by Helen Sanders, Editor

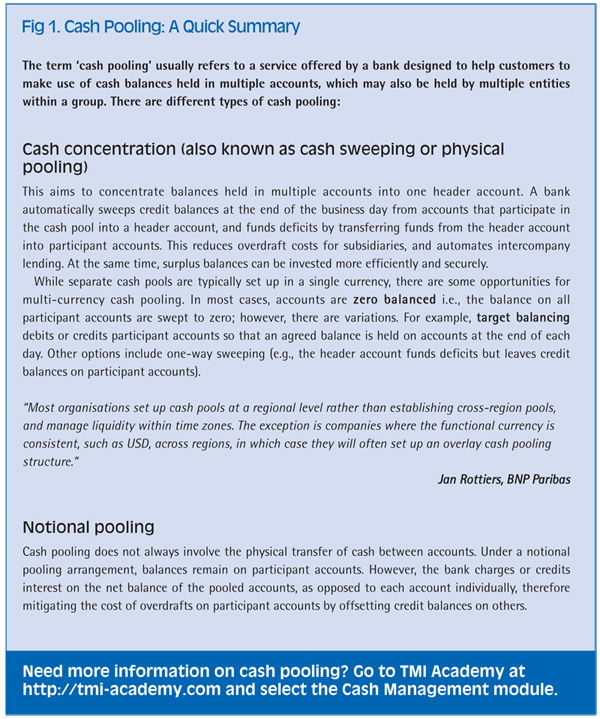

Cash pooling, particularly cash concentration (physical pooling) is well-established as a fundamental technique for treasurers to manage corporate liquidity, both domestically and cross-border (figure 1). However, given some of the recent regulatory and technology changes that have emerged in recent years, to what extent do treasurers really need cash pooling any more, particularly in regions such as Europe? As Chris Paton, Bank of America Merrill Lynch says,

“The basics of liquidity management have not changed: corporations still need to balance security, liquidity and yield, irrespective of the interest rate environment and degree of FX volatility at a particular time. What is changing, however, is the regulatory environment in which treasurers manage their cash, with Basel III and the liquidity coverage ratio (LCR), SEPA, liberalisation in China and changes to regulations in local markets all impacting on the opportunities to centralise liquidity.”

The impact of SEPA

As Jan Rottiers, BNP Paribas explains, with cash pooling a mature technique, demand for these solutions is relatively steady, and is supported by a large number of banks,

“In general, demand for both cash concentration, including variations such as target balancing, and notional cash pooling has remained consistent in recent years. While there has been some inconsistency in banks’ capabilities in the past, some have brought their technical capabilities up to standard so a growing number can now offer services such as intra-day zero-balancing as well as end of day sweeps.”

In theory, however, SEPA (Single Euro Payments Area) should have resulted in a decline in demand for cash pooling across SEPA countries. After all, one of the value propositions of SEPA was the ability to replace accounts held across all SEPA countries with a single euro account. Although an increasing number of companies are centralising payments including the use of payments-on-behalf-of (POBO) structures (and in fewer cases centralising collections, including collections-on-behalf-of [COBO]) it appears that treasurers have not significantly simplified their cash management and bank account structures. Bert Terlien, Head of Cash Pooling Product, Global Transaction Services, RBS confirms,

“SEPA has not resulted in any significant loss of appetite for cash pooling amongst our customers. There are still reasons why a company may hold multiple accounts in a country, and across Europe, and although we expect treasurers to simplify their account structures to some extent, cash pooling will continue to be a requirement.”

While it is true that the promise of SEPA has not been entirely fulfilled, for reasons that are beyond the scope of this article, corporations operating in Europe could reduce their bank accounts in Europe to a level where automated cash pooling services from their banks are no longer required. The fact that they have not done so, and show no immediate signs of doing so, would suggest that it is not a major priority. Indeed, given the ease and widespread availability of cash pooling in Europe (or rather, western Europe more specifically), achieving visibility and control over cash held in accounts with multiple banks, and enhancing controls over bank account management are likely to be more significant drivers of account rationalisation than the wish to simplify the use of cash management techniques.[[[PAGE]]]

An outdated requirement?

