- Daniel Farrell

- Head of International Fixed Income, Northern Trust Asset Management

Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

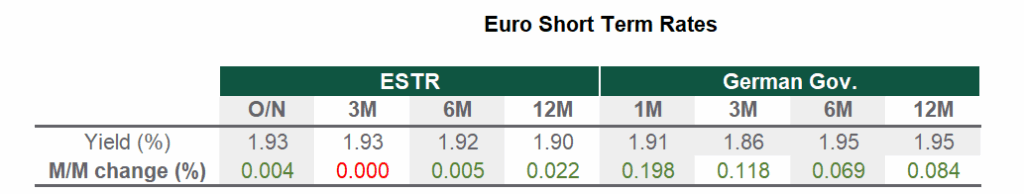

Eurozone Market Update

Eurozone data pointed to steady momentum in November. Composite PMI showed growth at 52.8, consistent with annualised GDP growth near 1.5%. The country mix was more evenly spread than in previous months, as Germany softened, France improved, and Spain remained a standout on jobs, accounting for most of the bloc’s Q3 employment gains. Consumer confidence held at -14.2, still subdued, but spending data appear more resilient. Inflation continues to moderate, as headline HICP inflation eased to 2.1%, led by lower energy and food prices, while core held at 2.4% amid persistent services pressures. The commentary from the ECB’s October meeting revealed a split: one camp saw rates as sufficiently restrictive, while others were open to cuts if the data warranted them. Board member Isabel Schnabel noted inflation is “in a good place,” but warned of upside risks from services and global fragmentation.

Source: Bloomberg, data as of 28 November 2025

UK Market Update

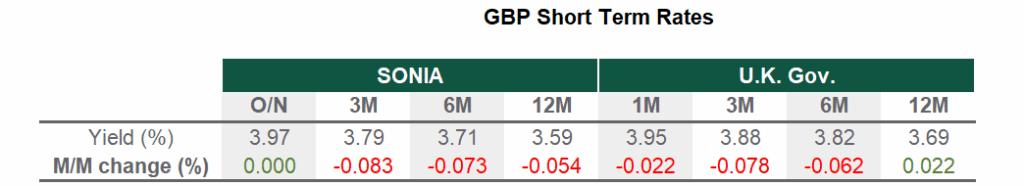

At its November meeting, the BoE held the Bank Rate at 4% following a finely balanced 5-4 vote, with Governor Andrew Bailey breaking the tie. Disinflation is progressing, with October CPI slowing to 3.6%, but services prices and wage dynamics remain too elevated for the majority to support easing. Four dissenters warned that policy is becoming too restrictive amid a softening labour market and fading growth momentum. Bailey acknowledged the recent downside surprises in inflation, but noted that “more than one or two prints” are required to validate cutting rates. Markets now see the December meeting as live, with approximately 50 bps of cuts priced by mid-2026. Elsewhere, Chancellor Rachel Reeves’ Autumn Budget brought limited surprises. The OBR’s £26bn headroom eased near-term gilt supply concerns, driving a brief rally. But the back-loaded tax measures and modest spending shifts were seen as incremental rather than game-changing. Markets welcomed fiscal stability but remain unconvinced on long-term sustainability.

Source: Bloomberg, data as of 28 November 2025

US Market Update

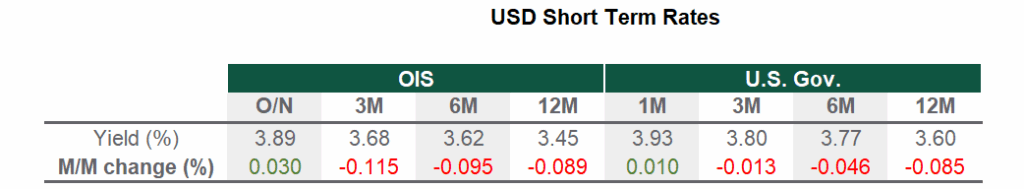

Although the US government shutdown ended in November, the record 43-day closure continued to limit data availability, forcing markets to rely on private indicators and amplifying the impact of each release. The delayed September payrolls report showed 119,000 jobs added against expectations of 51,000, but prior months were revised down by 33,000. Unemployment rose to 4.4%, the highest since 2021. Consumer data underwhelmed as retail sales rose just 0.2%, the Conference Board index fell to 88.7, and University of Michigan sentiment hit its lowest since 2022, with one-year inflation expectations up to 4.7%. Inflation data were mixed, with PPI steady at 0.3% but survey-based expectations firm. Fed commentary revealed division among members, while the October FOMC minutes signalled increasing scepticism about the need for a December cut, but did not go as far as a firm rejection.

