After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: April 01, 2012

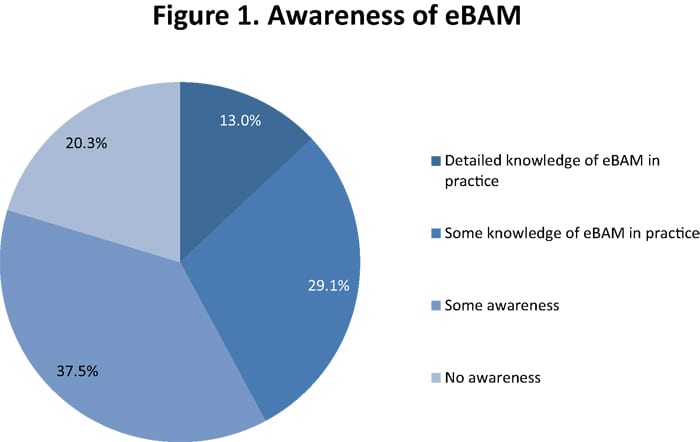

In this month’s Treasurer’s Voice, conducted jointly by TMI and Treasury Strategies, Inc. we asked treasurers about their opinions and experiences of eBAM (electronic Bank Account Management). The response to the survey was overwhelming, with 260 responses in just two weeks. What became very clear, however, was that although eBAM appears to have become a familiar concept, there are some common misunderstandings about what eBAM really is.

We first asked treasurers how much they knew about eBAM (figure 1). The results demonstrated that the majority (57.8%) have no or little awareness as yet, but as a relatively new initiative this was not surprising. Tom Durkin, Global Head of Integrated Channels at Bank of America Merrill Lynch explained that this was consistent with his experience,

“While there is one group of customers who have, or are in the process of implementing and testing eBAM, a larger proportion of companies are seeking more information about the opportunities it offers, how to execute, and a better understanding of best practices.”

Figure 2, however, illustrates that there are perhaps some inconsistencies in people’s understanding of eBAM. For example, nearly 14% of respondents indicated that they were currently using SWIFT for eBAM, which is not consistent with current data volumes. Carlo Palmers, Corporate Market Solution Manager, SWIFT describes,

“Companies have two ways of exchanging eBAM messaging with their banks, either through proprietary solutions provided by their banks, or through SWIFT. Although eBAM has been available since 2010, we only started to see traffic through SWIFT in October 2011.”

With very little eBAM traffic through SWIFT at present, it seems highly unlikely that this proportion (equivalent to 36 companies) is exchanging eBAM messages through SWIFT. Similarly, while some treasury management system (TMS) vendors, and independent vendors are now providing sophisticated and highly efficient solutions for managing bank account and signatory information within the organisation, this should more correctly be described as ‘BAM’ or bank account management, as opposed to eBAM. eBAM refers to the electronic exchange of messages with counterparty banks for opening or closing accounts, or changing signatories.[[[PAGE]]]

Click image to enlarge

This is not to denigrate the importance of BAM; indeed, as Carlo Palmers, SWIFT outlines,

“Many of the discussions surrounding eBAM (electronic bank account management) actually relate to BAM (bank account management) which is an essential pre-requisite.”

Monie Lindsey, Managing Director, Treasury Strategies, Inc. agrees,

“These results are very consistent with the experiences of our own clients. Bank account management is a huge pain point for corporations, particularly as their size and geographic footprint increases. These companies are looking to enhance administration, by removing manual processes and paper, and increase visibility/ control.”

She continues, however, that there remains a problem of definition, which needs to be resolved to add clarity to corporate users,

“It is significant that over 85% of respondents state that they don’t have detailed knowledge of eBAM. This reflects the broad use of the term in the marketplace without specific definition whether it relates to bank website functionality, SWIFT message standards, or digital authentication methods. All participants in the treasury management industry must help corporate practitioners understand how the various types of eBAM can be used in their own organisation.”

Companies should be looking to introduce an efficient, auditable process for holding, maintaining, approving and reporting bank account and signatory information which, in the case of large, complex organisations, typically requires a specialist system or functionality provided as part of a TMS. Consideration also needs to be given to how information on accounts that are managed by business units, as opposed to treasury or a shared service centre, is communicated internally, and how consistently processes for changing and approving accounts or signatories are applied.

Companies should be looking to introduce an efficient, auditable process for holding, maintaining, approving and reporting bank account and signatory information which, in the case of large, complex organisations, typically requires a specialist system or functionality provided as part of a TMS. Consideration also needs to be given to how information on accounts that are managed by business units, as opposed to treasury or a shared service centre, is communicated internally, and how consistently processes for changing and approving accounts or signatories are applied.

Once this has been done, treasurers and finance managers can turn their attention to how this information is exchanged with banks, to ensure that the process of updating account details is secure and consistent, with direct integration between the BAM system and bank communication system. This is typically either bank(s) proprietary system(s) or SWIFT. Tom Durkin, Bank of America Merrill Lynch explains,

“eBAM is still a relatively new initiative, but it already offers companies the opportunity to streamline and automate changes to accounts (such as opening and closing) and changes to signatories. With both proprietary tools and multi-bank solutions available, treasurers can choose the most appropriate means of implementing eBAM according to their business need. We are finding that many customers choose to implement eBAM through their primary bank’s proprietary channel initially, in order to test processes and gain more experience about the potential it offers, and then perhaps extend their use through a multi-bank channel such as SWIFT.”

