by Lex Greensill, Managing Director, Head of Supply Chain Finance for Europe, Middle East & Africa, Citi

Multinational firms have developed highly complex, sophisticated supply chains in recent years, but the recent tragic events in Japan have illustrated that while many factors can be controlled, every supply chain remains inherently fragile. While treasurers and finance managers cannot protect their supplier base physically, they are in a position to support them financially and therefore ensure that the financial elements of the supply chain are as efficient as possible. In doing so, they both preserve the company’s working capital position and are in a position to leverage the company’s financial assets as a source of financing.

Financing in good times and bad

Supply chain finance (SCF) has developed significantly since the credit crisis. Previously seen as a source of financing for small and medium-sized enterprises or companies in distress, an increasing number of firms, particularly large multinationals with strong credit ratings, have recognised the potential of SCF to help unlock liquidity and increase the robustness of the financial supply chain. In many cases, SCF was considered a stop-gap financing technique during a period of market turbulence, but it has rapidly become apparent that it is not simply a technique for troubled times. As markets start to ease globally, the value of SCF remains undiminished, and could be even greater in the coming years. With more conservative credit models and more stringent banking regulations, credit will not be as cheap or accessible as in pre-crisis days, while optimising liquidity will remain key to funding future investments.

Creating a ‘win win’

