Carbonomics 101: Carbon neutral vs. net zero – why the difference matters when setting climate targets

Published: September 05, 2022

The terms ‘carbon neutral’ and ‘net zero’ are often used interchangeably in the language of sustainability and climate but their differences are not necessarily well understood. In this article, we explore the difference between the two and why it matters for companies looking to reduce emissions and join the battle against climate change.

Global temperatures have risen by 1.1ᵒC from pre-industrial levels, and with each incremental rise there are increasingly harmful impacts on the environment. According to the Intergovernmental Panel on Climate Change (IPCC), if the world is to avert the worst impacts of climate change – widely recognised to be beyond 1.5ᵒC of warming – we must reach net zero carbon by 2050 [1].

However, what would you think if I said the world must reach carbon neutrality by 2050 to avert the worst impacts of climate change? You would be forgiven for not thinking there is a difference. ‘Carbon neutral’ and ‘net zero’ are two terms that are often used interchangeably with each other but represent two fundamentally different approaches to tackling climate change. This article explores these two terms, why it is important to understand the differences (particularly in the context of setting climate targets), and how net zero commitments more clearly demonstrate alignment to global emission reduction ambitions.

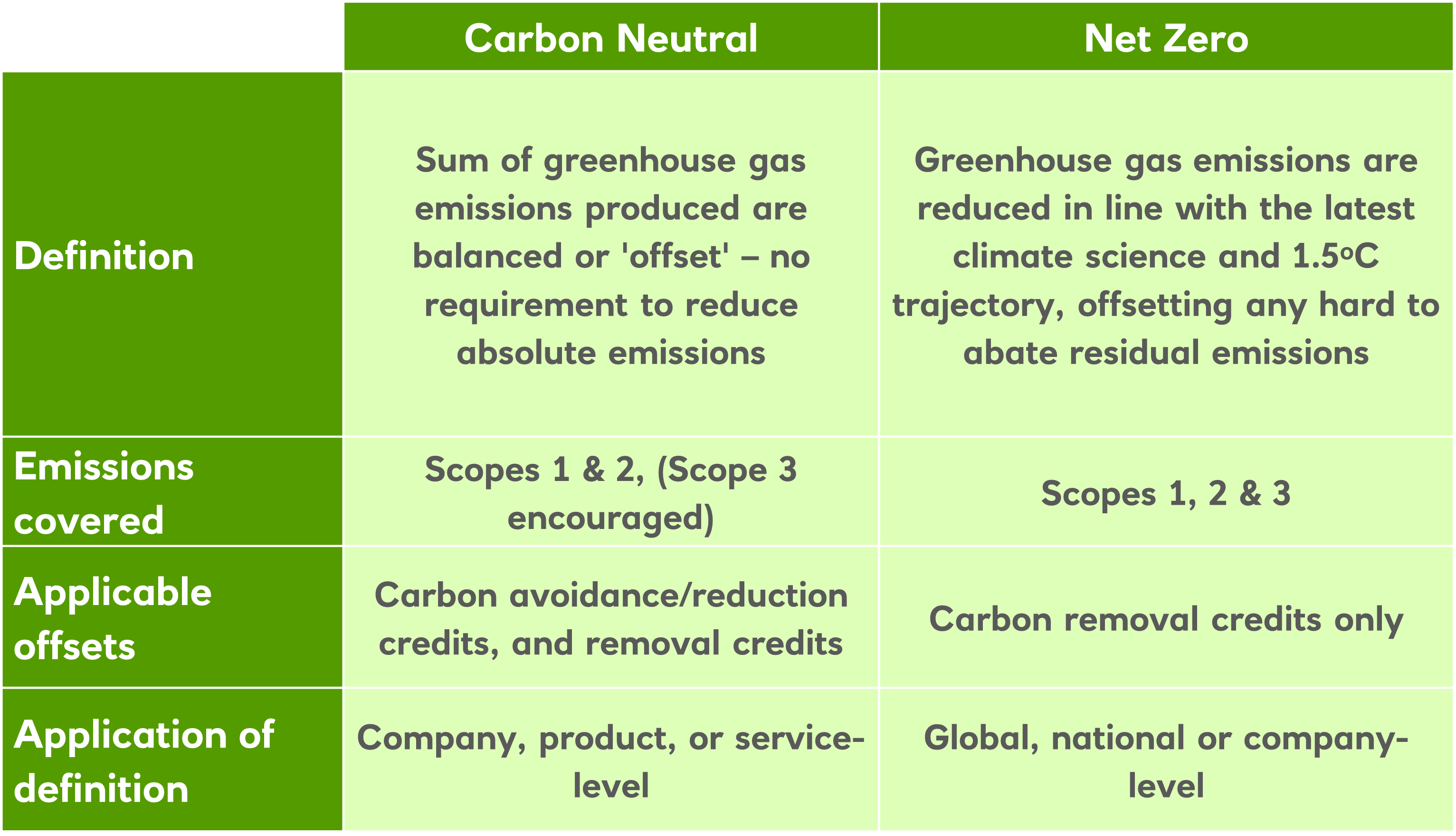

Understanding the difference between carbon neutrality and net zero

Carbon neutrality is defined by an internationally recognised standard, PAS 2060, and is where the sum of greenhouse gas (GHG) emissions produced are balanced or ‘offset’ by projects that either result in carbon reductions, efficiencies or sinks [2]. This can be achieved by buying carbon avoidance/reduction credits, which support the funding of projects that reduce the amount of CO2 released into the atmosphere, such as renewable energy generation.

