by Clarette du Plooy, Director, Corporate Treasury Solutions and Kees-Jan de Vries, Director, Capital Markets and Accounting Advisory Services, PwC

In November 2013, the IASB issued the long-awaited IFRS 9, ‘Financial instruments’, which replaces hedge accounting under IAS 39. The new standard responds to a number of needs:

- to improve the previous accounting standards for financial instruments, particularly given the increased use and sophistication of hedge accounting; and

- to address a number of accounting issues that emerged as a result of the financial crisis in 2008, especially with respect to the IAS 39 impairment model.

Treasurers and accountants have often complained that the hedge accounting requirements under IAS 39 were onerous, complicated and not really useful to the readers of financial statements. For example, IAS 39 comprises around 300 pages of the total 2,800 pages of IFRS, so 10%. Much of these 300 pages cover detailed hedge accounting guidance and rules. In practice, accounting has become a key driver in how treasurers manage risk, instead of reflecting how management decides to manage financial risks. This is especially true where companies are hedging commodity risks.

The good news for treasurers is that hedging under IFRS 9 will be both easier and more aligned with risk management. The bad news is that documentation is still required in order to qualify for hedge accounting. And although effectiveness testing as we know it today will no longer be required, there is a new requirement to maintain a hedge ratio and rebalance where needed. Accounting ineffectiveness will also continue to affect income statements.

Over two articles, we will dive into more detail and show the key changes to hedging under IAS 39, explain new concepts introduced by IFRS 9 and, most importantly, look at what that means for you. In next month’s edition, we will also address transition and early adoption, especially interesting for readers outside the EU. Click here for part two.

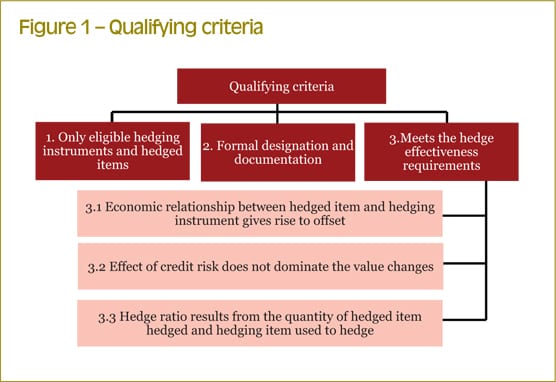

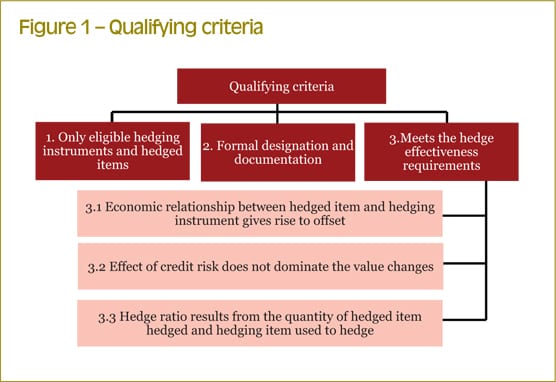

Qualifying criteria

As indicated by Figure 1, the requirements for hedge accounting remain relatively unchanged, but the meaning of effectiveness testing will be different.

Qualifying hedging instruments…

Under IFRS 9, more instruments may qualify as hedging instruments. Besides derivatives and financial instruments for currency risk, non-derivative instruments that are carried at fair value through profit or loss (FVTPL) may also be designated as hedging instruments. This, combined with the fact that IFRS 9 allows for many more instruments to be carried at FVTPL, means that more (and easier) hedge accounting can be achieved. In practice, this will not have a lot of benefit for the corporate treasurer. But it could mean, for example, that it is possible to hedge a loan given for interest rate risk with a loan that is carried at FVTPL, or that it is easier to set up certain commodity risk hedge relations.

Similarly to IAS 39, embedded derivatives have to be considered in financial liabilities or non-financial contracts; if these are deemed not to be closely related to the host contract, they are accounted for separately. Derivatives that are separately accounted for can still be designated as hedging instruments. Under IFRS 9 the concept of embedded derivatives for contracts that are financial assets has been removed. This means that certain non-derivative financial instruments (for example, a loan given with a structured interest index) will have to be carried in their total at FVTPL. Such contracts can now be designated as hedging instruments as well.

What do you have to do now?

- Review your treasury policies to ensure they allow new hedging strategies and instruments

- Review the hedging strategies to ensure they are best fit for the company and the risk being managed.

…and hedged items

IFRS 9 brings a dramatic change from IAS 39 with respect to which positions and risk can be designated as items being hedged. And change will be for the better. A number of exposures that were not allowed to be designated as hedged items under IAS 39 now can be. The most important are risk components of non-financial items, aggregated exposures, net positions and combinations of derivatives and non-derivatives.[[[PAGE]]]

Risk components of non-financial items

IAS 39 is infamous for ‘discriminating’ between financial and non-financial risks. Think about trying to hedge the aluminum component in a purchase contract for soda cans. Although the aluminum part in the cans is well known and can easily be measured separately, IAS 39 only allows the total change in market price of soda cans to be designated as a hedged item. This means that hedging the future purchase of soda cans with LME aluminium futures will never create a 100% effective hedge relation. This is due to the fact that market prices of soda cans will be influenced by more than just aluminium price changes. Ink and production costs are also components of the price. And of course these are not present in the aluminium futures.

