After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: September 01, 2012

In a world where markets are constantly changing, a well-structured investment policy can help treasurers achieve their corporate investment goals. But just as the investment landscape can swiftly change so too can corporate cash objectives. That is why it is important for organisations to establish an investment policy that clearly states their objectives and permissible investments, while also promoting long-term discipline in establishing investment goals.

In this article, we go step by step through an approach that treasurers can use to help make their surplus cash more effective, including an overview of the various investment options available for cash.

Effective liquidity management can increase cash efficiency by extracting the maximum value from cash resources and optimising working capital performance. The liquidity management process starts with a well-stated investment policy, which provides the guidelines that treasurers can follow to maximise their cash returns.

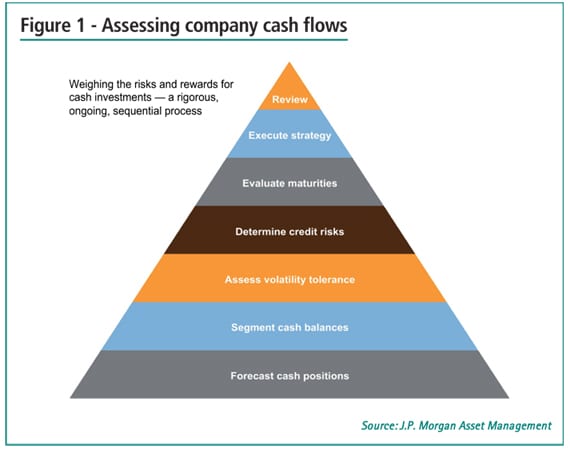

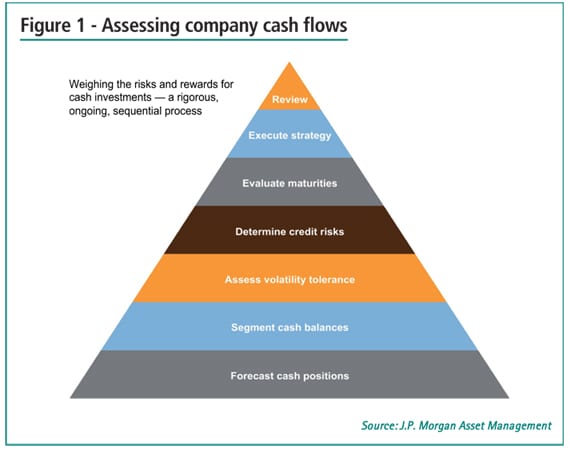

As shown in Figure 1, the process starts by determining if companies have a robust and accurate cash flow forecasting process in place. The precise details of a forecast will depend on how much visibility a business has on its cash flows, for example, when and where surplus cash is in the organisation, how much of it is available and for how long.

It is important to get this forecasting process right. If an organisation underestimates the level of surplus cash, it could miss out on potential investment returns. However, if the level of surplus cash is overestimated, treasurers may run into liquidity problems and be forced to pull money from investments on short notice, which could result in penalties or capital losses.[[[PAGE]]]

If an organisation determines it has sufficient cash to invest, the next step is to segment that cash appropriately. Analysing an organisation’s cash flow may reveal that surplus cash is available for investment, but for different time periods. For example, a company may choose to always hold some cash on its balance sheet, or may need the cash every six months, for example to pay tax bills or dividends. Categorising each of these different pools of cash can help organisations identify the priorities in terms of access, security and yield for cash across the business. Figure 2 provides an example of how a company might segment its cash into operating, reserve, restricted and strategic uses.

While these segments are only examples, the idea is that formally allocating cash in this way can help an organisation determine what might be an appropriate investment strategy for different segments, thereby helping to optimise investment opportunities.

Across each different cash segment, it is important for treasurers to assess their tolerance to loss, taking into account that strategies that aim to increase yield can potentially lead to greater fluctuations in the value of capital.

Figure 3 assesses the likelihood that a portfolio would experience a loss given interest rate volatility, the starting duration of a portfolio and how much time investors would typically have if they needed to redeem their cash. We can see from this data that the frequency of loss is zero over all time periods for starting portfolios with one-month durations. However, in situations where an organisation needs to pull money from a portfolio within a month, but that portfolio had an average two-year average duration, there is nearly a 20% risk of experiencing a loss in value. For longer-term investors, the likelihood of a loss decreases over time, reflecting the importance of having a sufficient time horizon to ride out short-term volatility.

Once a tolerable level of volatility has been identified for each cash segment, organisations can assess how to enhance yield. Adding credit risk is one option. In that case, an organisation would have to determine if it has the resources to conduct in-house credit analysis or whether it would need to rely on a third-party investment manager. Alternatively, companies can invest further out on the yield curve. In a normal interest-rate environment, longer-maturity investments will pay higher yields to reward investors for committing their money for longer. While extending acceptable maturities will widen the universe of possible instruments available to an investment strategy, it may also reduce liquidity or increase portfolio volatility.

