Carbonomics 101: Why Carbon Markets Play a Crucial Role in Corporate Sustainability Strategies

Published: April 25, 2022

Given the current focus on climate change it’s hard to believe that just three to four years ago there was still a large contingent that questioned global warming. Many cynics have pointed – and are still pointing – to the fact that our planet has experienced substantial climate changes over its 4.5-billion-year history, which have wrought all kinds of havoc on the population throughout those periods.

Is the current situation any different? The consequences of the climate change we are currently seeing, such as the wildfires across the globe and the severe flooding in Europe, are equally damaging as those centuries and billions of years ago. But the changes we’re witnessing today have resulted from a staggering rise in emissions and are largely self-inflicted. We can reverse that damage by fostering a net-zero economy – but to achieve that, we need a targeted strategy.

Every organisation needs a transition plan

According to the IPCC AR6 publication in 2021, we’ve already exceeded the dire predictions made in 2014 relating to the speed of climate change. Clearly, organisations need to develop a transition plan which lays out measures that can help to cut emissions and tackle climate change.

Net-zero strategies must:

In the longer-term, this means prioritising innovation and seeking out low-carbon technologies like:

Low-carbon technologies are coming to market faster than ever before, but innovation still takes time. Organisations must act today – not only reduce how much they emit but also to start removing the emissions that have accumulated over decades as a result of human behaviour.

Market enthusiasts say the answer to that is simple: put a price on carbon. Those that emit CO2 should pay a price. The higher that price, the argument goes, the less likely those ‘culprits’ are to continue emitting the same amount of CO2.

Source: NatWest

However, given the limited range of cost-effective alternative technologies available, simply driving up the price of carbon would not immediately reduce emissions. In fact, it would have some undesirable effects as many businesses won’t be able to afford the price and, facing a lack of alternatives, won’t be able to easily switch (or even stay in business). Nor would they be able to fully de-carbonise their operations.

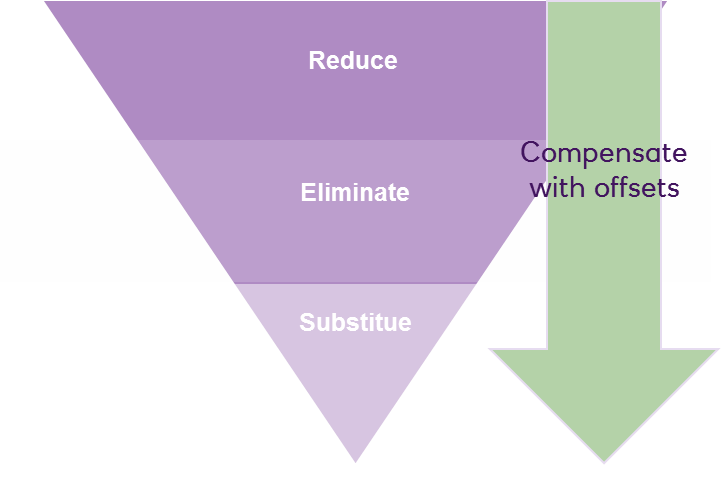

That’s why an emissions offset strategy is crucial for achieving net-zero, and should operate in tandem with elimination, reduction, and substitution. This is where carbon markets (both ‘Compliance Markets’ and ‘Voluntary Markets’) carbon credits play a meaningful role for companies.

What are compliance carbon markets?

The compliance carbon markets are applied to the power, heat generation, oil refineries and commercial aviation industries, representing the regulated ‘stick’ that puts a price on GHG emissions. It’s commonly known as the UK Emissions Trading Scheme (ETS), where companies buy emissions ‘allowances’ at auction.

The total number of allowances is currently set at the rather unambitious level of 155Mt of CO2, and due to be reduced by 2.2% every year from 2021. That cost is not insignificant and therefore is expected to help drive change in businesses and whole industries. However, the compliance carbon market doesn’t actually help remove CO2 from the atmosphere.

What are voluntary carbon markets?

This market helps to remove CO2 from the atmosphere. Projects (technology or nature-based) with the sole purpose of removing CO2 receive a Carbon Credit Certificate verified by an independent verification entity like Verra, Gold Standard, or the American Carbon Registry and Climate Action Reserve. This Carbon Credit Certificate can then be sold to organisations, corporations and individuals who have voluntarily implemented a climate strategy. The carbon credit holder can then apply the credit against their existing residual emissions.

What is a carbon credit?

A carbon credit represents the verified removal, or avoidance/reduction of one tonne of carbon dioxide from the atmosphere. A purchased carbon credit may be ‘retired’ to the owner to offset one tonne of carbon dioxide emissions. Carbon credits fall broadly into one of two categories: removal credits, and avoidance/reduction credits.

Removal credits are those that result from projects that directly remove carbon from the atmosphere. At present, removal credits are usually issued from nature-based projects like afforestation (establishing a forest, especially on land not previously forested) or rewilding, but more credits are expected to be issued from technology-based projects with technological advances.

Avoidance/reduction credits are those that result from projects that avoid carbon from being released into the atmosphere, compared to what would’ve been the case without the project.

Source: NatWest

Global Forest Watch estimates that primary forests (some of the densest, wildest and most ecologically significant forests on Earth) equalling an area of the size of Switzerland were lost in 2020. Global de-forestation is still too high: according to the United Nations, government subsidies, estimated at $200 billion annually, are often the key underlying drivers of forest loss worldwide, with policy makers rarely recognising their impact. But there’s some positive news: an increasing number of projects aim to prevent de-forestation, and those are also helping carbon removal to continue through mature trees (rather than having to wait five to ten years for trees to reach a sufficient size to capture bigger amounts of carbon).

