After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: May 01, 2013

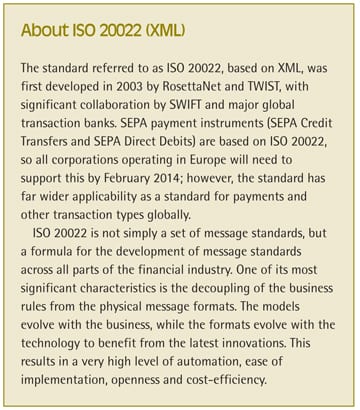

With the end date for domestic payment instruments in euro only a few months away, all companies should now have completed, or have made considerable progress towards migration to SEPA (Single Euro Payments Area). A vital element of the migration project is the use of XML ISO 20022 formats (XML) on which SEPA payment instruments are based. This article outlines some of the issues that treasurers and finance managers need to consider when implementing XML as part of a SEPA migration project, and the opportunity that XML presents to introduce considerable process efficiencies. These are further enhanced when used in combination with a robust and bank independent communication channel such as SWIFT.

Treasurers first need to ensure that their systems support XML, including both the channels with which they communicate with their banks, and that their internal systems, such as ERP, and treasury management systems (TMS) support XML formats. If using SWIFT, or modern electronic banking systems provided by the major banks, whether web-based or host-to-host, this will not be an issue. Systems provided by smaller, local banks, or older versions, may need to be upgraded or replaced. Before XML, proprietary banking systems transmitted and received files and messages in diverse formats, which in some cases has made it difficult to change banks, or the technology used to connect to them. In contrast, XML is a standard format, which better facilitates a harmonised approach to bank connectivity. For example, companies can add or change banks more easily, without the need to amend systems to send or accept files and messages in new formats. Alternatively, the SEPA migration project may also be an opportunity to implement SWIFT connectivity. SWIFT provides bank-neutral, robust, secure connectivity across multiple banking partners, thus further enhancing companies’ bank independence, and supports both XML and other formats.

A more significant technical challenge when introducing XML as part of the SEPA migration is to modify the internal systems that provide or receive information from the banks. These could include one or more ERPs, TMS, payment systems and reconciliation systems. While many vendors of these systems have modified them to support XML in good time for SEPA migration, their customers need to be using up-to-date versions in order to take advantage of this functionality. In the case of ERP, particularly where multiple systems are in use, and systems that are developed in-house, the upgrade process can be an extensive process with significant time, cost and resource implications. In these situations, it may be more realistic to make use of a third party conversion service to ensure SEPA-compliance before the February 2014 end date. These services convert outgoing legacy formats into XML, and incoming XML into formats that can be imported into in-house systems.[[[PAGE]]]

While the use of third party conversion services is likely to form a vital element of many companies’ SEPA migration projects, they should be considered a stop-gap for the purposes of compliance, as opposed to a long-term solution. By introducing another party and further processing steps for payment and reconciliation, additional risk, time and cost are inevitably involved, which treasurers and finance managers should seek to eliminate in due course.

Although ISO 20022 formats have widespread support throughout the financial community and bring a variety of benefits, there are some considerations and challenges that should be taken into account as part of the implementation process. Firstly, while the most significant advantage of ISO 20022 should be its uniformity, variations have materialised across banks. Consequently, treasurers and finance managers should insist that their banks and vendors support the Common Global Implementation (CGI) ISO 20022 standards as opposed to a proprietary version. This is essential in order to derive the full benefits of standardisation, not only within the Eurozone, but more widely as ISO 20022 becomes adopted as a global standard.

Another challenge, particularly bearing in mind that every company has competing priorities, is securing sufficient IT resources for the project. As SEPA migration is compulsory with a fixed deadline, and the impact of failed salary, supplier and debt payments could be catastrophic, treasury and the finance teams engaged in SEPA migration should be able to make a strong case for securing the necessary resourcing. Constraints on resourcing may also apply to the banks as a large number of customers seek to test the XML files they are producing. This is likely to impact on turnaround times for test files, which can affect project timelines. To avoid this issue, and to support our customers’ SEPA migration projects as efficiently as possible, we have introduced an automated XML tester. This enables our customers to obtain immediate, detailed feedback on any errors in their files, without the risk of project delay.

Successful implementation of ISO 20022 brings a variety of advantages in addition to SEPA compliance. The ability to use a single, standard format for payments information and other transaction types makes it easier to achieve a high degree of automation in processes such as bank account reconciliation. This is enhanced further through rich content, which is not truncated as messages are passed between financial participants, allowing the same information to flow from originator to beneficiary. ISO 20022 is relatively easy to create, and once systems have been modified to support it, the format can be used more widely than SEPA, across multiple regions and transaction types, and therefore represents a foundation for global standardisation. This is already a realistic prospect for customers of Deutsche Bank, which now supports ISO 20022 globally.

The ability to standardise formats and messages at a global level has significant implications for centralising and harmonising treasury and shared service centre (SSC) processes and information flows. As we will see later in this series of Deutsche Bank articles on the implementation and implications of SEPA migration, treasurers and finance managers leverage standardised formats to introduce or expand the use of techniques such as payments-on-behalf-of (POBO) or collections-on-behalf of (COBO). The challenge now for companies is how quickly they can migrate to SEPA, including ISO 20022, in order to ensure compliance by February 2014 and take advantage of these opportunities.