A commitment to carbon neutrality does not require a reduction in overall GHG emissions. However, for a business to be carbon-neutral, it must offset the GHG emissions it produces, even if those emissions are increasing.

In contrast, a commitment to net zero requires an organisation to reduce its GHG emissions in line with the latest climate science and 1.5ᵒC trajectory, with the remaining residual emissions balanced through carbon removal credits [3].

Note that a net zero commitment requires that credits are removal credits, whereas a carbon-neutral commitment permits avoidance/reduction credits. Removal credits support the funding of projects that remove CO2 from the atmosphere – for instance, through CO2 removal technologies or afforestation.

An organisation may go beyond a net zero commitment to be classed as ‘carbon positive’ if it removes more GHG emissions from the atmosphere than it produces.

Click here for more on carbon credits and carbon markets.

Lastly, there are also differences in the applicable scopes of emissions. Carbon neutrality has a minimum requirement of covering Scope 1 and 2 emissions, with Scope 3 encouraged [4]. Net zero must cover Scopes 1, 2 and 3. The requirement to include Scope 3, which includes supply and value chain emissions, adds an additional layer of complexity with respect to measurement of emissions, which will be explored elsewhere in NatWest’s Carbonomics 101 series.

Summary of differences between carbon neutral and net zero

For investors and regulators, net zero is becoming the benchmark for climate action

With increased recognition of the need to act in the face of the climate crisis, governments and companies alike have taken to announcing ambitions to reduce their environmental impact. Some 70 countries, accounting for two-thirds of global carbon emissions, have now set net zero targets to be met by 2050 [5].

While business commitments are moving in the right direction, companies are at different stages in their decarbonisation journeys. This contributes to the variety of terminology used when stating environmental ambitions, with some choosing to pursue carbon neutrality first, followed by a longer-term net zero commitment. Sky, for example, achieved carbon neutrality as early as 2006 and has since committed to achieve net zero by 2030 [6].

Achieving net zero is more challenging than carbon neutrality given its holistic scope (Scope 1-3 emissions), level of ambition (emissions reduced in line with climate science), and approach to residual emissions (removal vs. avoidance/reduction). A commitment to carbon neutrality is a positive step; however, setting targets in line with climate science provides stakeholders with a clearer view of the environmental impact that the company is aiming to achieve. To support companies with setting science-based net zero targets, the Science Based Targets initiative (SBTi) recently released the Corporate Net Zero Standard, which sets out guidelines, criteria and recommendations for alignment.

New initiatives are supporting corporate net zero ambitions

In the UK, the direction of travel indicates a future focus on net zero commitments, with the UK Government recently announcing its commitment to become the world’s first ‘Net Zero-aligned Financial Centre’ [7]. As part of this, asset managers, regulated asset owners and listed companies will be required to publish transition plans that consider the UK Government’s net zero commitment. Although this doesn’t make organisation-level net zero commitments mandatory, there may be increasing stakeholder expectations for companies to do so.

Investor-led initiatives are beginning to establish benchmarks to evaluate the corporate ambition and action of the world’s largest GHG emitters. Climate Action 100+ defines key indicators of success for business alignment with net zero emissions at the 1.5ᵒC trajectory, while the United Nations Principles for Responsible Investment (PRI) has released the Investor Climate Action Plans (ICAP) Expectations Ladder, which tiers companies according to the stage of their decarbonisation journey. The benchmark includes four tiers, with those beginning to consider climate aligned strategies falling into Tier 4 and those setting decarbonisation targets in line with the Paris Agreement (1.5ᵒC trajectory) falling into Tier 1. There are several other initiatives, including the United Nation’s Race to Zero, supporting the accelerated adoption of net zero targets [8].

The time to act is now

According to a recent report by Moody’s, examining 4,400 of the largest companies globally, 42% were found to have some form of emissions targets, but only 17% reference net zero. This serves to highlight that, whilst commitments to reducing environmental impact are becoming more prevalent, current corporate targets fall far short of alignment to 1.5ᵒC, with only 3% of companies with targets aligned to this benchmark [9].

Whether it’s carbon neutrality or net zero, it’s imperative that commitments are as clear and transparent as possible so that stakeholders can understand the level of ambition and impact. The ultimate aim of emissions reduction commitments should be to support our collective ambition to limit global temperature increases to 1.5ᵒC of warming. Net zero targets play a key role in ensuring transitions are in line with this goal.

Follow NatWest’s Carbonomics 101 series to stay informed on the development of the carbon markets and learn about the role they could play in your sustainability strategy. Access forthcoming articles in this series the moment they’re published by following us on social media, and visit the bank’s Sustainability Hub for essential tools and insights to help you on your sustainability journey.

Useful resources:

[1] https://www.ipcc.ch/sr15/chapter/spm/