After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: January 01, 2014

Wolseley has a centralised approach to treasury management with a global treasury centre based in the UK. Over the past few years, we have undertaken a journey of ongoing improvements to enhance both financial and operational efficiency. This article details some of the milestones in this journey, how we addressed challenges along the way, and the outcomes of these initiatives.

Until 2006, cash, treasury and risk were managed using a series of spreadsheets, with a large number of labour-intensive processes, such as confirmation transmission and matching, and manual transfer of data to ancillary systems such as the general ledger, consolidation system and electronic banking. In 2006, we made the decision to implement a treasury management system (TMS), which was followed in 2008 by automated confirmation matching. These provided a platform that would enable us to develop more sophisticated treasury strategies and support the evolving needs of the business more effectively.

One of the initiatives on which we embarked to do this was a global cash pooling programme which we implemented with Bank Mendes Gans (BMG) in 2010. We had a variety of objectives: in particular, by improving group liquidity, we could leverage cash surpluses across the group to reduce the need for external financing and therefore reduce bank charges. We would also improve cash visibility which would enable us to manage our cash and risk more strategically. Centralising cash at a group level brought a range of challenges, such as how best to collate data, which bank solution to use, how to communicate with banks and dealing with legal and tax issues such as transfer pricing in each jurisdiction.

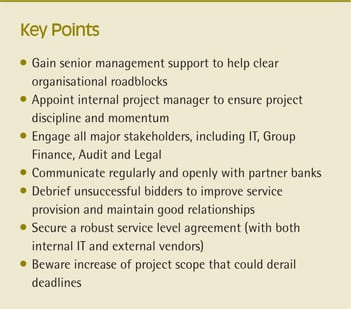

To support the project, we obtained senior management sponsorship, which was valuable in clearing organisational roadblocks. We appointed external consultants who already had experience of selecting global cash pooling solutions and engaged with our in-house legal counsel to ensure that we complied with local regulations, such as arm’s length rates. We worked closely with the banks to make sure that they fully understood our needs, and that we understood their proposition, and revalidated this regularly.

The solution involved two cash pools in Europe and North America respectively, each of which included multiple currencies. As a result, we improved our group liquidity position by €700m, which had a major impact on our financing needs and costs. We achieved better visibility and control over our global cash, therefore enabling treasury to manage our cash flow more effectively.

There were a number of factors that contributed to the success of the project. Obtaining senior management sponsorship was vital in ensuring that we had access to the right resources when necessary, and helped to ensure common objectives at a group level. Involving legal and tax early in the process meant that we could identify and address challenges such as local regulatory requirements early on and ensure that the cash pooling solution was appropriate to our organisational structure. As cash pooling represents a major change from a cash and treasury management perspective, it was important to spend time with subsidiaries to explain how cash pooling would work in practice, and the group-wide benefits of cash pooling. Finally, we had approached a number of our relationship banks as potential providers of our cash pooling solution, so it was important to debrief them fully on the reasons why we had not opted to work with them on this project.[[[PAGE]]]

In 2011, we experienced significant organisational change at Wolseley, with new senior management and a major restructuring. One of the outcomes of this was a renewed focus on treasury technology, including dedicated treasury technology resourcing, with a view to creating better automation, cash visibility and efficiency. To achieve these objectives, we devised a four-phase approach:

i) review operational efficiency and improve sub-optimal processes;

ii) implement additional functionality where required to improve efficiency, control and automation;

iii) upgrade the TMS to take advantage of new and enhanced functionality

iv) develop processes to improve group-wide visibility of cash and investments.

One area of improvement we identified was to move away from telephone dealing to online dealing with a view to automating manual processes, improving straight-through processing, and enhancing control over dealing. We would also be able to increase the number of banks to whom we offered deals, compared with telephone dealing, and improve the transparency of deal pricing. Our ultimate aim was to have a single system that could be used for internal deals with subsidiaries as well as external deals with our banks, although the initial project scope was external FX deals.

Based on our functional criteria, we selected 360T as our online dealing system. We also needed to implement a trade importer capability which would be integrated with 360T, for which we chose iTEX. In addition, not all our banks supported online dealing so we ultimately decided only to deal with banks that we could access online. The project has been very successful, and we now have fully automated both internal and external dealing. We have visibility over the bank bids received, enabling us to monitor pricing and bank performance, as well as the distribution of business awarded. By integrating 360T with our TMS, we are also able to capture deal details without manual intervention and risk of error.