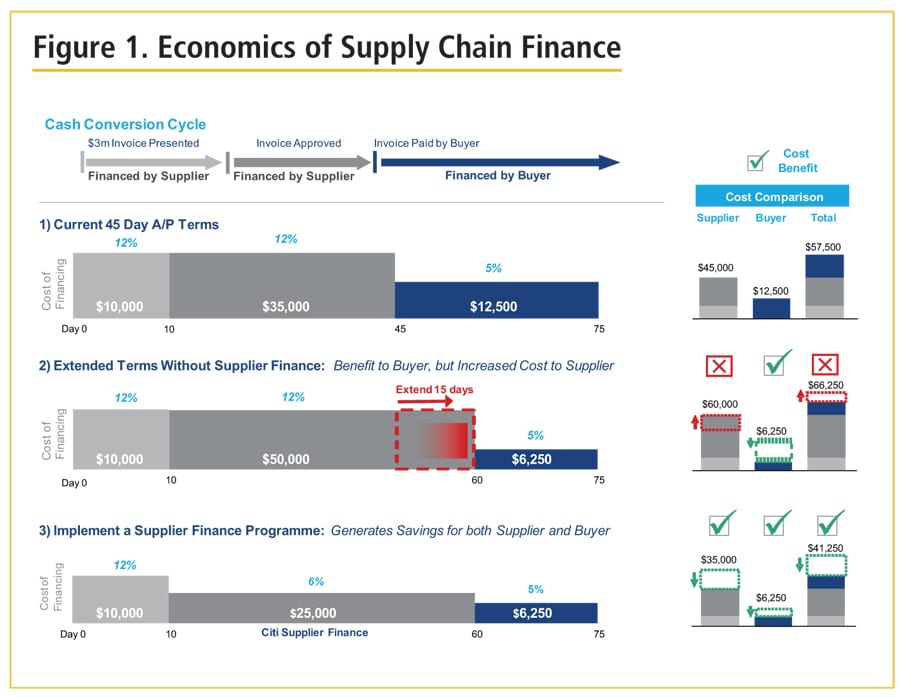

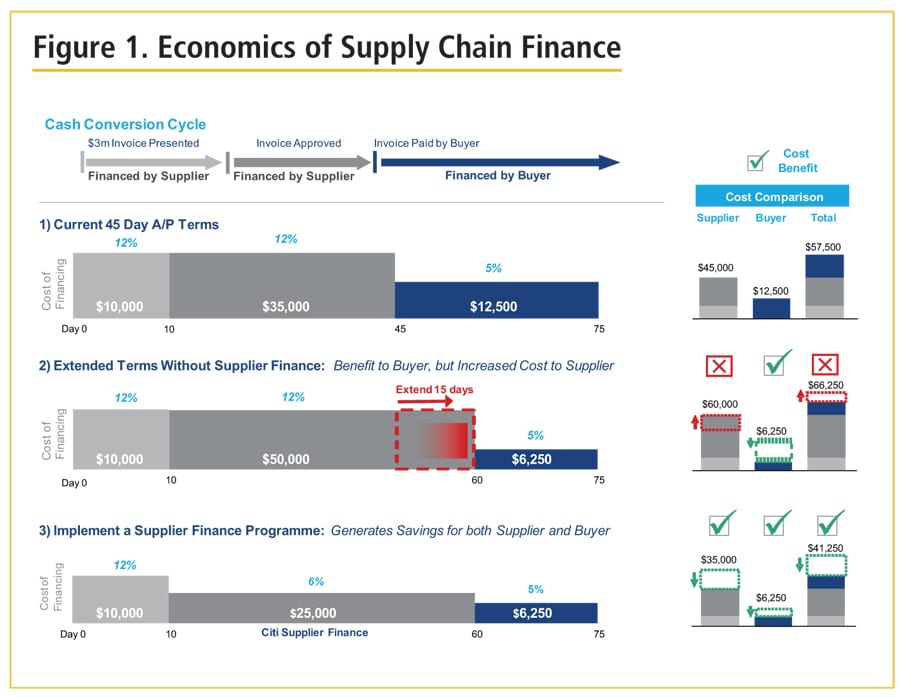

There are few financial structures which can truly be said to create a ‘win win’ for both parties, but SCF is undoubtedly advantageous for both buyers and sellers (figure 1). For example, buyers find that:

- Their financial supply chain becomes more resilient as key suppliers have greater financial certainty and are therefore in a better position to fulfil orders on time, reducing risk in the buyer’s financial supply chain.

- The cost of processing is reduced as the numbers of supplier queries, in-house payments processing and payment fees are reduced.

- Relationships with suppliers are improved, with the potential for achieving better commercial terms without negatively impacting on suppliers.

- An SCF programme does not compromise a company’s ability to source other forms of financing, and does not impact on its credit rating.

For the supplier, the benefits are comparable:

- Cash flow is predictable, as invoices are settled on time by the buyer’s bank. Working capital requirements are therefore reduced and cash flow becomes less constrained. Suppliers may also be able to offer more competitive terms as the cost of late payment does not need to be factored into invoices.

- There is the option to seek early payment as a means of financing. This financing is effectively pre-approved and is not subject to the supplier’s financial standing. For companies that could not otherwise source financing, or where the cost would be prohibitive, this can be a major benefit. For those with alternative means of financing, credit lines are released for other purposes.

- Reconciliation, account posting and management reporting is enhanced as remittance information is provided in a format that can be integrated with internal systems.

Initial objectives, secondary benefits

What has gradually become apparent as the number of SCF programmes increases is that companies have quite different business objectives when they first establish a programme, but that they subsequently experience additional advantages. For example, at a recent roundtable event hosted by Citi, a variety of companies discussed their experiences of SCF, including the initial motivation for establishing a programme. For example, for Philips, the key objective was working capital improvement; however, Bart Ras, Philips emphasises that the programme also enhanced the company’s competitive position,

“For example, just before the football World Cup, there was a shortage in the panel market, since many of the factories producing panels had closed down… They prioritised Philips as they could receive payment very quickly, as opposed to perhaps 60-day terms from another customer. Consequently, introducing a supply chain financing programme has proved to be a fantastic product to help sales and marketing and to satisfy demands from our customers.”

A markets start to ease globally, the value of SCF remains undiminished, and could be even greater in the coming years.

For Rolls Royce, the aim was to protect suppliers’ financial position, and therefore increase the resilience of the supply chain, but the working capital advantages have since become more apparent,

“A key issue that we face is security of supply: how do we ensure that our supply chains will remain resilient in the long term? This issue was particularly significant during the crisis, with the risk that suppliers would go out of business due to lack of liquidity, which would in turn have a very considerable impact on our business.

As the economy recovers, and liquidity constraints become less acute, an unexpected benefit has been the opportunity … for Rolls Royce to access working capital quickly and cheaply to fund the growth that we are planning… So we have been able to mitigate risk, optimise working capital and work more closely with suppliers, and in turn, to start building the supply chains of the future.”

Participants in SCF programmes

As SCF became more prevalent, many believed that only suppliers with a credit rating lower than the programme owner would be most attracted to SCF. In fact, companies have found that suppliers with an equal or higher rating have joined the programme, for a variety of reasons. Andrew Leach, Rolls Royce explains,

“Although we set up the programme to manage our risk to smaller or more vulnerable companies, we are actually seeing more blue chip and bigger companies using the programme than the smaller ones it was originally intended for. But these firms want to manage their balance sheet, by leveraging off-balance sheet financing options, and optimising their working capital. It’s also a zero cost option for them: they only pay for it when they use it.”