Given that companies are not focused on simplifying their cash management structures in Europe at this stage, cash pooling continues to be valuable as a means of centralising liquidity (or, if notional pooling is in use, to offset credit and debit balances). However, do treasurers need their banks to provide this service, or can it be done in-house, potentially saving costs and allowing more day-to-day flexibility?

From a technical point of view, this is undoubtedly the case. Many banks can now produce MT942 (intra-day bank statement) messages, and have invested in ‘real-time’ or close to real-time information services. Treasurers who work with multiple cash management banks can use a multi-bank communication channel in conjunction with a treasury management system (TMS) to collate information from their banks and combine payables and receivables information. From this, they can identify and create the transfers that are required to mirror a bank’s cash pooling service. Indeed, this process can be performed automatically using some TMS. In some respects, treasurers can go further than their banks by initiating these transfers between banks, rather than simply pooling between accounts with the same bank.

However, although technology permits a ‘self-managed’ approach to cash pooling, replicating a bank’s service may not be worthwhile in many cases. Bert Terlien, RBS notes the potential issue of cut-off times, for example,

“Technology has improved treasurers’ ability to obtain timely, accurate information, but it is difficult and time-consuming to replicate a cash pooling solution offered by a bank, especially for cross-border or cross-regional pooling structures. In particular, transfers initiated outside the bank take the form of payments (whether domestic or cross-border) which need to be completed within cut-off times. The risk of rejection, and unexpected flows on the account after the transfer takes place leads to margin for error that does not exist with cash pooling provided by a bank, which occurs after cut-off time.”

“Technology has improved treasurers’ ability to obtain timely, accurate information, but it is difficult and time-consuming to replicate a cash pooling solution offered by a bank, especially for cross-border or cross-regional pooling structures. In particular, transfers initiated outside the bank take the form of payments (whether domestic or cross-border) which need to be completed within cut-off times. The risk of rejection, and unexpected flows on the account after the transfer takes place leads to margin for error that does not exist with cash pooling provided by a bank, which occurs after cut-off time.”

Jan Rottiers, BNP Paribas is of a similar opinion,

“The ability to receive MT942 messages and real-time information may mean that some treasurers consider replicating banks’ cash pooling services internally, particularly if their cash flow forecasts are very accurate. However, it is often far more convenient for banks to offer this service, rather than having to account for each transaction, particularly in a multi-entity environment. Interest is calculated on intercompany balances automatically, and all participant accounts are included, whereas if performing these transfers manually, smaller balances may not always be included. Furthermore, as these transfers take the form of MT101 messages, treasurers are bound by cut-off times for the relevant bank/ currency, and there may be situations when payment messages miss this cut-off time, a risk that does not exist when banks provide this service.”

Chris Paton, Bank of America Merrill Lynch summarises,

“With connectivity and information exchange between banks and corporations now better than ever, it is feasible that some corporations may no longer see the need for cash pooling services, even without SEPA. The question, however, is whether they would really want to undertake this activity themselves. For banks, cash pooling is an automated, cost-effective core competence. In contrast, the large corporations that have access to the relevant technology are typically those with the most complex cash pooling requirements, so will rarely make sense to add the necessary resources to facilitate this.”

“With connectivity and information exchange between banks and corporations now better than ever, it is feasible that some corporations may no longer see the need for cash pooling services, even without SEPA. The question, however, is whether they would really want to undertake this activity themselves. For banks, cash pooling is an automated, cost-effective core competence. In contrast, the large corporations that have access to the relevant technology are typically those with the most complex cash pooling requirements, so will rarely make sense to add the necessary resources to facilitate this.”

Liquidity challenges in emerging markets

So if cash pooling continues to play a valuable role in Europe, Jan Rottiers, BNP Paribas highlights that the next step is to look further,

“Having set up efficient cash pools in regions where cash pooling is more straightforward, such as Europe, treasurers are now turning their attention to growth regions such as Asia Pacific.”

While centralising liquidity using cash pooling is relatively straightforward in Europe, the same cannot be said for other countries and regions, as figure 2 shows. (Note that this is indicative: please don’t rely on it for anything important.)