Following a change in our group policy to centralise FX dealing, we rolled out the use of 360T and iTEX for internal dealing in June 2012. This solution helped the subsidiaries comply with group policy and still have the ability to trade on live prices, albeit with Treasury instead of an external bank. The system also allowed for internal limits to be imposed and our processes were automated, ensuring a high level of service to our subsidiaries, including automatic emails on deal execution. We started with one subsidiary, and based on the success of this, we could then roll out the solution to our remaining subsidiaries. Having executed our internal deals, we then consolidate our position before dealing externally, allowing us to reduce the number of external deals we transact.

In the past, we produced journal entries for the general ledger system manually, which was labour-intensive and presented the risk of error. In June 2011, we therefore decided to automate the interface between our TMS and general ledger to streamline this process and provide better information to our accounting department, whilst reducing the administrative burden in treasury.

In 2012, we updated our TMS as the version we were using was outdated, and we wanted to take advantage of new technical and functional developments. This was a challenging project due to the number of stakeholders involved and the need to update our hardware and operating environment as well as the TMS itself. We also recognised that the TMS upgrade was an opportunity to review and clean up the data we held in the system, and purge the system of reports we no longer used.

We took a disciplined approach to the project, with a dedicated project manager and regular steering committee conference calls to ensure the project was on track. We also timed key project milestones to avoid going live over busy reporting periods, and used checklists and detailed project documentation to ensure that all tasks had been completed and checked, including a parallel run between the old and new versions before going live.

A number of lessons learned that worked really well for us on this project and will definitely be used in future projects were (i) providing detailed documentation on the upgrade e.g. project plan, parallel run schematic for each system, and a parallel run tick list, (ii) involving our IT department from the outset e.g., initial meeting with the TMS vendor, (iii) using the option to install the upgrade remotely i.e., saving time and costs, and (iv) having a vendor resource on site during the go-live period.

As a result of upgrading the TMS, we now have a more robust IT infrastructure and enhanced functionality. Our efficiency levels have increased with better integration with ancillary systems, reducing administration and improving controls. We also have a service level agreement now in place with our internal IT department to provide a robust framework for support and system improvements.

Since completing the TMS upgrade, we have also expanded our treasury technology environment further, which in turn has enhanced our ability to meet Wolseley’s cash and treasury management needs. For example, we have expanded the scope of our online dealing platform to include internal dealing, as described above. We are also now importing interest rates and FX rates automatically from Reuters into both the TMS and ERP to enable regular revaluation of deals.

An important undertaking during this project phase was to improve the way that we collated bank account information, in order to achieve better visibility and control of cash. We decided to import MT940 messages (end of day bank statements) from our banks globally via Bank Mendes Gans into our TMS. This proved a relatively straightforward process, although not all our banks supported MT940: in these cases, we automated the manual submission procedure. However, the project has been very successful in providing a consistent view of cash information globally.

In July 2013, we implemented a money market funds (MMFs) portal. This has allowed us to expand our investment portfolio to MMFs that are highly secure (AAA-rated), diversified instruments. We selected MyTreasury based on its look and feel and the functionality it offered. We are now able to deliver high-quality of reporting as well as achieving straight-through processing for MMFs.[[[PAGE]]]

We have now achieved an efficient treasury technology framework (figure 1) which has in turn allowed us to optimise our cash management infrastructure and decision-making. Few manual processes now exist, and most systems are now integrated within the overall framework. The project has been ambitious in its scope, not least as it had to be completed on top of normal day-to-day treasury activities; however, the outcomes have been substantial. Group liquidity has been improved by more than €0.7bn and we have made interest cost savings of €0.7m each year as a result of improved cash visibility. Internally, we have automated processes and connectivity more fully, reducing the administrative burden, improving services that treasury provides to the rest of the group, and enhancing security and control.

In the coming months, we intend to finalise this integration process with our remaining systems. Another objective is to improve the system support we offer to subsidiaries, to enhance subsidiaries’ experience of working with treasury, and optimising processes such as internal dealing, forecasting and reporting. Cash flow forecasting is a particular priority, building on the improvements we have already made to cash visibility, to enable us to make more strategic cash management decisions.

Royston is giving a 1 day training session on Cloud Based Treasury Solutions and TMS selection & implementation from the perspective of the working corporate treasurer in Brussels on July 19th.

For more information or to book your place, contact Jamie Lawes at [email protected] or click the image below: