After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: November 01, 2013

There is no doubt that the African opportunity is significant – and today, no other continent offers such a unique mix of opportunity and challenge as Africa. With its population, huge land area and untapped natural resources, Africa’s potential is substantial, which has considerable implications for businesses and investors.

Africa is considered by many to be a land of opportunity and a continent which has found its growth momentum. Africa has emerged as an investment destination for a number of reasons, including its abundant natural resources, improving economic indicators and evidence of maturing political stability. Growth in the population, alongside a rise in consumption, has been a significant driver in the continent’s growth story.

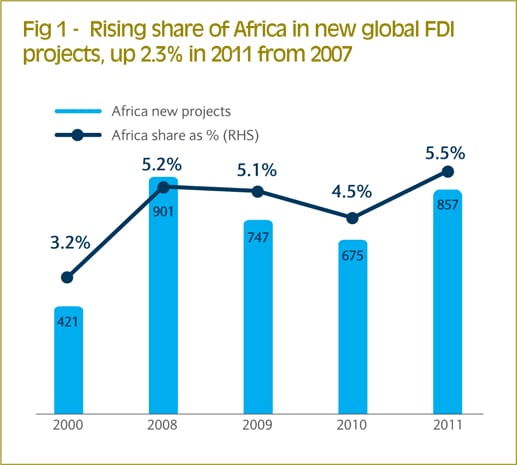

The improving FDI (Foreign Direct Investment) flows seen in the region are another strong indicator of increasing global confidence in the region. The conducive environment for business, as reflected in the World Bank’s ‘ease of doing business’ rankings, is a further driver of the improving flows. In the index, 14 African countries were ranked ahead of Russia, 16 ahead of Brazil and 17 ahead of India, and this result has consequently attracted FDI flows into Africa from both developed and developing nations, with China being a key contributor.

In recent years, China has emerged as a key investment partner for the African continent, investing heavily in both infrastructure projects, as well as in the health and education systems. This has enabled countries, including Angola, Ghana, Kenya, South Africa and Zambia, to develop their resources, thus fuelling regional growth.[[[PAGE]]]

A more detailed analysis of the Chinese investment projects by sector shows a total of 191 government and civil society projects (2000-2011), representing the largest investment in volume terms. In monetary terms, the transport and storage sectors projects dominated Chinese spending, with $16.7bn of investments (2000-2011). For the same period, energy generation and the supply sectors were the second most invested in sectors, with a $14.7bn allocation.

China is expected to build a new university hospital in the Tunisian industrial city of Sfax in 2013. The 300 bed hospital will be financed by a Chinese donation of $30m and is the largest cooperation project undertaken in Tunisia.

A comparison of annual financing flows from China with those from the US and the OECD (Organisation for Economic Cooperation and Development) demonstrates that in the early 2000s China was already providing as much financing as the US. At the peak of its investments in 2006, China was providing almost two times the total US investment and about one third from the entire OECD combined.

Over the period 2000-2011, China committed $75bn to Africa, amounting to almost a fifth of the total OECD-DAC (Development Assistance Committee) flows ($404bn) and close to the level of US commitment.

The investments in Africa represent not only a cash injection in the region but also a significant benefit to the economy by improving socio-economic factors, including the rising GDP, greater employment, declining poverty and better quality of life. Increasing FDI flows from partners such as the US, China and European countries, along with growth through self-development, will brighten the African growth story in the future.

Increasingly, Africa’s growth story is coming to the fore, with significant implications for businesses and investors. Business opportunities are available across 50 diverse markets, and most with their own regulatory, political and tax regimes. This can pose a challenge, but change is happening. The task remains to successfully navigate these issues in order to maximise trade.