strict and clear standards that ideally would apply to everybody. However, as always when a lot is at stake, finalising such rules is a major challenge. To start with, the lobbyists have entered the fray and are all vigorously and steadfastly defending their patch of turf, coming up with endless arguments. These arguments are most often understandable and justifiable, although somewhat specific to a particular category of market players, an industry sector, a product type or a particular business line. Laying down regulations for everybody without exception is therefore an almost impossible exercise.

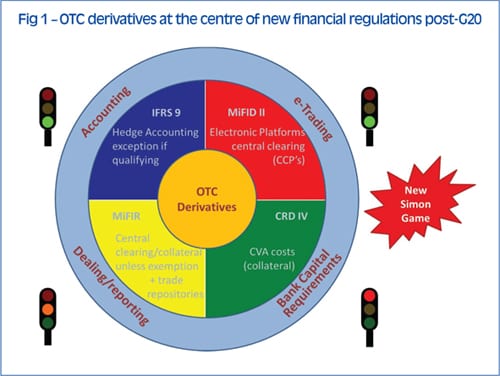

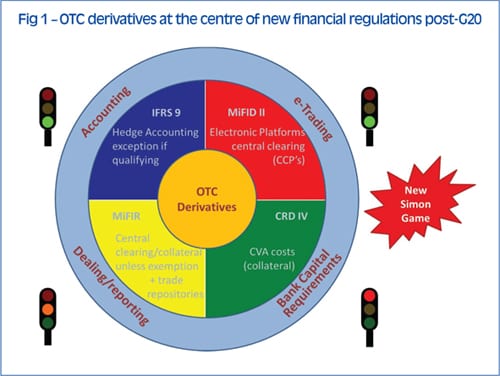

The difficulty of the task in part explains this elephant-like gestation period for the new financial regulations (for example OTC Derivatives, MiFIR ,MiFID II, CRD IVi, Basel III, CRA, etc.). Almost four years after the start of this lengthy financial crisis, nothing has yet been finalised. We understand the scale of the task. Nevertheless, are we not at risk of losing this impetus instilled by an authoritarian G20, this desire to regulate dangerous financial practices ever more drastically, of losing this political consensus on preventing another crisis happening again in the future? With the lapse of time we risk losing the impetus, the enthusiasm and most of all the vigilance needed to avoid experiencing such disastrous financial scenarios again.

You can sense a certain loss of momentum on the part of the regulators and a certain weariness on the part of the persons affected by these new measures. We may also observe a lack of any real international co-ordination, so at the end of the day we risk having measures that are not completely harmonised. This will potentially create competitive advantages or disadvantages for this or that financial centre compared to the others. We hope that Europe will not end up the loser.

Has the voice of the real economy been heard?

The voice of the real economy, represented by corporates, has been heard thanks to the EACT’s incisive lobbying, which was conducted by its chairman, Richard Raeburn. But some people still think that it is like trying to move a mountain. Politicians are aware of our arguments. They show a certain amount of sympathy for our worries and fears. However, they think they have to legislate and keep exceptions down to the very minimum. Furthermore, they are tackling the sets of regulations one by one, not as a whole, at the risk of generating glaring inconsistencies.[[[PAGE]]]

For example, obtaining an exemption for corporates under MiFIR (OTC Derivatives) would make no sense if at the end of the day CRD IV discourages corporates from using certain financial products by making them too expensive. We all think that corporates should be exempted from CVA (Credit Valuation Adjustment Capital Changes) calculations to avert the risk of significantly increasing the cost of derivative financial products and reducing access to them by corporates. This consequence would be the opposite of the result intended by the legislators. The idea is to well and truly cover yourself against financial risks and not to have greater exposure than you had before the crisis. This is nevertheless one of the possible consequences of such an inconsistency. All corporates support reform of the banking industry, which is necessary to avert many financial industry disasters, and not only in the Eurozone. We all want a better regulated financial industry, one that is sounder and more robust, to assure greater financial stability.

Click above image to enlarge

Click above image to enlarge

Exemption, what exemption?