Monie Lindsey, Treasury Strategies, Inc., concurs,

“Corporate treasurers are very aware of the potential benefits of eBAM, but are in a wait and see mode as standards evolve. They are taking advantage of individual bank and TMS eBAM solutions to achieve as many of the benefits as possible.” [[[PAGE]]]

Click image to enlarge

Respondents were asked their key motivators for implementing eBAM (which for the purposes of this article we will assume refers to both bank account management – BAM and the electronic exchange of messages - eBAM). As figure 3 shows, process automation and visibility over accounts were the most common drivers. Tom Durkin, Bank of America Merrill Lynch comments,

“While increasing automation and straight-through processing was the objective noted by the largest proportion of respondents (79%) increasing visibility over accounts and signatories was the second highest priority, indicated by 66%. We are seeing growing recognition that the ability to view and manage signatories effectively is a major advantage of eBAM, as it offers long-term benefit once the initial advantage of streamlined bank account management processes has been realised.”

Carlo Palmers, SWIFT adds,

“A key driver in the use of BAM and eBAM is achieving visibility and control over accounts and signatories, and being able to demonstrate to auditors that the company and its banks share the same view.”

While efficiency and visibility are key drivers for treasury initiatives, bank account management has frequently been overlooked in the past, as the amount of documentation required to maintain accounts and fragmented responsibility has made it difficult to identify how efficiencies could be achieved. BAM functionality through TMS and specific software are now proven and readily available, and eBAM capabilities are becoming more prevalent. SEPA is also a catalyst as companies seek to simplify and standardise their account structures. Consequently, there is now a focus on centralising bank account management within corporations, often within treasury.

Although eBAM is gaining traction, there are still some challenges to adoption, some of which are easier to address than others. One frequent frustration is the inconsistency between banks in the documentation that is required. Tom Durkin, Bank of America Merrill Lynch notes,

“Lack of standards in documentation is a problem cited by many people, but account documentation is often confused with KYC (know your customer) requirements. Realistically, this is an important element in each bank’s risk management strategy, and will differ according to each bank’s organisational structure, risk priorities and geographic requirements, so this is an area in which it is difficult for banks to compromise.” [[[PAGE]]]

One related challenge is that while different account documentation requirements exist across countries, these are not necessarily interpreted in the same way by individual banks. Twenty per cent of respondents indicated that there is not yet standardisation between different countries and banks. Seventeen per cent were concerned that their banks did not yet fully support eBAM. Tom Durkin, Bank of America Merrill Lynch comments,

“The lack of support for eBAM by some banks, and differences in formats between banks, is becoming less of an issue, with banks working together to define a central utility concept and refine the use of ISO20022 standards. While there is still some work to do, such as in defining a common approach to account documentation, significant progress has been made and eBAM is a valid and feasible opportunity for treasurers.”

Tom makes the point about a central utility, which Carlos Palmers, SWIFT, discusses further,

“While the eBAM pilot projects have been very positive, there have been two significant lessons learnt. Firstly, both parties need to install specific applications for exchanging eBAM messages, which is restrictive and hinders STP efforts. Secondly, it is not always clear what information needs to be exchanged in order to meet the requirements of each bank and each country.”

He continues,

“The way we are addressing both of these findings is through the development of a new central utility. This will enable any application to communicate more compliant eBAM messages, and also offer a single source of truth in terms of the information that is required for each bank and each country. This will, in turn, reduce customer queries and eliminate inconsistencies in the advices that are provided.”

While the central utility is likely to solve many of the current challenges, it will take some time until it is available. Carlo Palmers, SWIFT, outlines the likely timescales,

“The proposal for the central utility will be presented to the SWIFT Board in June 2012, and assuming that it is approved, should be in live operation in mid 2013. This will enable a lower entry threshold for the use of eBAM, as the infrastructure requirement will be reduced significantly.”

BAM offers considerable advantages in terms of increasing efficiency in account management tasks, such as opening and closing accounts, and maintaining signatories. To manage the final stages in the BAM process, however, i.e., i) automating bank communication of BAM actions, and ii) proving that the bank and company share the same view of accounts and signatories, eBAM is required. There remains the challenge that many treasurers and finance managers are not yet familiar with the opportunities for BAM and eBAM. Forty-four per cent of respondents indicated that they do not expect to implement in the near future as they do not have enough information.

There are other issues too, some of which are internal. For example, it is not always easy to convince internal stakeholders that account management responsibility should be migrated to a single department such as treasury. The least mature element of the entire bank account management process is the eBAM element, which will be enhanced considerably by the introduction of a central utility. This will make integration easier, enable bank account data to be stored centrally, allowing a ‘single source of truth’ and account documentation requirements for each country can be applied consistently with a single set of rules. This will bring particular advantage to companies that lack the volume or complexity of accounts to justify a specific eBAM solution, as Carlo Palmers, SWIFT confirms,

“Banks’ proprietary eBAM solutions are by definition single-bank; however, many corporations face the dilemma that they are multi-bank but lack the scale to justify a fully-fledged eBAM application; for these organisations, the central utility will be particularly valuable by offering cloud-based eBAM services, without the need for a specific in-house installed application. Those that have a BAM application can also use SWIFT to connect to the central utility.”

Although the central utility is not yet a reality, the opportunity exists today to automate, standardise and rationalise bank account management and related bank communications and reporting. Tom Durkin, Bank of America Merrill Lynch concludes,

“It is important that treasurers talk to their banks to find out more about eBAM and the specific potential it offers for their business. The bank should also be able to help in constructing the detailed cost benefit analysis, determining the right resources for an eBAM project and recommending the most appropriate channel for eBAM messaging.”

With particular thanks to Treasury Strategies, Inc. for their support with this feature.