by Charlotte Quiniou CFA, Director in Fitch Ratings’ Fund and Asset Manager Rating Group

A significant step towards European money market fund (MMF) regulation has been achieved with the Council of the European Union’s agreement on a revised proposed MMF framework in June 2016. This comes almost three years after the European Commission’s initial proposed text and more than a year after the European Parliament’s revised rules proposal, illustrating the difficulties in reaching a commonly agreed approach for the EUR1.2trn European MMF industry.

No effective rules before 2019

The draft regulation is now entering its final ‘trilogue’ stage, during which the European Commission, Parliament and Council need to agree on a final text. The first trilogue meeting was held in July and additional meetings will follow after the summer. This will nourish further debate on European MMF regulation and additional changes are likely to emerge. It remains to be seen if the UK’s vote to leave the EU will affect the regulatory debate and prolong the trilogue process. Once agreed, there is a proposed implementation period of 18-24 months. The reform would therefore not be effective before 2019 at the earliest.

[[[PAGE]]]

Two-tier framework persists

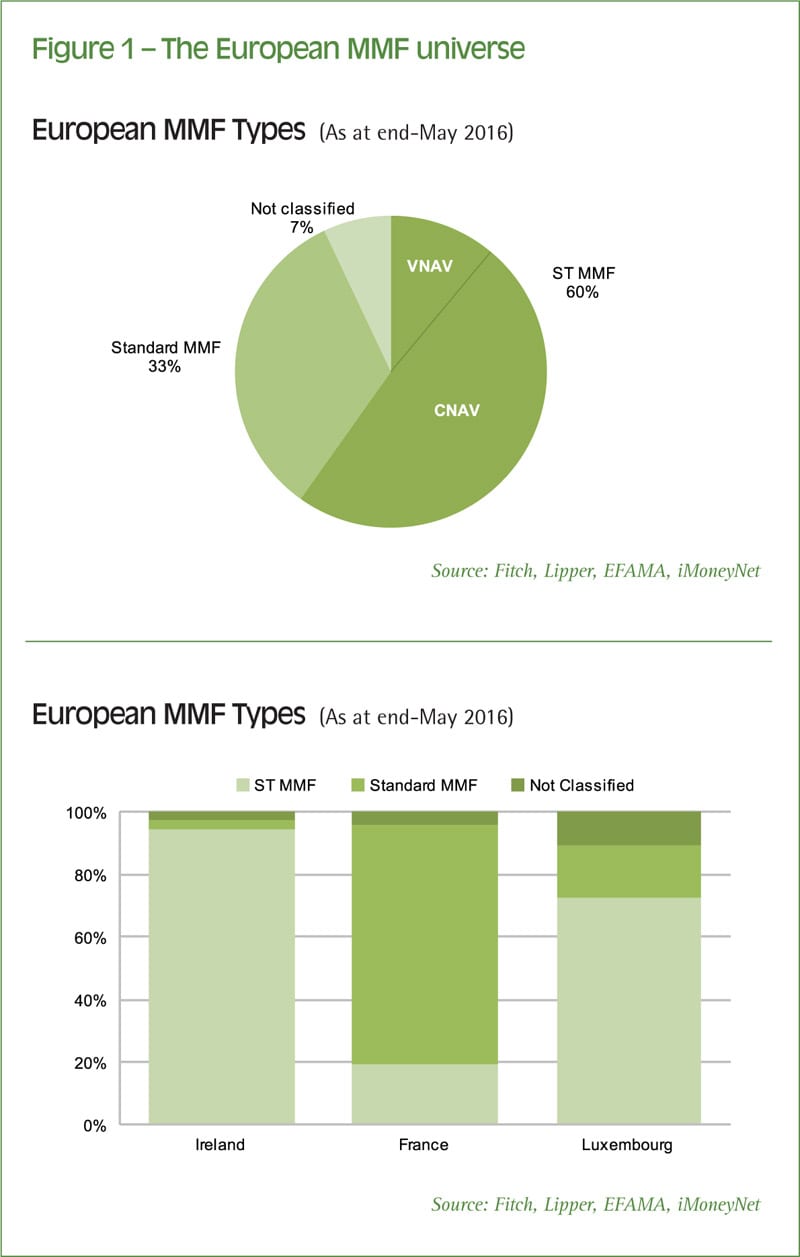

The proposal maintains a two-tier framework with short-term MMFs and standard MMFs, which is consistent with CESR’s (now ESMA) European MMF definitions introduced in 2010. Maturity limits on assets and portfolios are the differentiating points between the two categories. Fitch estimates that short-term MMFs represent about 60% of the European MMF universe, of which 80% are constant net asset value (CNAV) funds. The remaining 20% of short-term MMFs and all standard MMFs are variable NAV (VNAV) funds. Material country disparity prevails, however, on the short-term / standard MMF mix, notably for the three largest European MMF countries by domicile, namely Ireland, France and Luxembourg. These three countries jointly represent 90% of the European MMF universe.

LVNAV: a new and workable CNAV alternative in most parts

The Council’s proposal would see the emergence of a new type of short-term MMF, low volatility NAV (LVNAV) funds. They would co-exist with a new form of government-only CNAV funds, and the existing short-term VNAV money funds and standard VNAV money funds. Non-government CNAV funds would not exist in their current form anymore, representing a significant change for those investors, notably corporate treasurers, that are accustomed to short-term CNAV MMFs. Proposed rules that would apply to each of the four MMF types are summarised in the table below.

The proposed rules on LVNAV funds would make them a workable alternative to existing CNAV funds, notably as the sunset clause is removed. This is in contrast to the European Parliament’s 2015 proposal, which first introduced the LVNAV concept but with a five-year sunset clause, whereby LVNAV would only initially be approved for five years. Such a sunset clause would create the possibility that the structure would only be temporary, a strong drawback for the conversion of existing CNAVs, which represent half of European MMF assets.

