- Eleanor Hill

- Editorial Consultant, Treasury Management International (TMI)

- Jouni Kirjola

- Head of Solutions, Nomentia

Debunking the Myths

For many treasurers, creating an in-house bank is an intimidating prospect. But with robust planning, a clear phased approach, and some suitable technology from an experienced partner, it can be easier than you may think, says Jouni Kirjola, Head of Solutions, Nomentia.

Corporates that have set up an in-house bank (IHB) often discover greater process flexibility and simplification, as well as improved cost efficiencies, and centralised control over their cash flows. There’s a lot to recommend taking this path, yet creating and maintaining an IHB is for many a daunting prospect, which, frankly, the typically under-resourced treasury department cannot begin to think about.

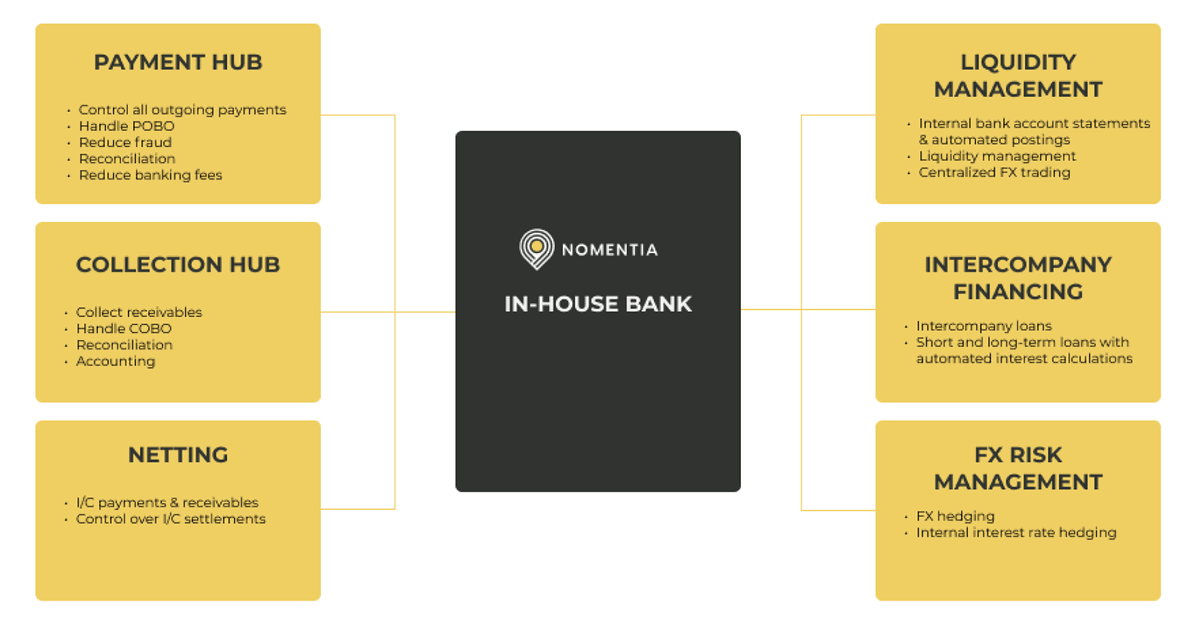

However, the notion of an IHB is open to a number of different interpretations, some of which may prove eminently achievable even for the most hard-pressed treasury team. So, while it could extend to a sophisticated global payments and COBO model, it may also simply be a means to enable treasury to get more visibility into the company’s liquidity position and manage internal FX deals. Fig. 1 outlines some of the possible elements to an IHB.

FIG 1 - Interpretations of an IHB

Benefits on offer

The fact that different approaches to an IHB are possible opens up the variability of reasons why a company may choose to operate one, notes Kirjola. A business handling a high volume of internal invoices, for example, may use an IHB to manage a transaction volume that otherwise would necessitate processing by external banks. As well as the cost consideration, in instances where its banks are not directly present in certain markets, using an IHB in this way can bring direct control and visibility over those transactions.

Companies using their IHB to manage operational FX flows may, for example, do so because its euro account for entities in the Eurozone can be augmented by a group account covering multiple other currencies. This enables greater control over the application of FX rates to those flows.

Similarly, the IHB may be used to internally define and calculate interest rates applied to balances in the IHB accounts of different entities. Kirjola explains that by removing external banks from the equation, it can help mitigate interest rate risk and control aspects such as margin and overdraft limits for those entities.