This distinction is removed under IFRS 9. This means that non-financial items qualify as hedged items when they are separately identifiable and reliably measurable. We will discuss what is ‘separately identifiable and reliably measurable’ under the hedge effectiveness testing paragraph in this article. For entities that hedge commodities, this will lead to an increase in qualifying relationships and also an increase in the effectiveness of these relationships.

What do you have to do now?

- Assess which non-financial items you potentially want to hedge

- Review contracts to ensure risk components are separately identifiable and measurable

- Determine appropriate hedging strategies to address the risks

Aggregated exposures

Aggregated exposures

Assume a company invested in a portfolio of shares that in relative weight and composition exactly matched the Amsterdam main stock index AEX. If the company then bought AEX options to protect the value of these shares, it would not be able to apply hedge accounting under IAS 39. This is because the underlying shares would not meet the ‘similar items’ test. In other words, the shares would not all move in the same direction if the AEX index moved. Under IFRS 9, there no longer needs to be a ‘similar items’ relationship. Rather, the hedge strategy should be in line with the company’s documented risk management policy, and it should be able to prove the hedge is effective in offsetting the risk.

Net positions

Companies often hedge currency exposure for the net balance of purchases and sales in a foreign currency. Under IAS 39, you cannot designate the net balance of these as the item being hedged. In practice, this does not really lead to any major issues, as under IAS 39 it would still be possible to assign the net amount as either a hedge of the purchases or the sales in foreign currency. However, conceptually it seems strange that the net risk in this case cannot be hedged, as that is exactly in line with the company’s risk management policy. Under IFRS 9 it is possible to designate the net amount as a hedged item.

The drawback of applying the IFRS 9 model is that the impact from the hedging instrument should be booked in a separate income statement line between revenue and cost of sales. However, in practice this removes some of the counterintuitive principles of IAS 39 for many corporate treasurers.

Combination of derivative and non-derivative

It is a common risk management strategy to combine a derivative with a non-derivative in an ‘economic hedge relationship’, but in the past, it was not possible to achieve hedge accounting for this. Under the new rules, aggregated exposures or hedged items that include derivatives qualify as hedged items. In practice, this happens when a company is hedging the forecast issue of a bond with a forward starting interest rate swap. It may be that at the moment of issuing the bond, it is decided that the bond will not be issued in the originally foreseen (and hedged) currency, but in another currency. Under IFRS 9, the company would then be able to conclude a cross-currency interest rate swap and assign the combination of the bond and the original interest rate swap as a hedged item in a new hedge relationship with the new cross-currency interest rate swap.

Formal designation and documentation

The formal prospective hedge documentation requirements of IAS 39 have not changed under IFRS 9. In fact, documentation plays a more important role under IFRS 9. This is because, to prove effectiveness, a company should be able to prove that the designated hedge relationship is in line with the companies’ document risk management policy. As this will be the main criterion for assessing whether a hedge relation is effective, this documentation should be precise.

Where a company is hedging a risk-component of non-financial items, it is very important to document how management will measure the risk component that is being hedged. Without this documentation, it would be impossible to prove after the fact how the hedge was set up.

The hedge relation should meet the hedge effectiveness criteria

Economic relationship between hedged item and hedging instrument gives rise to offset. IAS 39 requires hedge effectiveness testing to be done in a quantitative manner, taking into account the full (change in) fair value of the hedging instrument. The (change in) fair value of the hedging instrument is then compared to the (change in) fair value of the hedged item. The ratio of these two should fall between 80% and 125%. If a hedge relationship under IAS 39 is outside of this range, no hedge accounting can be applied at all.

IFRS 9 recognises that such bandwidth is arbitrary. In practice, it is of course possible that a company may be willing to enter into a hedge that may fall outside of this range, as there may be no better alternatives. The 80-125% range is therefore removed. So IFRS 9 brings greater alignment between how a company manages risk and the accounting for that. As already stated, the main principle is that if a hedge relation is in line with the entity’s documented risk management policy, and the risk being hedged can be measured reliably, hedge accounting can be applied.

Under IFRS 9, companies will have to demonstrate that the hedging relationship does not achieve accidental offsetting and that there is a real economic relationship between the hedged item and the hedging instrument. The mere existence of a statistical correlation between two variables cannot support, by itself, the economic relationship. As an example, there may be a (weak) statistical correlation between LME aluminium futures prices and euribor interest. However, it would clearly not be possible to hedge interest rate risk on a loan with LME aluminium futures. On the other hand, there may be a strong statistical correlation between Brent prices and gas prices in an energy market. That correlation may sometimes be outside of the 80% -125% range of IAS 39, but it may still be the company’s documented hedge strategy to hedge gas purchases with Brent derivatives if there are no gas derivatives available. IFRS 9 mentions in a detailed example the way many airline companies hedge jet fuel using combinations of crude oil, gas oil and jet fuel swaps depending on the applicable time horizon and whether or not these swaps are liquid. By reference to crack spread swaps, it can then be argued that jet fuel is based on gas oil prices and that gas oil prices are dependent on crude oil prices. It is therefore possible to define an effective hedge relationship if management documents and proves a correlation between the aforementioned price components of jet fuel.

