by François Masquelier, Head of Corporate Finance and Treasury, RTL Group, and Honorary Chairman of the European Association of Corporate Treasurers

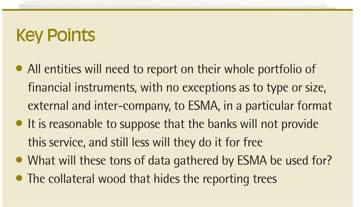

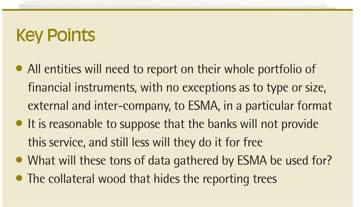

Surely the problem of the ‘collateralisation’ requirement (via CCP) under EMIR is the wood for which we cannot see the trees of the reports and confirmations that we have to issue? Everything leads us to think that, since everyone’s mind is so focused on the cash collateral to be provided, they forget that, as of September, they need to be ready to report all their financial instruments. Some people are going to be very surprised and caught off balance, you can be sure of that. Technology and automation will be needed to cope with it. Hurry up and ensure that you are in a position to comply!

The wood that hides the trees

Because of being so focused on posting cash collateral (which frightened more than one treasurer and for which exemption has been obtained), people have forgotten about preparing themselves for the reports to be issued from September for certain instruments (e.g., credit and interest rate instruments). Obviously, we still have to make sure that the final CRD IV retains the exemption obtained under EMIR, failing which that initial fear will come back to haunt the minds of treasurers. This risk should not be ruled out given certain reactions from American banks that are hostile to some measures proposed by the EU. We will stop being Doubting Thomases when we see the final published document. We remain confident, but cautious, because nothing is yet final.

However, even if we are exempted from posting collateral to provide security for valuation differences (i.e., ‘mark-to-market’ differences), we still have the obligation, with no exemptions, to report all these instruments to ESMA with no minimum limit to the authority set up for that purpose. This will most likely be done via a trade repository (TR), a sort of data collection and formatting intermediary. Furthermore, there is an obligation to mitigate risk through providing electronic confirmations within very short deadlines of mark-to-market revaluations and portfolio reconciliations. That’s all, just that![[[PAGE]]]

Reporting to ESMA

All entities (i.e., NFC or FC, NFC+ or NFC-) must report all their financial instruments, without any exception for whether they are external and inter-company and without any exception for their size or maturity, in a set 60-character format. So don’t expect to be exempted, because you won’t be. From 1 January 2014, all contracts will have to be reported, without distinction. This is the phased-in approach proposed by the EU. Is this a gift? Not really, because it amounts to the same thing as preparing yourself for everything that is going to be required. Since there is no possibility of going back, you have to make appropriate preparations right now. Some people still naïvely think that their banks (what, all of them?) will do these reports on their behalf for free. Perhaps some of them will offer this service. But this is by no means certain. It is reasonable to think that, since none of them is ready or willing to do it, they will not provide this service. Even if they do provide it, it will clearly come with a heavy price tag.

Click above image to enlarge

Click above image to enlarge

What are you going to do about contracts with the banks that refuse to do it? Are you going to give your whole portfolio to one single bank? Furthermore, what are you going to do about reporting your inter-company transactions? It is therefore clear that you must not, and cannot, rely on your friendly banker. He has plenty of other fish to fry, believe me. And don’t place too much reliance on your information systems providers (for example TMS and ERP), because they are well behind the curve and bogged down in other developments for which they need to prepare. They do not have the resources and often have difficulty in delivering, because the forthcoming regulatory and accounting changes (i.e., IFRS) are huge and have burdensome technical consequences. So you will have to fall back on your own resources.

Date backloading

Another problem that arises is transmitting historical information on financial instruments open at 16 August 2012. Yes, it seems a strange date, but that is the date chosen for starting the data history. Any contract open on that date must be reported, even if it has matured or been closed out in the meanwhile. That is essential to be sure you can extract the historical data from your TMS (treasury management system) or any other IT system in the required format with all the required fields. If the company cannot or does not store all financial contracts in one single system, for example because they cannot be input into a TMS because of their complexity or because they are not pre-formatted, you need to consolidate the information into one single software application in the one single required format. We can foresee that widespread use will be made of Excel exports, with a huge risk of error and many manual manipulations, which will be the source of conflicts, problems and error. It is for this transaction history record that it is absolutely essential to start such a compliance project very soon. You need to ensure that the data is complete, both the external data (with banks and third parties) and internal data (with affiliates).

Trade repositories (TR)

This brings up the question of (other) possible intermediaries with whom you might subcontract. You have to turn to a trade repository or information collection intermediary which will, on your behalf, handle the reporting within strict deadlines (D+1) in the required format (59 field and 5 sub-headings) to ESMA, the supervisory authority specially set up for that purpose. Some of you perhaps don’t even know the name of a TR. It seems that a dozen organisations have applied to ESMA for accreditation. But we may expect that at least REGIS-TR (Clearstream - Iberclear) and DTCC will be accredited. Assistance of this type will clearly have a cost, proportional to the number of transactions reported. However, this assistance will not be free of charge even though it creates no value whatsoever for treasurers or their companies. If you cannot automate the data extraction and formatting process for transfer to the TR, you will have to spend a lot of time on it regularly. This will have an additional cost. Some people have had the idea of using their MT 300 (or MT 600) messages which now contain all or most of the fields required for ‘populating’ and compiling the reports that need to be issued. Others will be making changes to their treasury software (most probably with development costs) to extract the data. Nevertheless, all data needs to be consolidated and complete in one single software application. Automation will bring security, greater internal control, lower TR costs and assurance of compliance. When all is said and done, it is the company that is responsible for supplying the report to ESMA and for the completeness and the relevance of the data delivered. If this turns out to be wrong or incomplete, it is the company that will be held liable.