There are technological benefits too. While an IHB could be operated manually, many companies opt to deploy a high degree of automation. This often brings benefits beyond treasury, says Kirjola. Traditionally when settling internal invoices, a netting approach is deployed. This will often require a significant amount of manual inputting, especially around AR/AP and reconciliations and booking processes. “By automating the entire settlement process, all the way through to reconciliation and posting to account, an IHB is able to optimise not just treasury processes but also those of the wider finance and accounting teams’ work, across the enterprise.”

Dispelling misperceptions

With many clear benefits, the reputation of IHBs for being somewhat challenging to set up is all the more unfortunate. The negative view may stem from early efforts being frustrated by the complexity of some ERP structures and the considerable cost of IHB deployment and maintenance within that environment. Kirjola is keen to dispel this legacy viewpoint, noting that modern solutions make it entirely possible to implement an IHB “with a fraction of the workload”.

A cloud-based IHB solution such as that offered by Nomentia, is typically initiated by a fixed statement of work through which each client is prepared for both its own role, and that of its system provider. The work that follows depends on the individual state of preparation, but Kirjola says a company that is already operating a cash-pooling structure is well on its way to building an IHB. Even with this structure in place, it will require further effort on the part of the project team to liaise with key stakeholders such as internal and external auditors, legal counsel, and the tax department, and the scope and timing of these conversations will be largely driven by the complexity and needs of the business.

The communication element continues once the project is underway. Indeed, one of the keys to success is effective change management, says Kirjola. He has noted that internal customers will often be treated differently to external customers, with internal invoicing and settlement processes sometimes being less rigorously pursued, especially where close working relationships are established.

Adopting a centralised and neutral IHB will enforce change that not all will appreciate at first. “The idea of the IHB needs to be explained and introduced to all stakeholders with care,” he suggests. “It needs to be understood by all that treating internal customers the same as external customers is fair. An entity providing services to another in the same organisation should be paid on time because unpredictable payments and collections diminishes forecasting confidence, which in turn has negative working capital consequences for the group.”

Decide and define

Having considered the benefits of an IHB, scoping the project can get underway. It may be enough just to use it for intercompany settlements, or perhaps an on-behalf-of structure could be added later. The planning process will incorporate the needs of underlying business processes, being steered by findings from initial discussions on change management and the results of consultation with the wider finance function, which may include any shared services arrangements, and feedback from internal and external auditors, tax, and legal departments. It’s important to consult with the internal IT department to ensure buy-in from the outset.

If a POBO structure is sought at an early point, it would be advisable to check the related capability of banking partners, says Kirjola. This discussion should explore market practice and at least cover the data banks require to offer this service. If a full POBO/COBO model is sought, he cautions that COBO tends to be more challenging to roll out across complex and geographically dispersed organisations, not least because widely inconsistent customer payment behaviours are more difficult to manage.

However, Nomentia offers a “bank and market agnostic tool” that, Kirjola says, “is capable of matching any transaction hitting the bank statement with its related open invoice”. Following a successful match, he explains that the cash can be allocated, the correct credit from the collection being placed with the correct entity within the IHB collection account.

The cash-collection issue may also be addressed through a combination of a bank virtual account structure, with its multiple accounts feeding the simpler IHB account set-up. The majority of large transaction banks now offer virtual accounts and may even refer to them as an IHB – but it is important to recognise the limitations of virtual accounts. Yes, they are a good first step for a smaller treasury group to centralise its cash management, but virtual accounts are inextricably linked to banks – and entirely maintained by banks. This limits the ‘independence’ of an IHB. And with multiple banking partners in the mix, this can add complexity. So, while virtual accounts can be very useful in an IHB set-up and add to its efficiency, it is worth being aware of the considerations.

Another area where challenges may occur is the regulatory impact of an IHB project. Those taking the IHB pathway will need to be grounded in or seek expert advice on related legal, tax, and regulatory matters. This, says Kirjola, may be a point at which specialist advisory services are sought, at a regional or jurisdictional level.

Challenges on these fronts have been encountered, but as a rule of thumb, Kirjola says where cash pooling is permissible, so too are in-house banking structures with POBO. That said, he adds that in Brazil and China, for example, even for intercompany settlements, transactions are limited to bi-lateral settlement. This is still beneficial but not to the extent that an unfettered IHB would deliver.