Many treasurers operating in Asia Pacific, Latin America or Africa would be delighted if essentially commoditised, comparatively ‘dull’ cash pooling solutions were readily available in these markets. Instead, they often face highly bureaucratic processes for repatriating cash or setting up intercompany loans, or cash may be ‘trapped’ in-country.

However, as Jan Rottiers, BNP Paribas continues,

“Regulatory change in China, and other countries in the region, mean that opportunities for liquidity management using cross-border pooling, as well as domestic pooling, are expanding. Given that ‘trapped’ cash is a perennial problem for treasurers, it is important to keep up to date with rapidly changing regulations to identify opportunities for managing liquidity more effectively.”

“Regulatory change in China, and other countries in the region, mean that opportunities for liquidity management using cross-border pooling, as well as domestic pooling, are expanding. Given that ‘trapped’ cash is a perennial problem for treasurers, it is important to keep up to date with rapidly changing regulations to identify opportunities for managing liquidity more effectively.”

As a result, Chris Paton, Bank of America Merrill Lynch emphasises the importance of allowing flexibility in approaches to liquidity management,

“When we work with customers to plan cash pooling strategies, it is important to define structures that can be flexed to take advantage of evolving business requirements and changing regulatory conditions. This is an integral element of our global liquidity platform, enabling our customers to support group liquidity needs on an ongoing basis.”

He continues,

“It is not only Asia Pacific where we are seeing a proactive reform agenda: similarly, in Latin America, there is significant change under way, with countries relaxing or tightening currency and regulatory controls according to their economic requirements. We continue to work closely with both local and US corporations to understand these constraints and manage liquidity effectively within this environment.”[[[PAGE]]]

Cash pooling opportunities in China

Regulators in China continue to deliver a rapid programme of regulatory reform which is opening up significant opportunities for both Chinese and foreign multinationals to extend liquidity management techniques such as cash pooling into China. Entities located in the China (Shanghai) Pilot Free Trade Zone (SFTZ) have been able to include onshore RMB (CNY) in cash pools located outside China for the past year. Bruno Francois, BNP Paribas comments,

“One of the most important changes that has been introduced recently is the ability to unlock cash previously ‘trapped’ in China, one of the highest priorities amongst treasurers in the region. Over the past 18 months, we have seen a number of developments. In July 2013, the ability to lend to overseas affiliates was introduced, but although a valuable opportunity for some, it only really allowed manual one-off, one-way transactions rather than facilitating cash pooling. Since February 2014, however, entities in the SFTZ have been able to include onshore RMB balances in regional cash pools, including two-way sweeps, a milestone development in the RMB internationalisation process.”

“One of the most important changes that has been introduced recently is the ability to unlock cash previously ‘trapped’ in China, one of the highest priorities amongst treasurers in the region. Over the past 18 months, we have seen a number of developments. In July 2013, the ability to lend to overseas affiliates was introduced, but although a valuable opportunity for some, it only really allowed manual one-off, one-way transactions rather than facilitating cash pooling. Since February 2014, however, entities in the SFTZ have been able to include onshore RMB balances in regional cash pools, including two-way sweeps, a milestone development in the RMB internationalisation process.”

However, there have been two recent, significant changes. Firstly, the geographic reach of the SFTZ has been extended to include the Pudong financial district; secondly, the ability to conduct two-way cash sweeping has been opened up to entities located outside the SFTZ, although restrictions apply. Bruno Francois, BNP Paribas continues,

“Of these two recent announcements, the future extension of the SFTZ is the more significant. In particular, the conditions for pan-China cross-border cash pooling are too restrictive for many companies for it to be a useful tool. In particular, minimum size requirements for the pool header onshore and pool participant offshore, and cross-border sweeping quota are the main constraints. However, the recent announcement that the SFTZ is being expanded to cover a wider area, which includes additional districts in the Pudong area, including which Lujiazui, the Shanghai financial district, marking a major opportunity for corporate treasurers. Many organisations will have an entity located in the expanded SFTZ, so they are able to take advantages of the flexibility offered by SFTZ cross-border cash pooling.”