To recap, the underlying risk should be the same or economically related and therefore have a similar but opposite response to the hedged risk.[[[PAGE]]]

The effect of credit risk does not dominate the value changes

IFRS 9 requires that the change in fair value of the hedging instrument without considering the change in credit quality cannot be too small to compensate the changes in fair value of the hedged item. In that case, the changes in credit risk dominate the fair value changes, and hedge accounting cannot be applied. For example, if a company enters into a long-term interest rate swap and after two years, the credit rate of the counterparty rating significantly decreases, and it may not be possible to continue the hedge accounting relation, as the counterparty credit risk will dominate the fair value changes of the swap.

IFRS 9 explains that this should not lead to unwanted accounting outcomes. If there is little change in the fair value of the hedging derivative and the underlying, even a small credit risk-related change in the value of the hedging instrument or the hedged item might affect the value more than the underlying. This does not create dominance of credit risk in the value changes.

After the introduction of IFRS 13, hedge accounting sometimes became challenging under IAS 39. Some hedge relationships were terminated, as they no longer passed the 80%-125% range requirement due to the inclusion of CVA/DVA in the hedging instrument and not in the hedge item. So the simplification of effectiveness testing under IFRS 9 will be helpful. However, the accounting ineffectiveness in terms of journal entries is not likely to change significantly.

The hedge ratio of the hedge relationship needs to be maintained

IFRS 9 effectiveness requirements introduce the concepts of hedge ratio and rebalancing. The idea is that there will always be an optimal ratio of the amount of hedging instrument versus the amount of risk being hedged. And if this ratio changes, the entity should change its hedging position or should book hedge ineffectiveness. Rebalancing thus refers to the adjustment(s) made to the designated quantities of the hedged item or the hedging instrument in an already existing hedging relationship. This concept has some parallels with the IAS 39 ‘delta neutral hedging’ concept when using options, but now it is a requirement.

As an illustration, consider an entity hedging 100 tonnes of coffee purchases with standard coffee futures contracts. These contracts have a contract size of 37,500 pounds (lbs). The entity now can use either five or six contracts (equivalent to 85.0 and 102.1 tonnes respectively) to hedge the purchased volume of 100 tonnes. In this case, the entity designates the hedging relationship using the hedge ratio that results from the number of coffee futures contracts that it actually uses (the five or six, depending on the company’s documented hedging policy). The hedge ineffectiveness resulting from the mismatch in the weightings of the hedged item and the hedging instrument is not created in order to achieve an accounting outcome that is inconsistent with the purpose of hedge accounting. Assume that, at inception, the company decides to hedge the risk with five standard future contracts, which would lead to a hedge ratio of 0.85. It may be that six months later, the company considers that the best way to hedge the risk is to use six standard future contracts instead of five. In this case, the entity adjusts the hedge ratio to 1.2. The modification of the hedge ratio is called ‘rebalancing’.

Under IFRS 9, rebalancing does not lead to the existing hedge relationship being terminated. However, an analysis of the sources of ineffectiveness that are expected to affect the hedging relationship during its remaining term should be performed. The hedge documentation should be updated accordingly. In addition, the hedge ineffectiveness should be recognised in profit or loss up to the date of rebalancing. The concept of rebalancing does not exist under US GAAP.

Under IFRS 9, it is no longer possible to voluntarily de-designate a hedge relationship that still meets the risk management objective. Due to the concept of rebalancing, the removal of the 80%-125% range, and the possibility of including derivatives as part of the hedged item under IFRS 9, this may not be a problem. However, this is a considerable change from IAS 39. Under IFRS 9, it is no longer possible to stop hedge accounting; a hedge relationship can only be stopped if the risk management objective changes or the hedge relationship ceases to meet the qualifying criteria.

What do you have to do now?

- Determine the optimal hedging ratios for existing hedging strategies

- Consider whether your tools are appropriate to measure the hedge ratio during the existence of the hedge relationship.

Conclusion

The IASB has tried to solve a number of practical problems under IAS 39. IFRS 9 is clearly an improvement on IAS 39. However, there remain a number of formal documentation requirements and the requirement to prove ineffectiveness (although the infamous 80%-125% range is removed). IFRS 9 certainly is an improvement for companies hedging commodity risks. For corporate treasurers in companies where only FX and interest rate is hedged, there may not be so many changes. It probably makes sense to reflect on the extent of hedge effectiveness testing currently taking place, and then decide on whether some of those can be stopped when IFRS 9 is applied.

In the next article, we will be discussing in more detail the journal entries relating to hedge accounting under IFRS 9, hedging with options and forwards and transition and disclosure requirements.