Some people have hailed a victory on MiFIR a bit too soon, thinking that they have obtained the exemption they wanted. However, the documents produced by ESMAii give the impression that the modular nature of the exemption could in practice prove to be complex and sometimes unworkable. We may ask ourselves if such an exemption should still be considered as an exemption. Is that the simplest way? Certainly not. It would have been difficult to come up with a more complex exemption, however high they raised the bar in terms of complexity. They have done everything we recommended them not to do.[[[PAGE]]]

The exemption under discussion seems to be a mixture of:

1. Reason for dealing in derivative products

2. Application of the hedge accounting principle and

3. A maximum threshold

This is a little bit of everything while being nothing in particular. Why make it simple when you could make it complicated? We still recommend the simplest possible rules for exemptions and we also insist on avoiding judgmental approaches of exceptions.

We have to admit that it is very hard to define the best criterion or criteria for exemption under MiFIR (EMIR). But that is not a good reason for not trying. We cannot see that the way suggested by ESMA is realistic or workable. We need to continue to try to modify this approach to achieve an approach that is simpler and easier to put into practice. We all have to be fair and to admit that ESMA made real efforts to improve its homework.

Whatever happens with EMIR, we have to fear that CRD IV will throw a spanner in its works and make it irrelevant. We recommend that there should be exemptions both under MiFIR and CRD IV to guarantee bilateral trading without clearing and without collateral (for corporates who so wish it). It nevertheless seems that the Danish presidency of the European Union has championed compromise draft legislation incorporating an exemption in CRD IV as well. As we have often mentioned, some corporates might find it beneficial to use collateral in the form of a CSA type bilateral agreements as a means of considerably reducing the cost of hedging (provided they are in a ‘long’ position in terms of cash).

Click above image to enlarge

In the Discussion Paper published by ESMA (European Securities and Markets Authority) in February 2012, we get a first broad overview of the way in which they want to organise the OTC derivatives reform in practice and how they want to modulate the exemption promised to corporates. Unfortunately, the document they have issued could not be considered as satisfactory for corporate treasurers. It has turned out to be complex in practice and unsuitable. It nevertheless sets the tone and gives us an idea of what lies in store for us. During summer, they made a much better second draft which certainly goes towards the right direction.

The chances of success for lobbying by treasurers

In spite of effective lobbying, which has been co-ordinated and intense, corporate treasurers risk running into the application of Basel III. We remain sceptical about the possibility of softening CRD IV on the CVA aspect. However, without a parallel and co-ordinated exception under CRD IV, an exemption under MiFIR, whatever its form may be, will be of no value. The subject is so technical and sensitive that it seems to us almost impossible to reconcile the differing points of view. Bankers (or at least some of them) have not yet realised the potential impact of such a reform with no exemption for corporates.[[[PAGE]]]

With no exception, treasurers will have to radically review their approach to hedging and use of derivative products. It is therefore a crucial regulation for all treasurers. Through lack of interest or lack of information, many of them seem to think they are not affected.

There will be a sorry and painful awakening, especially for businesses with poor or no ratings (non-investment-grade). The worst of the paradoxes would be having to borrow (expensively) to hedge against financial risk. It was a little over ten years ago that treasurers adapted their hedging strategies with the introduction of IAS 39. Tomorrow, they risk once again having to reconsider the overall approach to hedging. The life of the treasurer is certainly not an easy one. We are still paying for the effects of a crisis and for systemic risks for which we bear no responsibility. At the same time, some banks are still posting dismal results and alarmingly huge losses. These banks seem to have a lot of difficulty in understanding and learning from their past mistakes. As unfortunately is often the case, everyone will end up paying for a small minority of reckless cowboys.

Notes

i CRD IV – 20 July 2011 – Project on how to implement Basel III. http://ec.europa.eu/internal market/bank/regcapital/index.eu.htm

ii ESMA: European Securities and Markets Authority – Discussion Paper “Consultation on Draft Technical Standards for the Regulation on OTC Derivatives, CCPs and Trade Repositories” issued on 16 Feb 2012 – ESMA/2012/95. See www.esma.europa.eu