- Robin Bergholm

- Head of Working Capital Management, Wholesale Banking, Nordea

by Robin Bergholm, Head of Working Capital Management, Wholesale Banking, Nordea

Planning for the long-term

As we wrote about earlier, working capital management is a hot topic, and many organisations are setting out to drive their performance in the right direction, swimming against the tide of challenging marketplaces.

We urged caution and a long-term strategic approach, noting that to be effective, working capital management initiatives need clear scope, leadership, and an explicit mission with documented targets. Without these things, organisations are likely to start with good intentions and a flurry of uncoordinated activity — which quickly fizzles out as people realise the true scope of the task ahead.

That advice still holds true. Working capital management is about many iterative improvements to dozens of processes and activities distributed across the organisation. While there will no doubt be opportunity for ‘quick wins’, long-term sustainable results will need long-term sustained efforts. Any CEO or CFO that is looking for easy answers to “fix” working capital management should have their expectations quickly recalibrated.

Virtual and physical treasury centralisation catalysing working capital management

The centralisation of finance processes is gathering momentum. It affects physical treasury units and shared services centres, as well as the virtual — through the consolidation of IT platforms and the introduction of global cash pools and web-enabled data sharing. This trend provides a real opportunity for working capital management to be executed properly.

Every organisation follows its own path

But, as we also said earlier in the year, every organisation is different — and by no means all treasurers are sitting in a strategic, centralised role at the helm of an already effective working capital machine. In many businesses, working capital performance and treasury optimisation have been neglected while other avenues to growth and increased profitability have been pursued. For treasurers in these organisations, the journey ahead looks very different.

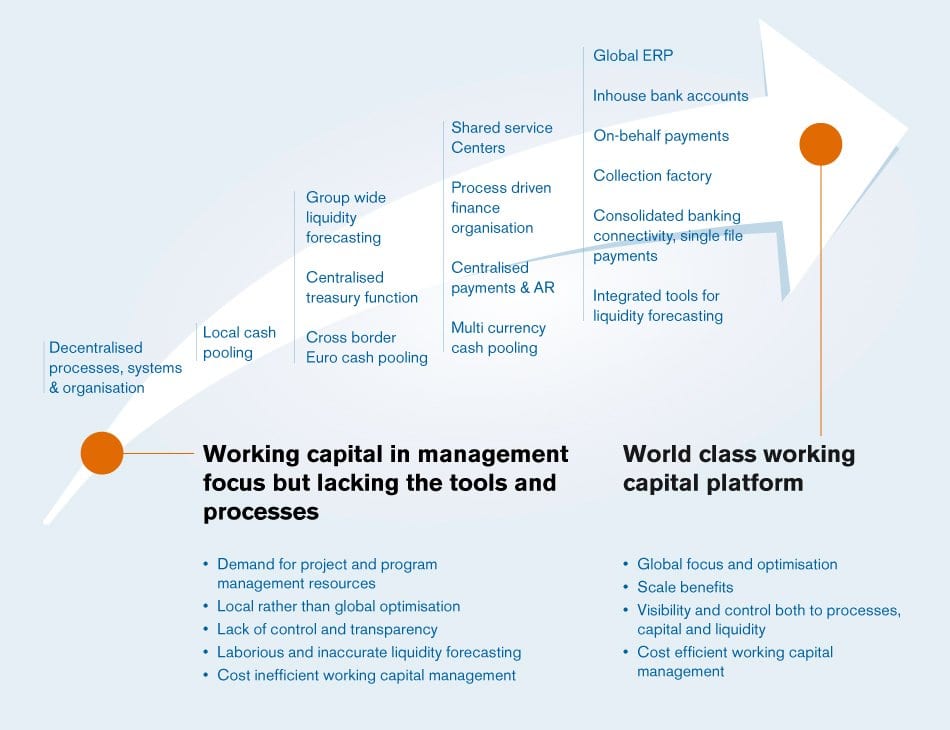

In the light of this, we’ve developed a maturity continuum that highlights some of the qualities and capabilities of world-class organisations. It’s important to note that this is not a checklist for your business: not all organisations follow the same path, in the same order, at the same rate, and they certainly don’t have the same endpoint in mind.

The path to visibility and control

The important thing to note is the general trend. In pursuit of working capital performance, organisations must be looking for greater visibility and control, and that means faster access to data, across organisational, country, bank and currency siloes. It means automation of processes. It means centralisation of decision-making. And it means system integration to put information where it’s needed in the business.[[[PAGE]]]

Exploring the changes

Most organisations will be starting with decentralised processes, systems and organisation, where management happens at a local level. Forecasting liquidity needs and performing even relatively basic financial processes is slow, manual and error-prone, and strategic management is inhibited by lack of control and visibility. This has a real impact on working capital efficiency.

As you look to mature, your strategies may become more ambitious. For instance, if you start looking at cash pooling at a local level, you might move to cash pooling across borders and currencies — giving you insights into the true cash status and available credit facilities across the group.

Centralisation of the treasury is by no means the only catalyst for working capital management improvements is nonetheless an important theme: it’s impossible to lead global improvements without it. Initially this will be management centralisation, giving treasury the visibility needed to make effective forecasts. But it also includes centralisation of more operational finance activities such as payments and collection through a shared services model and ultimately a full in-house bank model.

Technology plays an increasingly important part. Instead of manual processes, more mature treasury functions move toward automation, digitisation, and integration of finance systems with other business systems (such as ERP) and with bank systems, enabling rapid payments and a “single view of the truth”, as well as optimised process operating costs and reduced error and risk. Ultimately, with a truly end-to-end holistic view of business and financial operations, the group treasury has an accurate forecast of liquidity needs and instant control over working capital.