Bert Terlien, RBS concurs,

“The most exciting opportunities to centralise liquidity are taking place in China, where the opportunity now exists to include onshore RMB accounts into regional or global cash pools. While this capability has been extended to entities located outside the SFTZ, a number of restrictions apply. However, the expansion of the SFTZ opens up the opportunity for efficient liquidity management to a far wider spectrum of organisations.”

Leveraging the benefits

Cathy Dou, Head of GTS China, Bank of America Merrill Lynch, emphasises the potential value of these developments,

“Cross-border two-sweeping is a significant development for managing treasury in China. Specifically, two-way sweeping is an effective way to address the common challenge of trapped cash in China, which has long been an impediment for treasurers, while also allowing corporations to include cash in China within global cash management structures.”

“Cross-border two-sweeping is a significant development for managing treasury in China. Specifically, two-way sweeping is an effective way to address the common challenge of trapped cash in China, which has long been an impediment for treasurers, while also allowing corporations to include cash in China within global cash management structures.”

‘Trapped’ cash in China has been a major challenge for many corporations; however, although there have been early adopters of cross-border cash pooling, both within and outside the SFTZ, corporations have not been beating down their banks’ doors to take advantage of these opportunities. Bruno Francois, BNP Paribas explains,

“Despite the significance of this opportunity, many corporations adopted a ‘wait and see’ approach. One reason is that the SFTZ in its original form was not necessarily a location which suited the existing set up of corporates given its distance from the centre of Shanghai and the rather limited size.”

Secondly, the speed of change is often a deterrent. With such rapid change, many treasurers are waiting to see what other developments materialise before investing time and resources in setting up solutions that may shortly be superseded.

Increasingly, these concerns should not be obstacles to investing in financial and operational efficiency. The regulatory reform agenda in China is moving inexorably towards greater liberalisation, and the degree of reform that has taken place so far allows treasurers to implement solutions that can be flexed rather than replaced in to leverage additional opportunities in the future. As when setting up cash pooling or other liquidity management solutions in any country, treasurers have a variety of issues to consider. Cathy Dou, Bank of America Merrill Lynch outlines,

“There are certain factors for treasurers to take into account when considering cross-border cash pooling and POBO, ROBO or netting structures in China. Tax issues, both from a China and regional/global perspective, are key, such as withholding tax, the basis for enterprise level tax, and tax incentives in different countries, need to be analysed when determining the feasibility of a RMB cross-border pooling programme.”

Bruno Francois, BNP Paribas continues,

“There are specific issues that companies considering including onshore RMB balances in cross-border cash pools need to consider. One is the restriction that self-generated cash flow only can be swept into the pool (no overdraft facility can be involved in the structure). In that respect, time zones will have to be taken into account if sweeping into a cash pool in Europe (as opposed to Hong Kong or Singapore), especially when excess cash from overseas is required to compensate negative balances onshore. Secondly, treasurers need to consider the interest rate implications governing the lending/borrowing relationship between pool participants. CNY investment rates in China are higher than for many other currencies, so unless cash is required for liquidity reasons in other parts of the business, and the borrowing rate is higher than the CNY investment rate, it may be better to keep cash in China.”

Cathy Dou, Bank of America Merrill Lynch also urges treasurers to look at new opportunities that extend beyond centralisation of liquidity, to centralisation of financial processes such as payments and collections,

“The ability to use payment-on-behalf-of (POBO)/receivables-on-behalf-of (ROBO) and netting structures is another key development within the wider cross-border two-way sweeping programme. POBO, ROBO and netting will all become essential components in driving the success of cross-border two-way sweeping and an incubator of both inbound and outbound volumes. Furthermore, these structures will enhance liquidity management efficiency and reduce processing costs, which will provide sizable benefits to treasuries.”

[[[PAGE]]]

The end of notional pooling?

