After the Ballots

How the ‘year of elections’ reshaped treasury priorities

Published: September 01, 2012

When you talk about collateral, treasurers often bridle, worrying that they will be required to meet systematic margin calls. This discussion recently moved to OTC (over-the-counter) derivatives, which we know will need to involve margin calls in the future, unless exemption is given to non-financial companies (which seems to be the case). This collateral market today represents a few hundred billion euros under management. However, this market has a number of imperfections and a degree of inefficiency that are giving rise to operational problems. There are also market restrictions which prevent the banks, certainly, from making the best use of collateral. The idea we start from is, however, simple: why not use the assets that you hold to finance yourself or, in less favourable economic circumstances, accept them in order to bolster your own position? Collateral can be used for various reasons such as (1) margin calls on derivative product transactions; (2) as security for financing with market counterparties or central banks; (3) dealings with clearing houses or central counterparties (CCPs) and (4) for settling transactions.

Repurchase agreements, often referred to as repos, involve the sale of assets under an agreement or contract enabling the seller subsequently to buy them back. The buyback price will be higher than the initial price, with the difference representing interest calculated on the basis of the repo rate. The buyer of the securities is the lender (’giver’) and the seller is the borrower (’receiver’). The collateral is reassurance for the lender and serves to safeguard its assets. It boils down to a cash transaction combined with a forward transaction and, at the end of the day, can be likened to a secured loan.

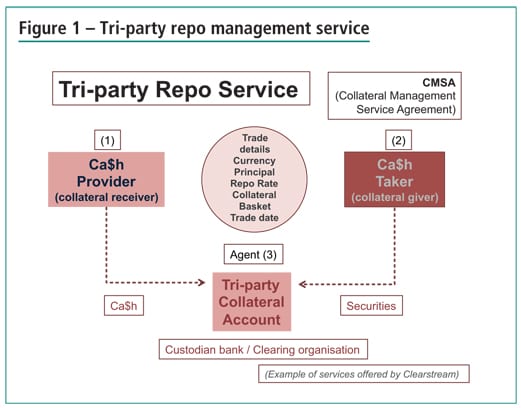

The characteristic of a tri-party repo is that there is a custodian bank or an international clearing organisation between the two parties. This third party plays the role of agent or intermediary, handling the transaction’s administration, including the allocation of the assets pledged as security. Examples of these intermediaries are J.P. Morgan, Bank of NY Mellon and Clearstream in Luxembourg. In return for this tripartite agreement, the intermediary provides a management service including the profile of the eligible collateral. This enables the buyer to define its risk appetite and, to a greater or lesser extent, gives it the ability to sell its assets in the event of problems.[[[PAGE]]]

This way of investing has quite a few advantages in that it may provide access to more exotic counterparties or ones outside the usual round of the main corporate banks, but also to more risky counterparties or ones not rated by a rating agency. You lodge your funds with a third party custodian organisation, after having agreed a deposit operation with the bank for a particular rate, amount, and term. Soon after, the custodian organisation credits your account with a portfolio of securities defined with it in advance, on the basis of criteria that are exclusive and specific to each deal. For example, the business might want only investment-grade risk (with a credit quality floor) in its basket of collateral, less than XX% of risk on the same issuer, or a maximum of XXX million EUR per sovereign risk, or exclusion for the risk of certain countries or certain sectors, etc. The stricter and tighter your criteria, the lower the rate and the smaller the maximum portfolio will be. The concept of putting together a basket is very beneficial, as it enables you to achieve a very aggressive investment rate, perhaps with a counterparty with no credit rating, and also with a pledge of a highly diversified basket of securities with a previously defined quality floor. Isn’t that magic?

