- Daniel Farrell

- Head of International Fixed Income, Northern Trust Asset Management

Exclusive insight for TMI subscribers! Northern Trust Asset Management share a monthly market commentary for treasurers.

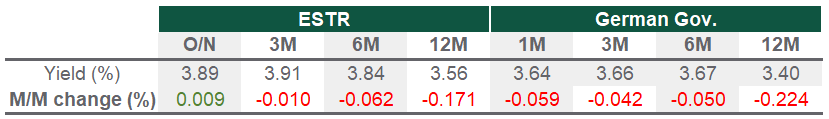

Eurozone Market Update

In November, eurozone inflation was 2.4% year-over-year, below expectations of 2.7% and October’s 2.9%. Core inflation, which excludes more volatile food and energy prices, fell to 3.6% from 4.2% in October, thanks to the continuing decline in energy prices. Despite this trend, ECB President Christine Lagarde stated, “It is not time to start declaring victory on inflation.” But markets are still moving forward with their forecast of 113 basis points (bps) in cuts by the end of 2024. Q3 GDP for the eurozone came in at -0.1%, missing market expectations of 0% and reflecting the region’s stagnating economy. Monthly retail sales fell 0.5%, in line with the depressed consumer confidence levels, allowing the market narrative to persist that the ECB is most likely done with hiking rates.

Source: Bloomberg, data as of 30 November 2023

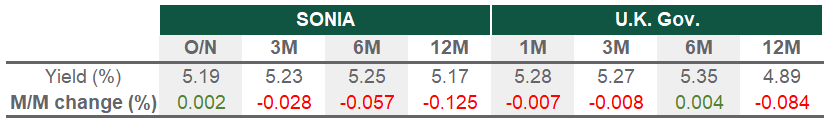

UK Market Update

As expected, the BoE left its monetary policy unchanged for the second successive meeting, with the deposit rate remaining at 5.25%. The only major change came from the BoE’s forward guidance, which indicated that monetary policy will likely be restrictive for an extended time. The bank continues to highlight that further tightening would be required if evidence of more persistent inflationary pressure arises. Governor Andrew Bailey later commented, “We are not in the place to discuss cutting interest rates — it is not happening.” Inflation fell to 4.6% year-over-year from 6.7%, but core inflation remained sticky at 5.7%. November’s flash composite Purchasing Managers’ Index (PMI) beat expectations with a 50.1 reading, bringing the UK back into expansionary territory.

Source: Bloomberg, data as of 30 November 2023

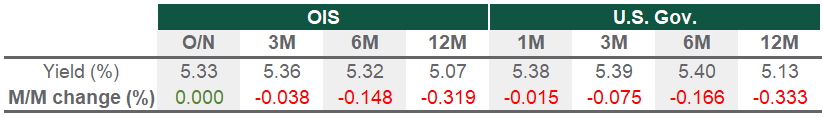

US Market Update

In November, the Federal Open Markets Committee (FOMC) left the federal funds target rate range unchanged at 5.25-5.5%. The only modest change in the accompanying statement noted that growth “expanded at a strong pace in the third quarter,” job gains “moderated since earlier in the year” and “tighter financial and credit conditions” are likely to weigh on the economy. The Fed preferred inflation gauge, the Personal Consumption Expenditure Price Index, softened to 3.0% year-over-year from 3.4%, ensuring rates will remain on hold at the FOMC December meeting. The latest Q3 GDP print exceeded expectations, accelerating to 5.2% from 4.9%, driven by non-residential fixed investments and state and local government spending

