- Ben Poole

- Editorial Team, Treasury Management International (TMI)

- Emer Murnane

- Assistant Group Treasurer, Smurfit Kappa

- Frank Greene

- Group Treasury Manager, Smurfit Kappa

By setting five key performance indicator goals for a recent sustainability-linked revolving credit facility – and requiring success in all of them to gain the maximum margin benefit – Smurfit Kappa’s treasury team has demonstrated how a cross-functional project can unify an entire business. This award-winning financing project has also illustrated how treasury can not only embrace and drive ESG, but also push the boundaries of sustainability norms.

Sustainability is in the DNA of Smurfit Kappa, the Dublin-headquartered paper-based packaging multinational. The firm designs, manufactures and supplies its products worldwide, operating in 36 countries across Europe and the Americas. Producing 7.7 million tonnes of packaging per year, the company recycles 6.3 million tonnes of recovered paper annually. Smurfit Kappa is also responsible for 67,000 hectares of certified forest plantation.

Emer Murnane, the company’s Assistant Group Treasurer, elaborates: “We’ve had ESG [environmental, social, and governance] embedded into the way we work for a long time, even before it became the prominent structural driver for businesses that it is today. In fact, since 2005, we’ve been reporting on our sustainability developments through our annual sustainable development reports. Our entire Sustainable Development Report is third party assured by KPMG per the Global Reporting Initiative (GRI) Guidelines (Comprehensive).”

