by François Masquelier, Head of Corporate Finance and Treasury, RTL Group, and Honorary Chairman, EACT

In this article we describe the concerns of corporate treasurers with regard to bank account management and try to determine the wish list of processes for its future enhancement. The new eBAM messaging can be one of the solutions, coupled with ad-hoc IT tools to store information and initiate messages to banks. It is also a way to improve even further treasury internal controls. Eventually, a better view of their accounts enables treasurers to better manage bank relationships.

Bank data issue

Treasurers want to better manage and securely store all bank data and official documents (e.g. corporate signatories, proxies and mandates, account opening forms, ISDA schedules, KYC questionnaires, etc…). When treasurers need to show proof or evidence of agreements with original documents, for (internal/external) audit reasons for example, it can be difficult to find them. They have often been signed and exchanged years ago and nobody can find a trace of them. Large corporations work with sometimes more than 20 banks, with paper stashed across the company. They have activities across the world. Who can claim that he is able at any moment to identify the comprehensive list of all his group bank accounts? How can we know which bank accounts are open or closed? The information related to these accounts is spread across the group affiliates, rarely centrally stored and sometimes no one knows precisely who has access to which accounts. The information can be kept somewhere in a filing cabinet or a storage box. When an audit is due, can you immediately and easily identify what your signatories are? Does it take time to communicate changes through the necessary channels when an account signatory leaves the company or changes department? The communication with your banks in terms of power of signatures is generally done on paper and by post. Therefore it takes time to get originals ready and you never know if they will be well received by addressees at the bank. Annual (external) audit confirmations are for all treasurers a classical January nightmare.

Dream solutions

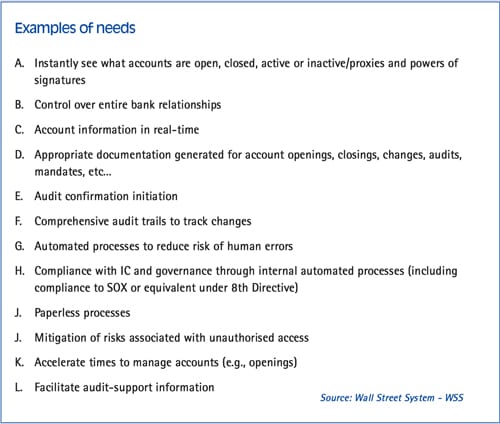

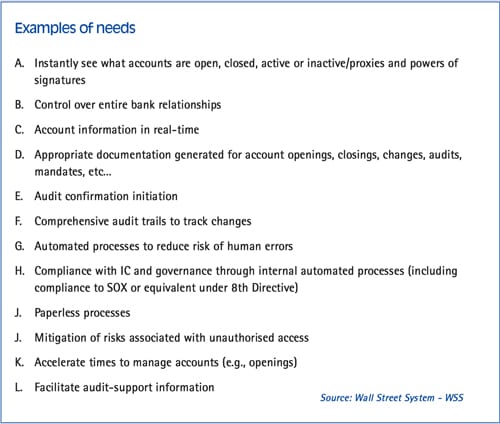

Ideally, treasurers would like to automate workflows, streamline authorisation processes and reduce audit time. They dream of (1) a centralised account management centre, a single centralised and secured repository for all information concerning corporate bank accounts that would enable the treasurer to see, edit and report properly on account access and provides instant document generation. They also dream of (2) a bank management centre providing real-time score cards, including 360 degree view of all the banks with which they work. It should include information on fees, services, ratings, credit profiles and more. In their dreams, treasurers would also like to have an authority management centre, a single central auditable record of who is authorised to initiate, approve and sign any type of financial transaction. What a nice wish list! Is it wishful thinking or technology of the near future which we can foresee and start considering?

There are solutions on the market (a few) which enable treasurers to administer their global banking accounts and the maintenance of them, including: internal signatories, authorisation thresholds and account support documentation.[[[PAGE]]]

Regulators want financial transparency

Managers are coming under increasing pressure to streamline processes, consolidate cash and provide faster, more accurate information. Fortunately, the technology provides more solutions for tracking down idle cash. Now treasurers want to have a comprehensive view over all their bank accounts. Without access to this information, it is impossible to maximise cash centralisation or to maintain good bank relationship management.

Therefore more and more corporates have invested in technologies to generate real-time payment data, reduce administrative and banking costs and improve the quality of management information.

After a payment factory, what are the next steps?

Now, they want to move a step further after having implemented a state-of-the art treasury management system (TMS) and rolled out their payment factory across the world. For internal control reasons, treasurers also want to reduce enterprises’ operational risks. With the never-ending financial crisis corporates need to improve the quality of counterparty exposure information. For all those objectives, treasurers need a bank administration solution (BAS) covering:

(1) Maintenance of a central registry for bank accounts information;

(2) A controlled workflow for opening, maintaining and closing bank accounts; and

(3) Eventually the implementation of streamlined and secured eBAM processes for exchanging messages with bank counterparties.

How near are those targets to being achieved? Some very large corporations can probably claim to be there (e.g., GE, Microsoft, Shell or HP). The others are far behind, still thinking about what will be their next steps and targets. The idea is also to move away from (remaining) paper processes and to move towards full electronic messaging. Today, more than ‘eBAM’, we should say ‘ BAM ‘ (messaging). The electronic part of this type of message format remains conceptual in reality.

SWIFT has developed the new eBAM format (ISO 20022 XML messages transported via FileAct) in order to dematerialise, automate (via STP processing) and standardise the processes around bank account management. They have now created around 15 different types of eBAM messages. In future, SWIFT expects that banks and corporations will be able to get rid of fax machines and paper transmission via post. The idea is also to use electronic digital signatures instead of the current (paper) signature cards.

Main objectives of SWIFT with eBAM:

- Reduced total elapse time;

- Increased corporate customer satisfaction;

- Reduced cost;

- Improved STP and traceability.

Technology is there, but banks are not ready

Even if technology is ready (or quasi ready) banks are usually not ready at all. They are mired in other financial issues and have completely different priorities. eBAM could therefore be considered as a system to further improve cash management. We are still only at the early stages of eBAM. Investing in IT solutions not really tested and proved, with banks not ready to generate or to treat messages and in a shaky economic environment, is not a priority (solutions do exist, e.g., AvantGard Integrity Treasury Solution; Speranza with WSS or Equity).

The problem with e-solutions is that sometimes they go too fast and certainly faster than legal provisions. It may well be that a treasurer has to rely on paper legally binding documents and that he is not yet allowed to base some of the official documents and evidences on soft copies or on electronic messaging. The ‘electronification’ should not let the score run ahead of the music.

We should and could not cut corners on breach rules. It will be a full change of bank management approach, or even a revolution. Some treasurers still struggle to justify a business case that tries to convince management to move to digital documenting and messaging with banks (eBAM). Nevertheless, we believe it is time after having implemented a payment factory to define the road map for the coming years. This new eBAM format can give you a fantastic opportunity to enhance your internal controls in treasury and to revisit or revamp your internal processes, procedures and bank relationship strategy.

Pioneer treasurers are like prophets who try to deliver messages to a world not yet prepared and ready to move. However, if we do not start with IT solutions (for example VISUALSIGN from Equity or others), even if current messaging remains physical, we will have no chance to shape the eBAM to our needs.