For a higher rated company, the cost of discounting the receivable through an SCF programme may be a little higher than obtaining credit through a bank line or equivalent mechanism; however, as Bart Ras, Phillips outlines, this is not necessarily a disincentive,

“As Citi makes a non-recourse payment to the supplier, it has the effect of shortening the balance sheet, and is an alternative form of financing working capital without utilising a bank line. So many CFOs are happy to slightly overpay for discounting the receivable, in order to avoid bank debt and remove accounts receivables from the balance sheet. This is something we now do ourselves as well by joining our customers’ supply chain finance programmes.”[[[PAGE]]]

Implementing a successful SCF programme

There are several factors that contribute to the success of an SCF programme, and which ensure that both buyer and suppliers are able to leverage the potential advantages. The right level of resources and commitment internally, together with the right SCF programme partner, with the global reach, expertise, technology platform and streamlined on-boarding process is critical. One participant at our recent roundtable advised,

“It is important to be clear what your objectives are. You need the right implementation resources, such as in IT, and senior management support to ensure that approvals take place at the right time. Make sure too that your programme marketing is fit for purpose: the programme should effectively sell itself.”

Building supplier relationships

Suppliers will not simply flock to join a customer’s SCF: they will need to understand all the implications, and to have a high level of trust in the buyer and the buyer’s bank. As Bart Ras, Philips explains,

“When we first launched, I expected that suppliers would be desperate to join, but this didn’t appear to be the case at all initially. Our focus was therefore on gaining trust, and as a result, we soon saw the first suppliers joining the programme. Since then, we have opened up the programme to selected suppliers with transparent preconditions.”

Global reach

The banking partner supporting the programme needs the geographic coverage and global branding to give suppliers the confidence to join the programme. With over 57,000 active suppliers across 36 countries within our buyer programmes, Citi has the track record, reputation and proven capability that buyers and their suppliers require.

Onboarding process

The onboarding process should be as straightforward and convenient as possible for both buyers and suppliers. Citi has a structured approach to onboarding, enabling all parties to gain rapid benefit from the programme. For example, once the buyer has introduced a supplier to the programme, Citi provides the supplier with comprehensive online and onsite training and support, a straightforward enrolment process and convenient mechanisms discounting receivables, both automatically and manually. We have 16 onboarding teams globally to support our clients and their suppliers in their local language.

Technology platform

The right technology platform is key to the initial set-up and ongoing success of an SCF programme. The platform needs to be accessible across the supplier base, and provide all parties with a secure, easy-to-use solution to support the process from invoice submission through to approval, payment and discounting. The system needs to be integrated easily with buyers’ and sellers’ internal systems to optimise the purchase-to-pay process. Citi has developed an extremely successful, proprietary platform which delivers the efficiency, usability, control and management reporting required by our clients and their suppliers.

Experience and innovation

Buyers must be confident that their SCF provider will be able to deliver their service in a convenient, efficient way, as well as having the financial strength to finance the programme. With 634 SCF programmes in place, Citi has experience of a diverse array of clients across the world. As banks such as Citi invest further in SCF, we envisage that these programmes will continue to increase in sophistication, convenience and flexibility, such as in risk participation and programme structuring.

Achieving scalability

As companies’ SCF programmes have matured and participation increased, some are now reaching their credit limits with the originating bank, which raises the question of scalability. Banks and central banks alike recognise this challenge and are committed to supporting companies in achieving their working capital objectives. For example, Citi’s supply chain finance programme is now eligible as part of the Bank of England programme, for which every company that makes a contribution to the UK economy is eligible. We are therefore committed to bringing in central bank resources when required, but we also help to put the right structure in place to allow our clients to use their own cash to fund the programme, and to bring in other banks in a seamless way when required to give further scalability. This was the experience of one Citi client who outlines:

“We worked closely with Citi, our legal team and other banks. Now we have plenty of headroom and a structure in place so that there are banks ready to buy Philips paper – indeed, there has been a great deal of interest in this. This has been a highly innovative evolution to supply chain finance, and I’m sure there are still developments to come.”

The future of supply chain finance

SCF is not simply a temporary mechanism for supporting buyers and their suppliers during economic difficulties, it is a long-term alternative means of financing for both buyers and sellers. A client from the roundtable concluded,

“I believe that supply chain finance will be around for a long time, even if companies’ liquidity requirement reduces. We only need to pay one amount to Citi, as opposed to making multiple supplier payments. So hedging is also easier, as I can forecast cash flow successfully. We have far fewer supplier payment queries, as they can track invoices online and finance payments automatically or manually.”

Companies which are looking for economic ways to fund new investments, increase financial efficiency and position themselves for growth should be looking at SCF today as a vital means of increasing their competitive advantage.