If increasing yield is viewed as a rational objective, treasurers would then have to decide how to implement and support the strategy. If an organisation decides it would like to revise its strategy to achieve a higher yield on its cash, then the change must be reflected in its formal investment policy and approved by senior management.

Once revised, the policy will need to be regularly reviewed to ensure it remains aligned with the objectives and risk requirements of the treasury department and broader business. It may also need to be reviewed on an ad-hoc basis if extraordinary events occur. For a detailed analysis on drawing up an investment policy, please request our white paper, Instituting an Investment Policy from your J.P. Morgan Global Liquidity relationship manager.[[[PAGE]]]

As well as the typical bank solutions such as interest bearing accounts and time deposits, the following options are available:

1) Money market mutual funds and liquidity funds

Money market mutual funds are open-ended pooled investment vehicles that invest across many of the short-term and high-quality securities discussed earlier, with the aim of providing a secure and liquid home for investors’ cash. Most money market funds are managed to maintain a stable net asset value (NAV) at a constant price per share such as EUR 1.00 or USD 1.00 – only the yield moves up and down. In order to be called a money market fund certain criteria must be met as set out by Undertakings for Collective Investment in Transferable Securities (UCITS) and European Securities and Markets Authority (ESMA).

2) Bond funds

There are various short-term bond fund options, primarily available for stable cash balances, which can provide a range of higher yields depending on the client’s appetite for risk. Some funds invest in very short-duration securities and, as a result, may have less volatility than most short-term bond funds, but still offer higher current income than money market funds. If, however, interest rates rise sharply, the funds could lose money. The advantage is that if investors are comfortable with some volatility in NAV, they get the benefit of higher yields.

3) Separately managed accounts

Separately managed accounts (SMAs) represent another option for treasurers who want more customised solutions or to spend more time on other core treasury functions. SMAs are customised portfolios of securities that meet specific investment needs with greater precision and flexibility.[[[PAGE]]]

Figure 4 illustrates sample portfolios that meet different objectives. The first portfolio, for example, has a mix of money market funds, commercial paper and CDs, agencies and time deposits, and offers a tailored solution for an investor whose primary objective is liquidity and for whom principal preservation is a top priority. The third portfolio, allocated across CMBS, MBS and credit, among other investments, is more suitable for an investor whose primary objective is returns, and who has a time horizon of at least 18 months and is comfortable with volatility. The second portfolio, which includes a greater allocation to corporate, may suit investors looking for a balance between liquidity and return.

Not only can SMAs deliver customised investment solutions, but they can also leverage a firm’s global resources, in-depth research and risk management. From an investor perspective, one of the main advantages of SMAs is that they can offer investors direct ownership of securities in the portfolio, which permits greater customisation and control of tax liabilities. The firm may also be able to offer monthly FASB-compliant reporting, online web access to portfolio data, dedicated client portfolio and account managers and access to economists, sector specialists and credit analysts.

During the credit crisis, the priorities for many treasurers were to preserve capital and ensure significant liquidity to meet business needs. Today, many companies are flush with cash and do not have the same liquidity requirements. As a result, they are looking to improve the return on their surplus cash. In order to choose from the various cash options available, companies should have a process to evaluate investments that meet their particular requirements for security, liquidity and yield.

Given the uncertain economic outlook, adding more interest rate or credit risk may be unsuitable for some investors, while timing the market over short periods can also be difficult and the wrong decision could cost yield or expose the balance sheet to greater counterparty risks. Treasurers may therefore look to outsource their cash management or supplement their reliance on ratings agencies to investment managers with strong credit and risk management capabilities.

Investment managers should be questioned on their ability and mechanisms to gauge and monitor interest-rate expectations and risks across a full interest rate cycle. Treasurers with longer investment horizons may often work with an external manager to structure an investment portfolio appropriate for their risk tolerance and liquidity needs.

IMPORTANT NOTICE TO UK AND CONTINENTAL EUROPEAN INVESTORS

FOR PROFESSIONAL INVESTORS ONLY – NOT FOR RETAIL USE OR DISTRIBUTION. “PROFESSIONAL INVESTORS” CORRESPONDS TO PROFESSIONAL CLIENTS AS DEFINED WITHIN THE EUROPEAN UNION DIRECTIVE 2004/39/EC ON MARKETS IN FINANCIAL INSTRUMENTS (MiFID).

Any forecasts, figures, opinions or investment techniques and strategies set out, unless otherwise stated, are J.P. Morgan Asset Management’s own at the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. They may be subject to change without reference or notification to you. The views contained herein are not to be taken as an advice or recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yield may not be a reliable guide to future performance. You should also note that if you contact J.P. Morgan Asset Management by telephone those lines could be recorded and may be monitored for security and training purposes. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co and its affiliates worldwide.

Issued in the UK and Continental Europe by JPMorgan Asset Management (Europe) Société à responsabilité limitée, European Bank & Business Centre, 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, R.C.S. Luxembourg B27900, corporate capital EUR 10.000.000.