The transfer of title of the securities therefore completely protects the company providing the cash. The portfolio can also be over-collateralised’. For instance, by demanding a portfolio of 110% for cash of 100%, the lending company gains additional security for itself. Should this basket of collateral lose value or in the event of any default in the underliers, the independent organisation is authorised to draw directly on its client’s (the borrower’s) stock of securities to balance the portfolio and bring it back up to 110% immediately. If it cannot do this within 24 hours, the borrower will be in default. The cash provider could then have the portfolio sold to recover its initial stake and the principal loaned. Furthermore, both the principal and the interest are protected by the existence of this collateral. Similarly, if it is the counterparty itself that defaults, the lender can utilise its portfolio as collateral to recover its initial stake. At a time when a bank failure is unfortunately no longer just theoretical, this product has the advantage of being threefold;

(A) diversification of investments and access to new and more risky counterparties;

(B) security for the investment via the basket pledged as collateral; and finally

(C) higher yield because of the counterparty’s lower credit quality.

Furthermore, there is nothing to stop the beneficiary of the collateral (i.e., the lender) using it for other purposes such as to cover margin calls for OTC transactions, to achieve a lower hedging cost on longer-term transactions (long-term operations are by nature more expensive since they incorporate the cost of counterparty credit risk). It also receives a daily revaluation to market value from the independent custodian organisation. The deposit granted can be treated as a ’cash equivalent’ type deposit (IAS 7) if it fulfils the criterion of a maximum term of three months.

Even though the European Central Bank (ECB) is injecting massive funds into the market to bolster market and bank liquidity, this tri-party repo type of deal is still very common, unlike other products that are less attractive and less used at a time of an overabundance of cash.

In terms of the documentation to be provided and signed, a single central basic document called a CMSA (Clearing Master Service Agreement) is needed with, an organisation such as Clearstream, together with a GMRA (Global Master Repurchase Agreement) for each bank counterparty with which you are going to work (bilateral document for each counterparty). The client or the business then has an account opened with the agent to which the securities will be credited. These documents are, to all intents and purposes, framework agreements of the ISDA or GMSLA type, well-known to international law firms.

Using a third party, called the tripartite agent, in the agreement (Clearstream in the example suggested above) provides some extra security for the lender. The approach using a basket of assets is also a good precautionary measure which gives the lender worthwhile protection in the event of default. Usually, corporate lenders do not want to invest directly in products issued by governments or other non-financial organisations. Furthermore, we should not forget that because of the future legislation on OTC derivatives, non-financial type companies will need to use what are called trade repository organisations to report on their derivative products. Selecting a tripartite agent that can carry out both types of operation gives you an independent counterparty as a partner and allows you to strengthen your relationship with it, while automating certain procedures and transaction flows. It is worthwhile bearing this point in mind when you need to select a third-party custodian organisation. Finally, for those who do not have a custodian bank, this third-party agent organisation can also play this role at the regulatory reporting level (for example, REGIS-TR) and can enable you to deal with other counterparties, particularly smaller money market funds, or to negotiate deposits with smaller banks.[[[PAGE]]]

In the meantime, this product is very simple yet little known and little used by corporate treasurers. It is also often unknown to CFOs. The difficulty consists in ’selling’ the product in-house to management. Even if it seems somewhat bureaucratic and complex, third-party management simplifies things and, at the end of the day, the cost is borne by the borrower. It allows you to you diversify your risks when you have large amounts of excess cash to invest and when in-house rules are too tight. Why not use somebody else’s portfolio? Why not even use your own portfolio of securities if you have one (but not your own company’s shares)?

The operation obviously works both ways for companies that have good or reasonable collateral to offer. Even where the portfolio brings in a return (the coupon is still payable to the lender) it is often a bit ’sleepy’. Even if it bears interest or dividends, the securities portfolio does not do anything to the books. Giving it as collateral could be a way of ’waking it up’ and giving it a second, parallel, existence. We are talking about a simple and secure product that can meet several objectives at the same time. There seems to be very little doubt that this type of product is going to become more widespread within non-financial companies in the next few years. Why not go out and look for additional return while increasing security through diversifying collateral? Why not use the collateral lodged with us for many purposes, thereby killing two or even three birds with one stone? In the times we are living through, a wise treasurer cannot be too careful.