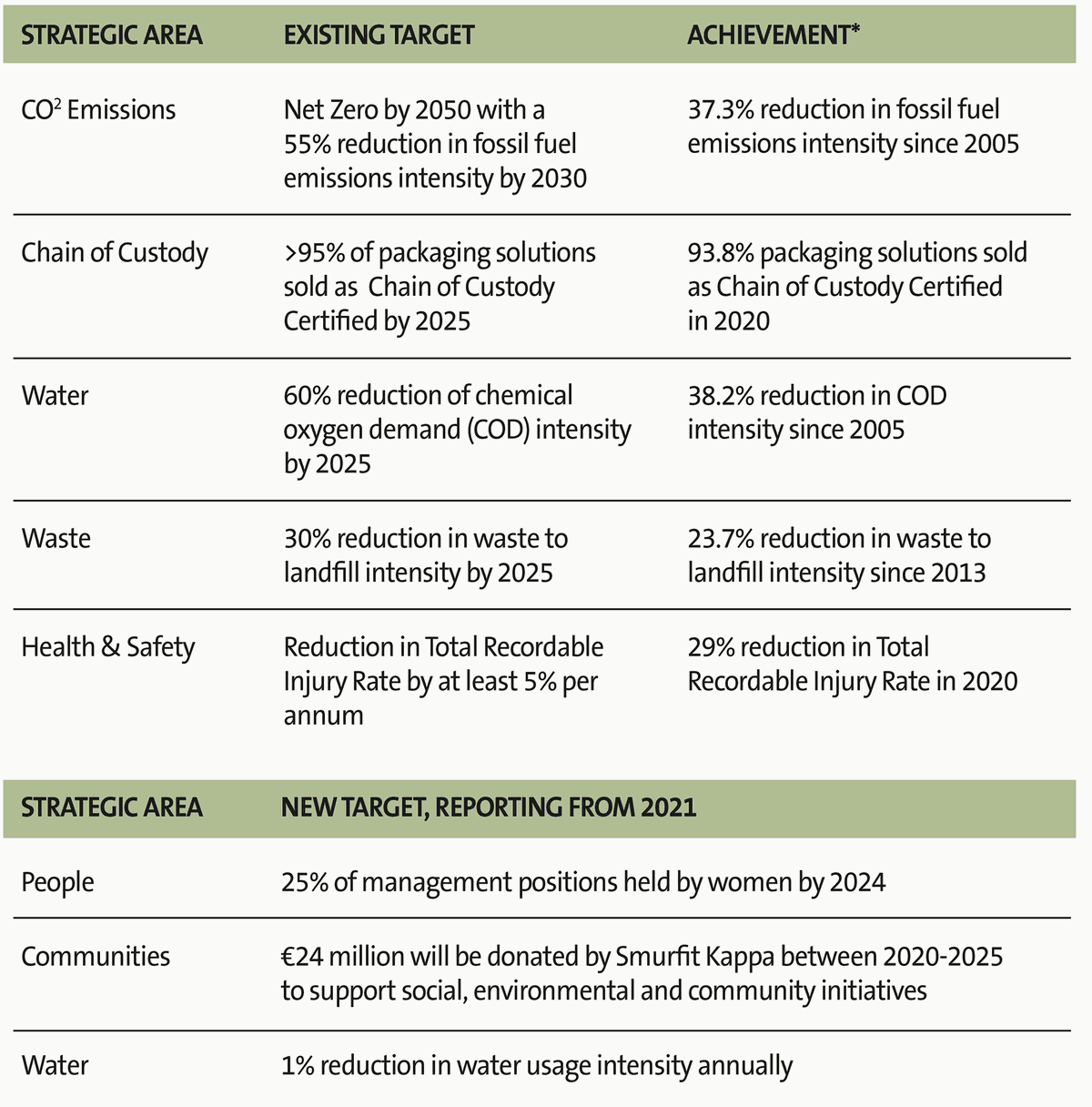

The company recently upgraded its sustainability targets in a commitment called Better Planet 2050, which contains ambitious targets across many strategic areas. The initiative covers everything from CO2 emissions to the certified chain of custody, which guarantees that materials used come from sustainably-managed sources. Water usage is also addressed in several ways, including the water intake at the firm’s mills, the quality of water returned to the environment, and the associated waste handling. Beyond the environmental issues, the new targets also cover a range of diversity and inclusion (D&I) and community and social responsibility topics.

Unleashing sustainable financing

With Smurfit Kappa making its Better Planet 2050 commitments, treasury saw a chance to contribute towards these goals in a significant way. In January 2021, the company announced it had amended its revolving credit facility (RCF) to incorporate its sustainability objectives into its financing. The €1.35bn sustainability-linked revolving credit facility (RCF) embeds the company’s sustainability targets in five key performance indicators (KPIs) that can potentially change the margin by approximately five basis points depending on how many of the KPIs Smurfit Kappa successfully attains.

Murnane explains: “The RCF was a way of embedding the ESG focus that we have as a company into our financing. It focused on the environmental aspects of the circular economy, how we produce our product and also the health, safety and wellbeing of our 46,000 employees.”

The facility margin is now linked to five annualised ESG-related KPIs:

“When this was discussed initially, advisers noted that our five KPIs were particularly ambitious,” Murnane continues. “However, we purposefully wanted all five KPIs to be incorporated and to be of equal importance in terms of margin impact. For us, it was the right decision that we must achieve all five KPIs to get maximum benefit. This is important because we are demonstrating to our employees, our customers, suppliers, and our debt and equity investors that all areas of our strategic ESG priorities represented by the KPIs are important to us.”

Main sustainability targets of Smurfit Kappa’s Better Planet 2050 initiative

*According to the latest publicly available figures published in Smurfit Kappa Sustainable Development Report 2020

Linking up and liaising

While there is sometimes a danger that treasury can be seen to be operating in a silo, the success of the sustainability-linked RCF at Smurfit Kappa came down to treasury’s ability to interact with a variety of business units across the organisation.

Murnane elaborates: “We worked closely on this project with other areas of our business such as our sustainability team, our corporate planning team, and our finance team. We believe that this project effectively communicated to all of our internal and external stakeholders our determination to prioritise ESG goals and KPIs by introducing financial incentives to reach our targets and financial penalties should they not be reached. This also has the knock-on effect of getting buy-in to our ESG ambitions both across the business and across our wider stakeholder groups, and we have received very positive feedback around this cross-departmental collaboration, not just from our banking group but from within the organisation as well.”

The close work with the sustainability team, in particular, gave treasury great insight into which KPIs to build in. “It’s always difficult to annualise something that is a long-term target,” continues Murnane. “Our aim was that the KPIs would stretch us but also be achievable. That is where the very close relationship we have built with our sustainability department came into play. Because they have a great deal of knowledge built up as a result of reporting on these metrics over many years, they were in a perfect position to help us set these benchmarks at challenging, but ultimately achievable, levels.”

