After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: September 01, 2014

As a mid-cap company operating globally, HMY Group faced the liquidity and risk challenges typically more familiar to large multinationals, but without the same scale or leverage with their banks. In this article, Ignacio Sanchez, Treasury & Risk Manager, describes how HMY Group has addressed the challenge of managing FX exposures, whilst minimising utilisation of bank credit lines.

HMY Group is a market leader in shopfitting, initially focusing on large supermarkets but now supporting the entire spectrum of retail premises. Although M&A has been an important part of its strategy throughout its history, the current group was formed from the merger of two companies (Hermes and Yudigar) in 1998, which had previously been headquartered in France and Spain respectively. Both companies had proved very successful in meeting the needs of customers in their domestic markets, but recognised that they would be in a better position to meet the needs of their customers as they expanded both Europe-wide and globally by merging. For example, when Carrefour expanded into Spain, the company needed a consistent approach to fitting out their retail facilities to create a distinctive, trusted brand across their business. Similarly, as customers reach beyond Europe into new regions, they are increasingly relying on HMY to support them in each new market. As a result of expanding our business in line with that of our customers, we now have eight factories globally and employ around 4,500 people in 65 countries. Although HMY is not the largest company in this industry, we have the widest geographic presence, whereas others have tended to focus on particular regions.

[[[PAGE]]]

Although the business is far smaller than many multinational corporations, and therefore the scale of our activities is less substantial, we share many of the same challenges and requirements in cash, treasury and risk management. Our treasury department was formed in 2010, initially with the aim of implementing a European cash pool, but the scope of our activities has expanded significantly since then. For example, some of our current priorities include reducing trapped cash, ensuring compliance with local regulations in each market and managing our global liquidity and market risk.

FX risk is clearly an issue for a business with our geographic reach. We aim to invoice our customers in euros wherever possible, but this is not feasible in all cases. In addition, we have costs in foreign currencies in countries where our factories are located. A relatively new development for us is to pay some costs in RMB from Europe. Although the ability to settle cross-border flows in RMB has existed since 2009, and been expanded subsequently, suppliers initially preferred to receive USD or euros; however, there is now far greater willingness to both receive and pay in RMB. In countries such as Turkey, customers typically pay in either USD or euros, but some pay in local currency. In Brazil, we receive USD from customers and aim to pay our suppliers in USD to neutralise our FX risk. In all these cases the flows between our local production sites represents the biggest part of our FX risks which impact on local results we try to neutralise.

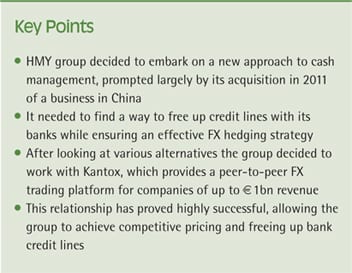

Despite our objective to minimise FX risk wherever possible, we still need to manage a variety of FX exposures. Historically, we have bought or sold foreign currencies in the traditional way through our banks as part of a wider relationship with them. However, for a business of our size, the costs of managing our FX exposures in this way were high and substantial differences between the rates banks were offering (noticed by the benchmark with the middle market rate) meant that we always had to seek competitive bids. Furthermore, we were concerned that we lacked transparency in the bid-offer spread. Our decision to embark on a new approach to FX exposure management was prompted by an acquisition we made in China in 2011. We needed to sell USD 18m to make the acquisition but as a result of various delays in the transaction, we ended up having to transact multiple FX forwards. On each occasion, we were quoted completely unknown spreads which in turn impacted on the acquisition cost. Furthermore, FX transactions frequently used up the credit lines we had in place with our banks that we also needed for FX interest rate transactions.

These challenges came to a head as a result of two pressing business priorities. Firstly, as the way in which business is conducted changes, we needed to obtain guarantees for our customers and suppliers from our banks, putting further pressure on our credit lines. Secondly, we needed to manage our hedging more precisely for our LBO restructuring. To overcome these issues, we needed to find a way to free up our credit lines with our banks whilst ensuring an effective FX hedging strategy.

We looked at alternatives and opted to work with Kantox, a company that provides a peer-to-peer FX trading platform for companies of up to €1bn revenue. Kantox matches FX transactions with other companies wherever possible, avoiding the need to tie up credit lines with our banks. Where matching is unavailable, Kantox access the wholesale market directly and as a result of the company’s FX volumes, is able to trade at tighter spreads than we could achieve directly. We recognised that this approach would bring a variety of associated benefits. The counterparty is visible, which is important for transaction auditability and compliance. As Kantox is regulated by the Financial Conduct Authority (FCA) with segregated client accounts, we would not be at risk to the company.

It was initially difficult to explain to senior management why we were moving away from traditional FX dealing, and how using Kantox’s service would help us to address the business challenges we were facing. However, having described in detail how it would work in practice, and emphasised the regulatory and compliance advantages, we were able to move forward with our proposal. We request transactions via a convenient web portal and Kantox promptly responds to these requests and the deal is transacted by telephone. We still bid competitively with at least one bank to validate the rates we are receiving. Furthermore, we still do some FX business with our partner banks for relationship reasons.

We have benefited from using Kantox in a variety of ways. We are achieving more competitive pricing, initially around €300 – 400 for a small (€500k – 1m) transaction but the benefit increases as the size of transaction grows. We also have the advantage that our bank credit lines are freed up for other activities that add more value. While banks tend to offer rates on larger transactions that are more comparable with those we receive through Kantox, we need to balance this with the issue of credit line utilisation.

Looking ahead, based on the success of the relationship with Kantox and the value of their business model, we are hoping to work with Kantox across a wider range of financial products (e.g., FX swaps), a project that is already underway. In addition, by forecasting major supplier payments more accurately, we also intend to hedge more precisely, based on the actual amount and due date, rather than the approximations we use today.

By working with Kantox, we have been able to achieve more competitive pricing and greater transparency, whilst freeing up our credit lines. This has enhanced rather than detracted from our banking relationships as we are able to transact more value-added business with our banks. Similarly, while we continue to deal some FX with our banks, this is typically for transactions that are more attractive to them, building positive and value-added relationships.