Source: Bloomberg, data as of 30 November 2023

Looking Ahead

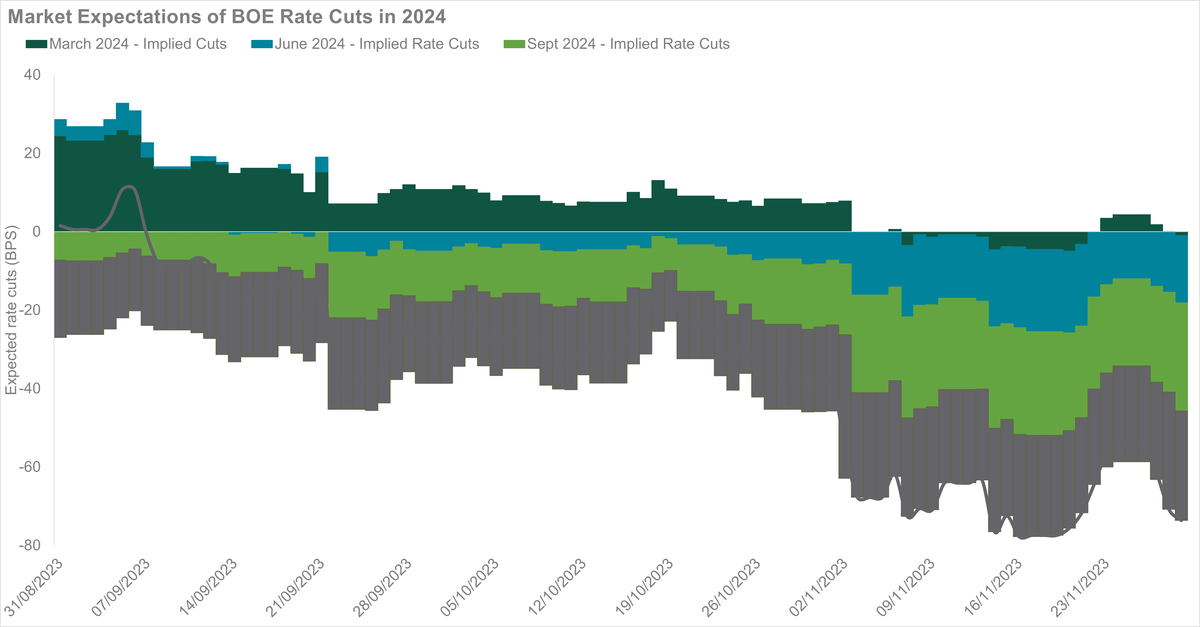

The three central banks continued their holding pattern in the most recent round of policy meetings. Subsequently, market participants have concluded that central banks have reached the peak of their hiking cycles and have shifted their focus to the timing of the first interest rate cut as well as the magnitude of easing during 2024. While headline inflation has fallen substantially, the reaction function of central bankers will be driven far more by the sticker core component that excludes volatile energy and food data. We would caution against optimism that the inflation battle has been won. While inflation is trending in the right direction, we believe that the path to 3% on core prices is much easier to obtain than getting back to central bank targets of 2%. We believe the market is pricing in a premature start to the cutting cycle and overestimates the magnitude of easing for 2024.

Chart of the Month: Recently Changing Market Expectations for Bank Of England Rate Cuts in 2024

Source: Bloomberg as of 30 November 2023

Are you exposed to unintended investment risks? Benchmark yourself against 200 treasurers globally

IMPORTANT INFORMATION

For Asia-Pacific (APAC) and Europe, Middle East and Africa (EMEA) markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors.

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust Asset Management’s (NTAM) and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For additional information on fees, please refer to Part 2A of the Form ADV or consult an NTI representative.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Hypothetical portfolio information provided does not represent results of an actual investment portfolio but reflects representative historical performance of the strategies, funds or accounts listed herein, which were selected with the benefit of hindsight. Hypothetical performance results do not reflect actual trading. No representation is being made that any portfolio will achieve a performance record similar to that shown. A hypothetical investment does not necessarily take into account the fees, risks, economic or market factors/conditions an investor might experience in actual trading. Hypothetical results may have under- or over-compensation for the impact, if any, of certain market factors such as lack of liquidity, economic or market factors/conditions. The investment returns of other clients may differ materially from the portfolio portrayed. There are numerous other factors related to the markets in general or to the implementation of any specific program that cannot be fully accounted for in the preparation of hypothetical performance results. The information is confidential and may not be duplicated in any form or disseminated without the prior consent of NTAM.

This information is intended for purposes of NTI and/or its affiliates marketing as providers of the products and services described herein and not to provide any fiduciary investment advice within the meaning of Section 3(21) of the Employee Retirement Income Security Act of 1974, as amended (ERISA). NTI and/or its affiliates are not undertaking to provide impartial investment advice or give advice in a fiduciary capacity to the recipient of these materials, which are for marketing purposes and are not intended to serve as a primary basis for investment decisions. NTI and its affiliates receive fees and other compensation in connection with the products and services described herein as well as for custody, fund administration, transfer agent, investment operations outsourcing and other services rendered to various proprietary and third party investment products and firms that may be the subject of or become associated with the services described herein.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors, Inc., 50 South Capital Advisors, LLC, , Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

© 2023 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.