- Daniel Farrell

- Head of International Fixed Income, Northern Trust Asset Management

Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

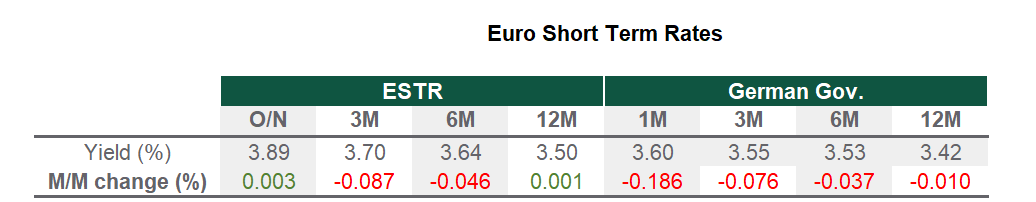

Eurozone Market Update

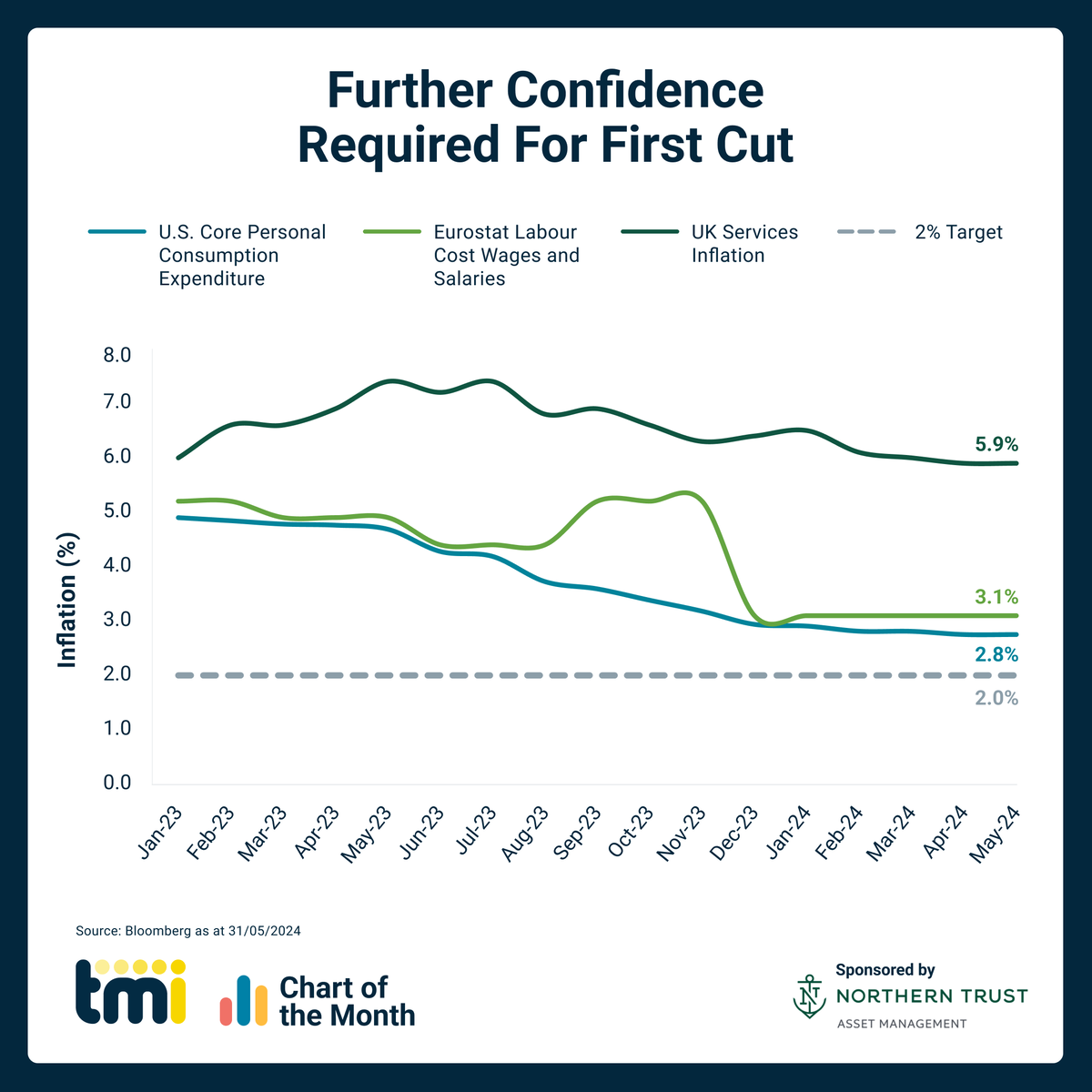

In May, the flash figures show that eurozone headline inflation rose to 2.6%, from 2.4% in April (see Chart of the Month). Core inflation stood at 2.9% versus expectations of 2.7%. Services inflation was up to 4.1% from April’s 3.7%. However, despite the inflation bump, the market expectation at the beginning of the month was for the European Central Bank (ECB) to make its first rate cut at its 6 June meeting, which proved correct as a 25 bps cut came to pass. The region’s composite Purchasing Managers’ Index (PMI) continued to trend up in May, hitting 52.3. This beat the previous month’s score (51.7) and consensus (52.0). The increase was led by manufacturing PMI, which increased to 47.4 from 45.7, while services PMI remained at 53.3.