While regulatory changes are fuelling additional use of cash pooling in some countries, the opposite can also apply. There have been rumours circulating for some time that new restrictions on banks required under Basel III, specifically the liquidity coverage ratio (LCR) that banks will need to hold, will mark the end of notional pooling. The reason for this concern is that the regulation does not necessarily allow credit and debit balances to be netted when calculating the LCR. Consequently, banks would need to hold additional liquid assets to cover debit balances in a notional pool as these are not offset by credit balances. For notional pooling to be feasible, there needs to be a legal right of offset in place and cross-entity guarantees, and the legal and tax situation in each county may also vary in the enforceable right of compensation in case of bankruptcy. In many cases, the relevant guarantees are already in place; however, there will be differences between banks and locations.

Notional pooling will continue to be feasible in a Basel III environment, but there are considerations of which treasurers need to be aware

Given these uncertainties, there is no clear industry position on notional pooling at this stage, but in general, the banking community is suggesting that structurally at least, notional pooling will remain feasible. Bert Terlien, RBS considers,

“We are of the opinion that notional pooling will continue to be feasible in a Basel III environment, but there are considerations of which treasurers need to be aware, which should not be a particular surprise. For example, the right of set-off is an important issue, but rules on this already apply under IAS 32. What will be key is how rules are interpreted and implemented: for example, what constitutes a counterparty is a topic of discussion for multi-legal entity structures.”

He continues,

“It is becoming clearer that on-balance sheet netting of client balances remains possible under Basel III within an appropriate legal and regulatory reporting framework for capital reporting purposes, but not for the calculation of the bank’s leverage ratio. We continue to look closely at this, and may need to give more attention to the gross amounts that are being netted within client structures, but given that we have always taken a prudent approach in applying rules on locations, eligible participants and the legal framework in which notional pooling is conducted, we continue to see a future for notional pooling.”

Chris Paton, Bank of America Merrill Lynch also suggests that notional pooling will continue to be feasible under Basel III regulations in their current form, as long as the cross-entity guarantees are in place,

“Notional pooling is complex in theory, but straightforward in practice. The key value proposition has always been to net assets and liabilities from an accounting and regulatory perspective. If the ability to net balances disappears, then so too does the concept of notional pooling. However, at Bank of America Merrill Lynch, cross-entity guarantees between participating entities is a critical element of our notional pooling solution, amongst a range of other risk controls. This positions our solutions within current regulations, and unless unanticipated regulatory changes are announced in the future, we do not expect this to change.”

Ultimately, however, there is a commercial as well as a structural issue. While notional pooling may be feasible in theory, it may not be as attractive commercially to banks, and therefore the cost to corporates is likely to increase. Consequently, the value proposition may be less compelling, and treasurers and their banks will need to find alternative means of achieving their liquidity objectives. As Jan Rottiers, BNP Paribas discusses,

“Notional pooling fulfils a particular business need which continues to exist independently of regulatory changes that might affect the design of these solutions and that are entailing higher costs for the bank to offer them. Whether or not notional pooling continues to remain the most appropriate solution to meet this business need, or if other forms of cash pooling are likely to offer comparable benefits, will differ for each individual customer”.

While it therefore seems too early to tell quite how existing notional pooling solutions will be impacted, and what banks’ willingness to offer them in the future might be, Chris Paton, Bank of America Merrill Lynch argues that Basel III offers opportunities for corporate treasurers, as well as potential concerns:

Cash pooling continues to add value irrespective of the interest rate environment.

“One element of Basel III that is frequently overlooked is that it encourages a major shift of emphasis amongst banks. All else being equal, corporate business becomes more valuable to banks relative to similar activity with other banks or non-bank financial institutions. As corporate treasurers realise this, they are able to demand more from their banks in supporting their payables and receivables, cash concentration and alternative financing requirements.”

Delivering long-term value

Despite the theoretical impact of SEPA and progress in technology automation and information flows, cash pooling continues to offer significant value to corporate treasurers, whatever the market conditions. Bert Terlien, RBS concludes,

“Cash pooling continues to add value irrespective of the interest rate environment. When borrowing rates are high, it plays a valuable role in managing intercompany lending, which remains the most cost-effective means of financing. When rates are low, leveraging surplus cash across the business to achieve better returns, or pay down debt, is essential.”

These benefits are not only restricted to ‘easier’ European markets, for example, but may be even greater as regulatory reform in markets such as China and other Asia Pacific, Latin America and African countries continues.