Source: Bloomberg, data as of 28 November 2025

Looking Ahead

As we move through December, markets are contending with tighter year-end funding conditions and elevated repo rates. Balance-sheet constraints are already lifting USD and GBP repo levels, which are expected to stay high into year-end, pushing up money market yields. The final central bank meetings of the year are pivotal. The Fed faces stable disinflation and softer labour data; with markets pricing a December cut and no pushback ahead of the blackout period, a move this month looks likely. If not, January becomes the default. The ECB should maintain its cautious easing path amid weak growth and contained inflation. The BoE is expected to cut rates, supported by softer growth and employment data and a disinflation trend broadly in line with its own forecasts, which will guide policy lower into early 2026.

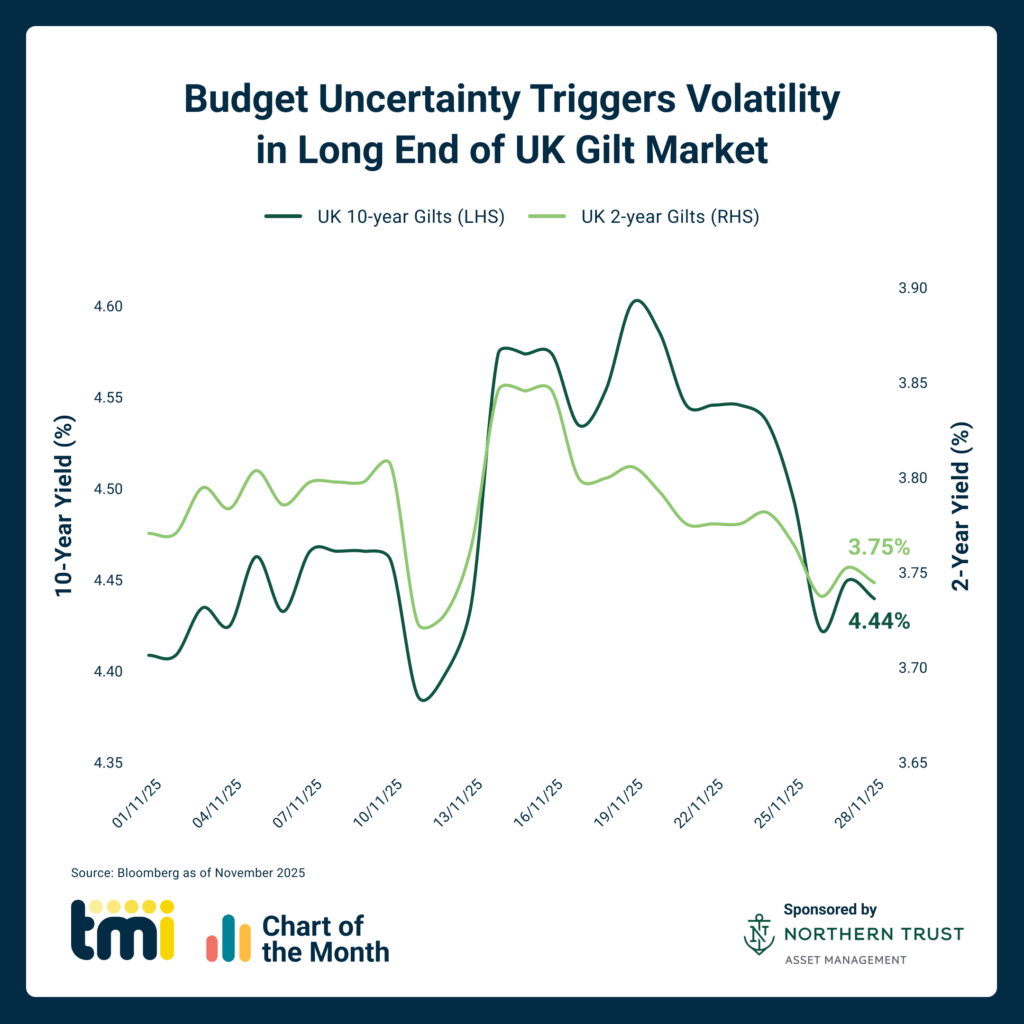

Chart of the Month

IMPORTANT INFORMATION

Northern Trust Asset Management (NTAM) is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Issued in the United Kingdom by Northern Trust Global Investments Limited regulated by the Financial Conduct Authority (Licence Number 191916), issued in the European Economic Area (“EEA”) by Northern Trust Fund Managers (Ireland) Limited regulated by the Central Bank of Ireland (Licence Number C21810) , issued in Australia by Northern Trust Asset Management (Australia) Limited (ACN 648 476 019) which holds an Australian Financial Services Licence (License Number: 529895) and is regulated by the Australian Securities and Investments Commission (ASIC), and issued in Hong Kong by The Northern Trust Company of Hong Kong Limited which is regulated by the Hong Kong Securities and Futures Commission.

This information is directed to institutional, professional and wholesale current or prospective clients or investors only and should not be relied upon by retail clients or investors. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTAM may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

© 2025 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.