Platform for success

Technology naturally has a starring role in the most efficient IHB set-ups. Companies can adopt a simple standalone book-keeping-based approach, with entity accounts and invoice settlement. But, notes Kirjola, an IHB comes alive when a solution from a provider such as Nomentia is deployed to embed the concept into everyday processes.

Within the Nomentia platform, when a payment needs to be made, whether this is to an internal or external counterparty (so an intercompany settlement or a POBO), the process is the same. “It’s very easy to see what is happening,” comments Kirjola. “Our technology gives a natural feel to the whole IHB process.”

Automation is a key feature of the Nomentia platform, and it can be applied to as many IHB processes as is required. However, it may be that treasury requires some manual payments to be retained. If this is the case, the platform UI/UX has been designed to make even those outlier payments easy to execute, says Kirjola.

“Treasury is increasingly being run by people who are either not used to clumsy old-fashioned interfaces, or have no wish to hang on to those old and inefficient methods. We’ve opted for a simple and clean interface across the board, where every user can shape their experience to what they need, using simple parameterisation tools.”

The modules selected and how the platform appears to users will be driven by the goals of the business. This has inevitably created a complementary list of ‘must-haves’ and ‘nice-to-haves’, notes Kirjola. “An IHB is in part about managing cash and liquidity, so cash visibility delivered at a global or entity-level perspective is a key component for many companies. Then as a nice-to-have, as treasurers are considering their bigger organisational picture, we are seeing more calls for the accounting part of the IHB. As part of this, for instance, we offer the capability within the Nomentia platform to send out MT940s [account statements] and ready-made bookkeeping data.”

Engaging the business

Planning the roll-out of an IHB means engaging all entities in the early phases of the discussion process, says Kirjola. “It might not ultimately be that important for them, depending on what is within the scope of the project, but their involvement will enable them to adjust their systems, processes, and perspectives accordingly and in good time.”

In terms of implementation and roll-out phases, when moving towards a POBO/COBO set-up, for example, bank co-operation will be necessary. This necessitates a revisit of current bank agreements, notes Kirjola. Indeed, with some POBO services not permissible even in parts of Europe, it may be necessary to agree and create separate local entity accounts for transactions such as tax or salary payments. He also warns that establishing the right agreements and subsequent connectivity with some banks “can take months”. It’s another reason why these discussions should be started as early as possible.

For those implementing the Nomentia platform as part of their project, Kirjola says that the practical work will often be preceded by an open discussion with the client on best practice within the IHB space. Workshops will also be organised to help plan and guide requirements and approach tactics. Once past this stage, piloting the project for a phased roll-out, with parameterisation, using the standard Nomentia SaaS package can see the system in production in an average of around 10 weeks.

With the completion of the pilot and the platform’s wider roll-out, its optimal performance has to be reached and maintained. This in part is a product of necessary ongoing commitment from the in-house entities, says Kirjola. “Unless adoption is widely enforced, it is not unheard of for some entities to continue using legacy processes instead of the IHB tool.” Encouragement and reassurance may be required across the entities until the value is seen by all.

One concern for some new users of the IHB platform is that all internal transactions are being booked correctly and are able to hit the IHB account. This is particularly important for treasury, says Kirjola. “To ensure accuracy and instil confidence, we monitor transactional activities and will provide reports for the main users to show that balances match and that the system is performing as it should.”

Performance monitoring can extend to POBO set-ups where a third-party bank is involved. That bank should normally expect to receive and process correctly formatted payment data from its client’s AP system. Within the IHB platform, Nomentia can automatically generate alerts for the corporate if it detects data errors, enabling rapid exception handling and smoother external payments flows.

Small steps, big results

For those who can see the advantages of an IHB but believe the set-up is too demanding to warrant the effort, it’s clear that a new perspective is possible. Small steps get results and for Kirjola, treasurers who are already using a netting tool but suspect an IHB may be beneficial can begin with a simple review of the status quo. He advises working with the wider finance team to evaluate those existing processes and structures, and then making an honest assessment of whether they are still fit for purpose.

Where an IHB is identified as a likely progression, Kirjola stresses the importance of understanding that it is not an all-or-nothing solution. Indeed, while the range of approaches and options for an IHB can be expansive, a discussion with the team on the aim and scope of the project will give the initiative shape and realism. And with a technology partner such as Nomentia on hand to guide the process through to completion, what once may have seemed intimidating is now an attainable goal.