Frank Greene, Smurfit Kappa’s Group Treasury Manager – Debt Funding & Risk Management agrees: “The opportunity to work on a cross-functional project like this with our sustainability colleagues was a special privilege. The need to live in a more sustainable world and tackle the climate crisis are some of the most critical issues of our time, and so to be able to contribute positively by doing our small part in helping to address these global issues while working as a treasury professional was very rewarding. Embedding the KPIs in our financing was also an excellent opportunity to move outside the treasury function by delving deeper into our operations to learn more about our wider business and the sustainable product we produce using ever more sustainable production processes. ”

The Smurfit Kappa treasury team was also tasked with selecting specific banking partners to advise on the RCF. This in itself can be a challenge given the solid reputation of many large relationship banking groups. Murnane explains: “Choosing a banking partner for this project was very difficult because given the calibre of our relationship bank group in this area. We eventually selected Rabobank and ING to be our advisers. They have been hugely supportive and fantastic to work with.”

Recognising a job well done

Setting up the RCF and gaining approval from the banking partners was a massive achievement for the Smurfit Kappa treasury team. So much so that it went on to be recognised by the Irish Association of Corporate Treasurers (IACT) – the project, which Dublin-based law firm Matheson supported, picked up the inaugural IACT Treasury Award in May 2021. Six criteria were used to judge the award contenders: innovation, reach, ESG, excellence, economics and inspiration. Having won the IACT Treasury Award, the Smurfit Kappa project then also went forward to represent Ireland at the European Association of Corporate Treasurers (EACT) Award 2021.

IACT seeks the next generation of treasury talent

As mentioned, the timing of the inaugural IACT Award was arranged to allow the winning treasury project to represent Ireland at the EACT Award 2021. Aimee Cullen, Head of Treasury, CarTrawler, and IACT committee member, says: “We were thrilled to receive the entry from Smurfit Kappa because they’ve not only set the bar for themselves regarding integrating ESG goals into corporate finance, they’ve set the bar for all of us.”

Alongside its Excellence Award, the IACT has recently launched a Future Leader Award to recognise new Irish talent in the treasury space. Cullen explains: “It can be easy to become a little bit set in our ways in treasury, so we want to shine a light on those people who have different experiences and can contribute fresh ideas to our treasury community and help to change the way we think.

“We’re looking for the talent coming through the organisation, as well as people just starting their treasury career, or perhaps who have changed career paths to work in treasury. We will be taking nominations [for the Future Leader Award] from our corporate members and patrons. We’re looking for a person who has been a primary contributor to the success that their treasury team has achieved.”

The scope of the Future Leader Award covers a wide range of treasury activities, which should encourage entries from across the spectrum. Cullen continues: “The winner could be someone who played an important role in the development of a digital treasury transformation process, for example. We’re also looking for people who have contributed to their community. If you think about ESG [environmental, social and governance] there’s a great deal of scope there for innovation and thought leadership coming from young talent.”

The IACT Annual Treasury Management Conference, scheduled for November 17 in Dublin, will dedicate a session to future treasury leaders, exploring all areas of career planning, training and leadership.

Greene says: “We are delighted with how the project went, and I think both the IACT award and the reception from our banking partners are testament to the fact that we did a good job, which is extremely pleasing. It was certainly a learning process for us in treasury, given that we are more used to dealing with financial metrics as opposed to ESG metrics. For our colleagues on the sustainability side, it gave them a glimpse into our world by seeing the mechanics of amending a syndicated facility agreement and managing that process with the banking group. Thankfully it was very well received and looking back I don’t think we’d change a thing.”

Looking forward, the work that Smurfit Kappa put into its sustainability-linked RCF will stand it in good stead for the future, with a critical liquidity line secured and sustainable targets to achieve. Murnane concludes: “The experience that we gained from working with other departments and communicating across the business is invaluable for us. The relationships that we have built up during the project are absolutely relationships that we are carrying forward. And the treasury team is also excited to deepen its ESG involvement in the future.”