Source: Bloomberg, data as of 31 May 2024

UK Market Update

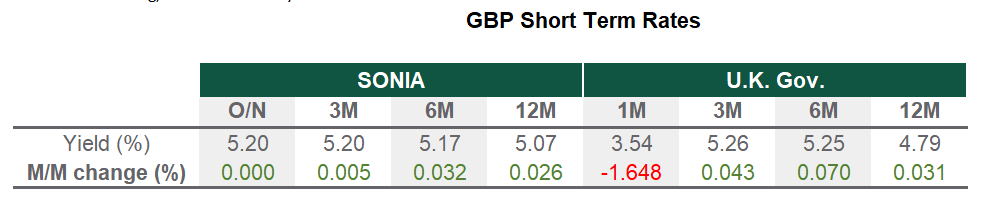

The Bank of England’s Monetary Policy Committee (MPC) kept the base rate unchanged at 5.25% in May. The voting split was 7-2, with two members favouring a cut. Rate cuts are only likely in the second half of 2024 as the MPC seeks more evident signs from domestic-led inflation. The UK labour report was mixed, with unemployment up to 4.3% in March. Still, wage costs reaccelerated, as private sector average weekly earnings came in a little hotter than anticipated. Markets saw this as a positive sign for lower rates. UK headline inflation fell to 2.3% in April, but core inflation surprised to the upside at 3.9%, versus 3.6% expected. Services inflation is still running strong at 5.9% compared to the previous print of 6.0%. The inflation print led markets to push back the timing of a rate cut to November 2024. Elsewhere, Prime Minister Rishi Sunak announced the UK general election for 4 July 2024, but the consensus is that the election result will not cause any significant changes in the market.

Source: Bloomberg, data as of 31 May 2024

US Market Update

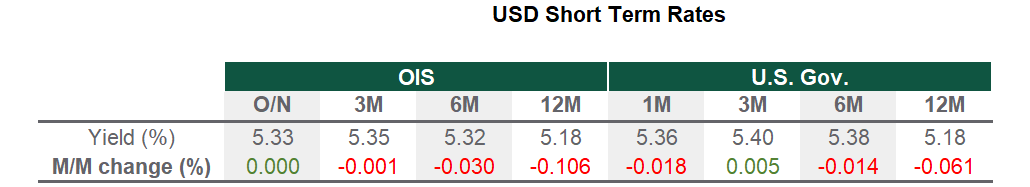

The Federal Open Market Committee (FOMC) decided to unanimously leave the federal funds target range unchanged in May, which was unsurprising given the recent readings on inflation and public commentary by Fed officials before the meeting. The main message from the FOMC press briefing was that the path of economic data this year, especially the inflation data, had not given the Committee “greater confidence that inflation is moving sustainably toward 2%” and, as a result, it will take longer than initially expected for the Committee to start cutting rates. Annual headline inflation edged down to 3.4% from 3.5%, while core inflation dropped to 3.6% from 3.8%, the lowest in three years. The PMIs for May grew, with the manufacturing sector rising 1.3 to 51.3 and flash services activity rebounding by 3.5 to 54.8

Source: Bloomberg, data as of 31 May 2024

Looking Ahead

While the FOMC and BoE left rates unchanged in May, the ECB signalled it would likely start easing in early June. The FOMC noted that recent inflation data hasn’t increased its confidence in reaching the 2% target, but Chair Powell did trim some tail risk by suggesting a hike is unlikely. The BoE inched closer to a rate cut, tweaking its statement by including data-dependent forward guidance. However, the varied views on inflation's persistence in the MPC statement lead us to believe a June cut would be premature. And while the ECB cut rates by 25 bps in June, guidance on the subsequent pace of the cutting cycle is vital. Central banks need more data on inflation to gain confidence in achieving their targets. Incoming inflation and labour data remain crucial for our interest rate outlooks.

Chart of the Month

Source: Bloomberg as of 31 May 2024

IMPORTANT INFORMATION

For Asia-Pacific (APAC) and Europe, Middle East and Africa (EMEA) markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors.

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust Asset Management’s (NTAM) and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For additional information on fees, please refer to Part 2A of the Form ADV or consult an NTI representative.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Hypothetical portfolio information provided does not represent results of an actual investment portfolio but reflects representative historical performance of the strategies, funds or accounts listed herein, which were selected with the benefit of hindsight. Hypothetical performance results do not reflect actual trading. No representation is being made that any portfolio will achieve a performance record similar to that shown. A hypothetical investment does not necessarily take into account the fees, risks, economic or market factors/conditions an investor might experience in actual trading. Hypothetical results may have under- or over-compensation for the impact, if any, of certain market factors such as lack of liquidity, economic or market factors/conditions. The investment returns of other clients may differ materially from the portfolio portrayed. There are numerous other factors related to the markets in general or to the implementation of any specific program that cannot be fully accounted for in the preparation of hypothetical performance results. The information is confidential and may not be duplicated in any form or disseminated without the prior consent of NTAM.

This information is intended for purposes of NTI and/or its affiliates marketing as providers of the products and services described herein and not to provide any fiduciary investment advice within the meaning of Section 3(21) of the Employee Retirement Income Security Act of 1974, as amended (ERISA). NTI and/or its affiliates are not undertaking to provide impartial investment advice or give advice in a fiduciary capacity to the recipient of these materials, which are for marketing purposes and are not intended to serve as a primary basis for investment decisions. NTI and its affiliates receive fees and other compensation in connection with the products and services described herein as well as for custody, fund administration, transfer agent, investment operations outsourcing and other services rendered to various proprietary and third party investment products and firms that may be the subject of or become associated with the services described herein.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors, Inc., 50 South Capital Advisors, LLC, , Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

© 2024 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.