Nature-based solutions alone won’t be enough to tackle emissions: tech solutions, such as DACCS (Direct Air Carbon Capture and Storage) and BECCS (Bioenergy With Carbon Capture and Storage) will be instrumental to successfully remove GHGs. While the technology is still in its infancy, and the price of tech- based carbon credits can be ten times the price of nature-based credits, continued investment in the area will spur progress. A good example of the benefits of steady investments helping technologies to mature are solar panels: over the years, their efficiency has continued to improve, and today solar panels have become a viable alternative to energy production, with further efficiency gains expected.

What is the current state of the voluntary carbon market and how is it expected to evolve?

To generate a carbon credit, businesses, organisations, or individuals need to launch a project that has carbon removal at its core. However, the voluntary carbon market expects more: ‘only’ removing CO2 isn’t enough (as organisations such as the Taskforce on Scaling Voluntary Carbon Markets [TSVCM] or the Science Based Targets initiative’s [SBTi] Foundations For Science-Based Net-Zero Target point out). These projects also ought to support local community development and livelihoods, as well as re-introduce biodiversity. The money generated from the sale of carbon credits must also largely benefit the local community. These projects often span 30 to 40 years and carry nature-based and political risks, but the benefits clearly outweigh those risks, and the higher the critical mass built in supporting these projects, the less risky they become.

Currently, the voluntary carbon market has a number of pain points: in particular, it needs to be more accessible, and price transparency has to improve, but there are already initiatives underway to resolve these challenges.

With demand rising and limited supply, we’re seeing a fast-increasing number of larger corporates investigating how they can start their own projects to ensure a long-term supply of carbon credits. By working directly with a project, or in fact initiating the project, companies have more control over the quality of the project and its outcomes.

Interestingly, the investment required to start (CAPEX) and maintain a project gives economists a floor price to the price of carbon. Using carbon credits generated from projects to offset residual emissions could act as a starting guide for valuing the social cost of carbon.

However, most businesses won’t be able to afford the investment, time or resources to start their own project, or maintain it over the usually long-time span of 30 to 40 years. These businesses will welcome projects that will generate excess credits, which they can buy. If the market price of those credits is much higher than the floor price, the provoking question of who gets that difference would naturally follow – one would hope the lion’s share goes to the local community.

What can we expect for the price of carbon credits?

Carbon prices are mainly driven by supply and demand in the carbon markets. As such, they only cover a small proportion of the societal costs of emissions. Hence, there is a significant divergence between the price of carbon across different markets and the price that experts say is necessary to reach the temperature goals set by the Paris Agreement. In their paper ‘The Social Cost of Carbon, Risk, Distribution, Market Failures: An Alternative Approach’ Nicholas Stern and Joseph E. Stiglitz argue that the social cost is close to $100 per tonne – this compares with high quality carbon credits currently priced around the $7-17 per tonne.

Clearly, a gap needs to be bridged. Charging $100 / tonne today would cause social and economic upheaval: given the limited range of cost-effective alternative technologies, simply driving up the price of carbon would not immediately reduce emissions. Many businesses wouldn’t be able to afford the price and, facing a lack of alternatives, wouldn’t be able to easily switch (or even stay in business). Nor would they be able to fully decarbonise their operations.

Corporate pioneers show the way forward

Multinationals are leading the way with carbon pricing schemes, acknowledging that an internal fee on carbon not only helps to meet emissions reduction targets, but also encourages low-carbon innovations and consequently improves future competitiveness. According to the CDP, nearly half of world’s biggest companies are now factoring the cost of carbon into business plans.

Some companies have reported that internal carbon prices have affected their budget allocations or the creation of a new business function. It also impacted investments, shifting capital towards energy efficiency measures and low-carbon initiatives, and has an influence on their product offerings. Companies that commit to an internal carbon price agree to align with the UN Global Compact’s Business Leadership Criteria on Carbon Pricing:

British Land, one of the largest property development and investment companies in the UK, announced in June this year that it plans to achieve a net-zero carbon portfolio by 2030. The firm, which already reduced its carbon intensity by 73% and embodied carbon in development by 16%, is creating a transition fund to finance its net-carbon journey. The company decided to source the capital for its fund internally by imposing an actual carbon price of £60 per tonne on every single one of its developments.

In 2012, Microsoft implemented an internal carbon fee, applied on scope 1 and scope 2 emissions from the company’s 12 business units, including its global data centres, as well as on a part of its scope 3 emissions (such as employee air travel).

For more information on what Scope 1 / 2 / 3 emissions are, please take a look at the definitions provided by the Carbon Trust.

The US firm calculated its carbon price by dividing the amount of investment needed to meet the company’s carbon neutral commitment by its annual projected greenhouse gas emissions. With the funds raised via its carbon fee, Microsoft has reduced emissions by 9.5 million tonnes of carbon dioxide, purchased more than 14 billion kilowatt-hours (kWh) of green power, and achieved more than $10m per year in energy cost savings [1].

Companies should prepare early – and here are four steps that can help

There is no doubt that the transition to a de-carbonised world will be challenging for many businesses, as increasingly stringent climate regulation and climate change itself start to hit the bottom line and position carbon as a key factor guiding corporate decision-making. Laying the foundations today for a well-rounded sustainability strategy that puts carbon markets at its core will pay dividends tomorrow. Here are four steps every business can take to get started:

Emissions offsetting is quickly cementing itself as an essential part of the corporate sustainability strategy toolkit – alongside emissions elimination, reduction, and substitution. Early preparation could mean the difference between success and failure as the transition to net-zero hots up. Follow our Carbonomics 101 series to stay informed on the development of the carbon markets and learn about the role they could play in your sustainability strategy.