Various identifier numbers have to be used. For instance, it will be necessary to have a Unique Transaction Identifier (UTI). This number will contain 52 alphanumeric characters. Each subsidiary entity dealing in this type of financial instrument with the parent company or directly with a bank must be pre-identified with a Legal Entity Identifier - LEI). Furthermore, each transaction must also have its own identification number (Unique Product Identifier - UPI). These different numbering systems add an extra layer of complexity to the exercise. Finally, we should add that Dodd-Frank reporting in the USA is not identical. So double reporting may possibly be required. Not all the guidance for obtaining and determining these numbers has yet been completely finalised.

It can readily be appreciated that these reports will not be easy to produce, and that they will need a lot of advance work on automating the systems and ensuring they interface fully. In my view this is one of the most difficult challenges, technically, to which solutions must be found within the next few months. Finally, we observe that you are required to keep this information for five years.

Obviously, reporting directly to ESMA would be yet another solution to be considered. However, it would certainly be very complicated, at least at the outset, without having any background or experience in how these reports work in practice. These reporting obligations point us back to article 9 of the EMIR regulations which require D+1 reporting of instruments regardless of whether they have, or have not, been cleared by a CCP.

Risk mitigation, confirmation, reconciliation, dispute and bilateral collateral

For any OTC derivative not cleared through a CCP (Clearing House), EMIR stipulates and imposes additional risk mitigation measures. All FCs (Financial Counterparties) and NFCs (Non-Financial Counterparties) must have procedures, agreements and other arrangements for measuring, monitoring and mitigating counterparty risk and operational risk. This includes confirmations to be issued within strict deadlines in electronic format, together with reconciliation, risk management and the resolution of any disputes. Yet again, this is expected to be phased in in a number of stages. A bit more time will be allowed for derivatives falling under set thresholds for clearing. Depending on the products and depending on the planned phasing in, we are talking about deadlines of between two and seven working days. That is still quite short. Quarterly reconciliation (if > 100 contracts) or annual reconciliation (if < 100 contracts). The frequency increases for the OTCs outside these clearing thresholds. Furthermore, for these derivatives a daily mark-to-market revaluation has to be provided. It is a matter of being prepared, and taking the time to ensure you are prepared. Irrespective of which TMS you have, it will still take time to revalue a portfolio. Exceeding these thresholds by product type will result in the whole portfolio being “tainted”, irrespective of the product, in the future.

SWIFT, through Swift Alliance Lite or ACCORD, provides solutions, for example with FIN MT type messages for transaction confirmations. For the reconciliations, SWIFT proposes using FILE ACT. SWIFT is also linked up to several TRs and will streamline communication between counterparties.[[[PAGE]]]

The problem of auditing the processes

We would be justified in asking whether or not an audit is required for the processes put in place to provide reports to ESMA. As part of an external audit (or even an internal audit), it would neither seem inconsistent nor come as a surprise if the audit firm considered the process implemented as a basis for providing assurance on the compliance and the ability of the systems and staff to produce the required information. Practice will soon tell us what audit firms will require. However, those carrying out reporting on behalf of their subsidiaries (either for inter-company’ transactions or for external transactions with local banks) must be able to assure their ‘internal customers’ that the report has indeed been produced and sent to ESMA. It would come as no surprise to find subsidiaries demanding assurance of compliance by means of an SLA (Service Level Agreement). At the outset at least, it would not seem absurd to have this process audited by an audit firm, particularly if this service was carried out centrally and rebilled to the subsidiaries. Even though it is still too early to say what will be required, it is advisable to forestall subsequent requirements by providing evidence of proper performance and implementation of the report issue process, and to save the data on transactions over the last five years. We should remember that audit firms send out confirmation of balances and bank transactions outstanding at the end of each accounting year. This would also make it possible to reconcile the report to ESMA with the published and filed accounting position. Under all circumstances, this is an internal control that needs to be put in place over a financial compliance process.

The million euro question

Plenty of you are asking “what will all this information gathered by ESMA be used for”? It is by no means certain that they will be able to use it, or that it will be effective in reducing systemic risk in the future. Unfortunately, nobody can halt this process, and it cannot be changed in any way whatsoever. We need to put up with it and accept it, with no disputes. It is no longer the time for negotiating or trying to avoid an inevitable measure. It is the time to hurry up and comply.

At this stage it is clear that many questions and points are still open or need to be defined more narrowly. Of the 59 fields to be filled in, several of them are problematic irrespective of the TMS used. Automation has become inevitable, I fear. If you are not yet using SWIFT, it is time to think about it or to use other confirmation control software, perhaps MISYS CMS or others, so that the deals you carry out can be confirmed electronically. The ESMA guidance will be published soon. It is therefore advisable to stay alert and to watch developments meticulously and carefully.

Typically it is about a report, which people may think inappropriate, with no added value for non-financial companies, but with a huge cost that is disproportionate to the size of the issues it addresses. The smallest companies will not have the time or resources to comply. They may choose not to hedge at all to avoid these impossible burdens. In which case will the desired effect be achieved? Companies will be at greater risk than before EMIR. Is that really what the EU wants? It will have the opposite effect and will certainly be counter-productive. Surely they are trying to do too much?

Have no doubt about it, this is neither the end of the story, nor assurance of a better financial world, regardless of what European or US politicians may think. It’s just another report, isn’t it? We need to keep our spirits up and get down to work.