Obstacles to the development of LVNAV funds would come from the liquidity requirements of the proposed rules. The new liquidity requirements for government CNAVs and LVNAVs, if introduced as is with limits on the eligibility for portfolio liquidity buckets of government-related securities that benefit from strong market liquidity, would be challenging to implement. This is due to the scarcity of ultra-short-dated asset supply. Banks in particular are reluctant to accept short-term funding from money funds, especially at quarter and month-end, owing to their own prudential regulatory requirements.

Standard VNAV MMFs would need to increase liquidity levels

The proposal achieves the objectives of making funds safer and investors better protected through portfolio diversification and liquidity across European MMFs. This is particularly true for most standard VNAV MMFs, which would have to raise their portfolio liquidity. Liquidity practices vary greatly in this segment of the market, according to a study by Fitch, which identified that, on average, standard VNAV funds did not have more than 14% of their assets in securities maturing within one month. This will be contrasted with the new rules that would require that VNAV maintain 15% in weekly liquid assets. A fund’s ability to provide timely liquidity to investors is a key constituent of a Fitch’s MMF rating, reflecting MMF’s core role as a liquidity management tool for investors.

The proposed portfolio diversification and liquidity rules are close to existing investment practices of most CNAV and some short-term VNAV MMFs. Fitch’s MMF rating criteria go beyond the proposed rules in some areas in identifying and measuring key risks.

Operational challenge

New fund valuation rules would raise an operational challenge for fund administrators, fund managers and investors. The introduced focus on mark-to-market pricing would require adjustment to current pricing policies. The amortised cost valuation method, which is currently authorised for existing CNAV assets in its entirety and up to three months for VNAV assets, would see its usage substantially reduced.

Gates and liquidity fees to contain severe redemption risk

The proposed mandatory application of liquidity fees or redemption suspensions for LVNAV and government CNAV funds (see summary table) would lead to more careful portfolio liquidity management and stronger interaction with investors. No such measures have been defined for VNAV MMFs, aside from the usual available UCITS provisions.

Similar rules have been introduced in the US MMF regulation that will enter into force in October this year, requiring US MMFs to place provisions for liquidity fees or gates tied to the amount of a fund’s weekly liquid assets. Specifically, if a fund’s weekly liquid assets fall below 30%, the fund’s board may impose a liquidity fee of up to 2% or suspend redemptions for up to ten business days. If weekly liquidity drops below 10% of total fund assets, fund boards are required to impose a 1% redemption fee, unless the board determines that the fee would not be in the fund’s best interest or that a higher (or lower) fee is more appropriate. In anticipation of these sweeping changes to MMFs, Fitch updated its MMF rating criteria in December 2015.

[[[PAGE]]]